It does not involve managements judgment for estimating particular items like warranty or provision. Ad Save On The Leading Accounting Principles Reference Guide Today.

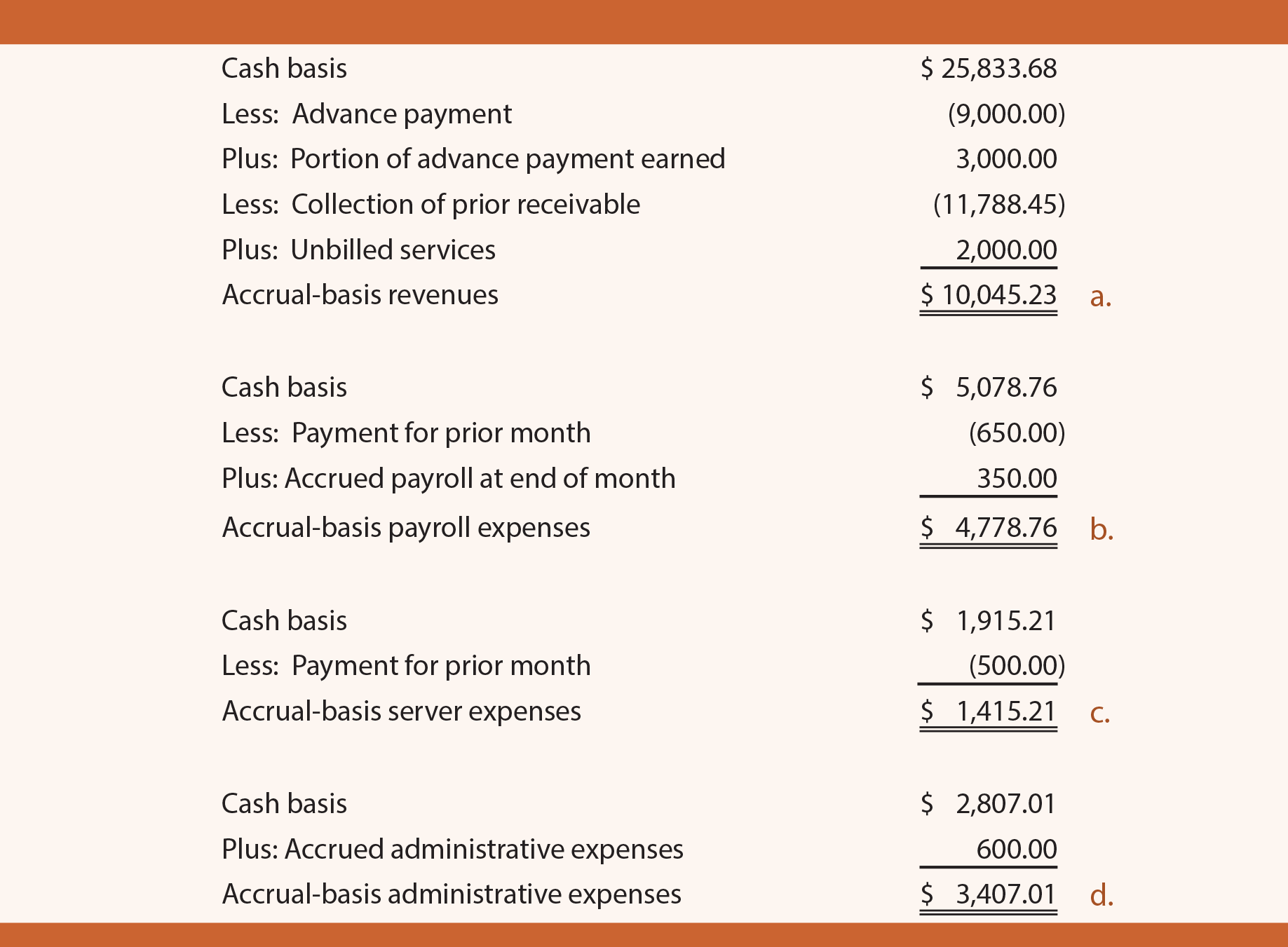

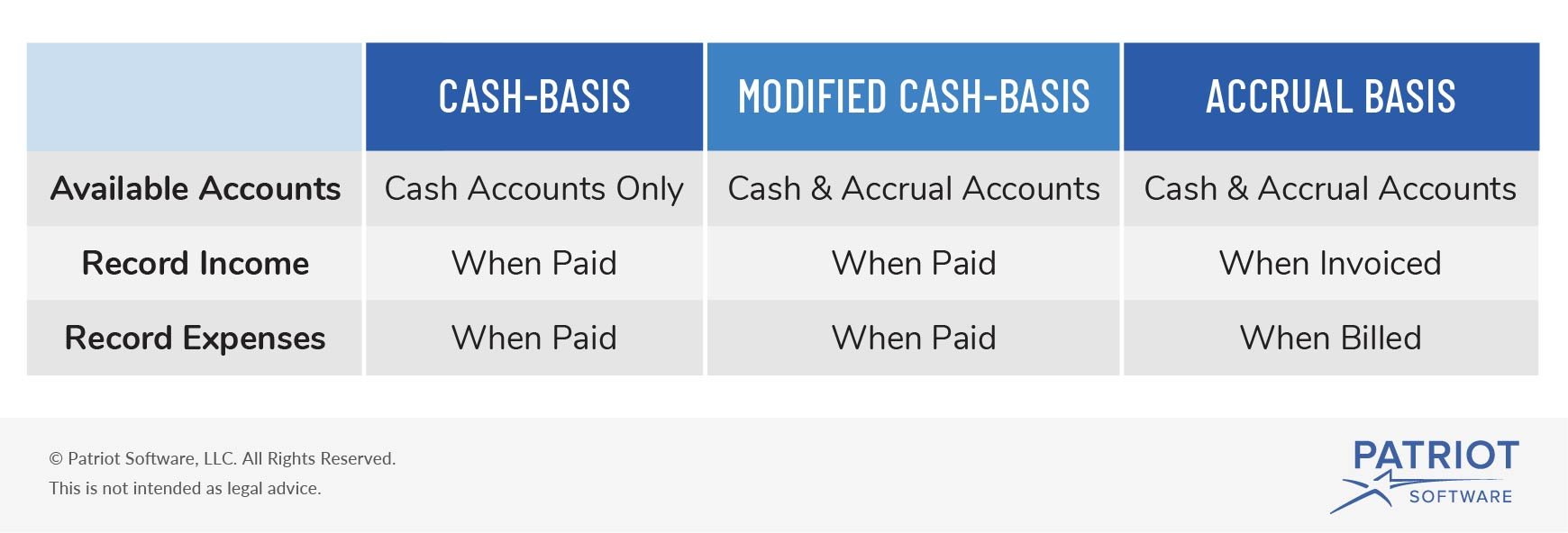

The modified cash method of accounting is a hybrid between cash and accrual. The modified cash basis is a bookkeeping practice that combines elements of the two major accounting methods. I stock-related expenses including stock options. It follows the cash-basis method to record short.

Modified cash basis gaap.

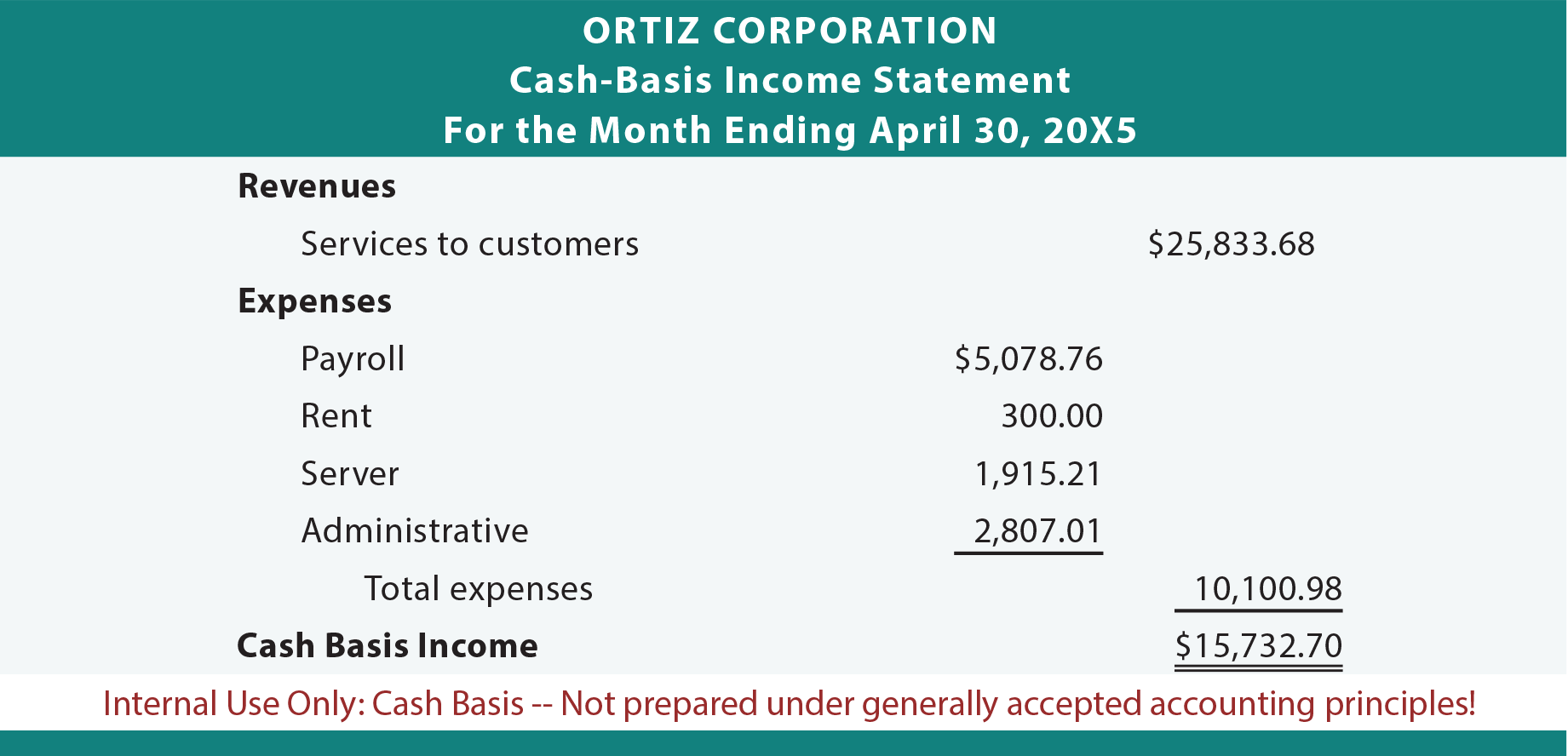

Accrual Versus Cash Basis Accounting Principlesofaccounting Com Nhpc Balance Sheet Cecl Fasb

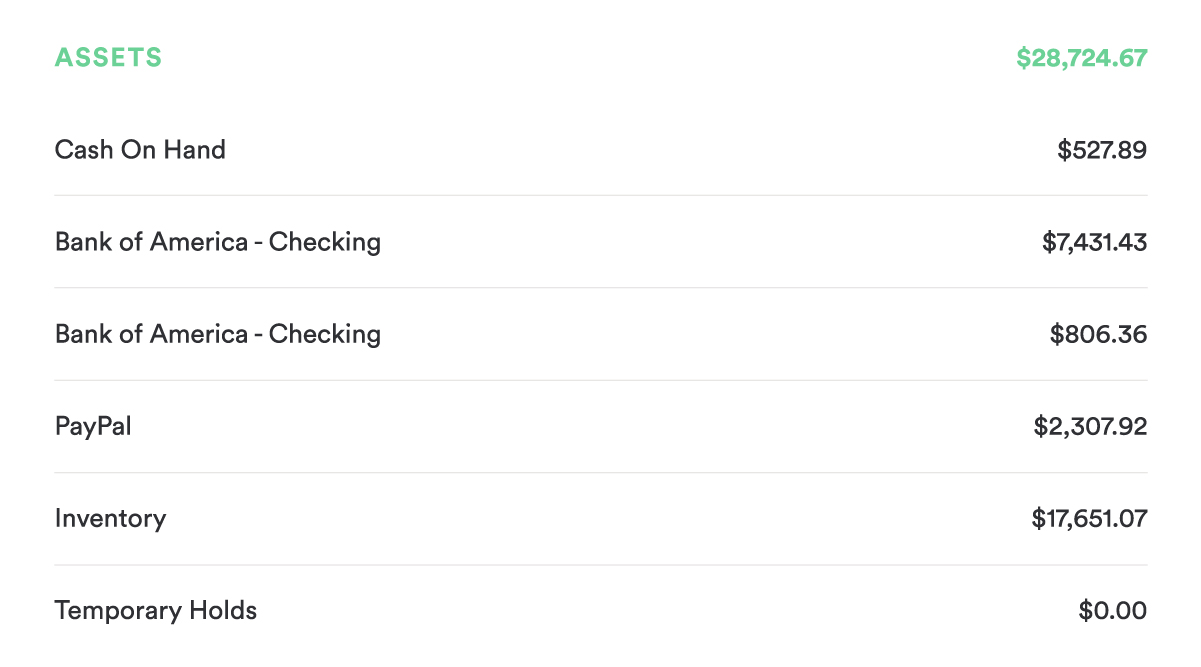

This bookkeeping system combines the simplicity of cash. Financial statements have been prepared on the modified cash basis of accounting which is a basis of accounting other than US. The modified cash basis is not allowed under Generally Accepted Accounting Principles GAAP or International Financial Reporting Standards IFRS which means that a. The modified cash basis of accounting isnt complex like the accrual basis of accounting.

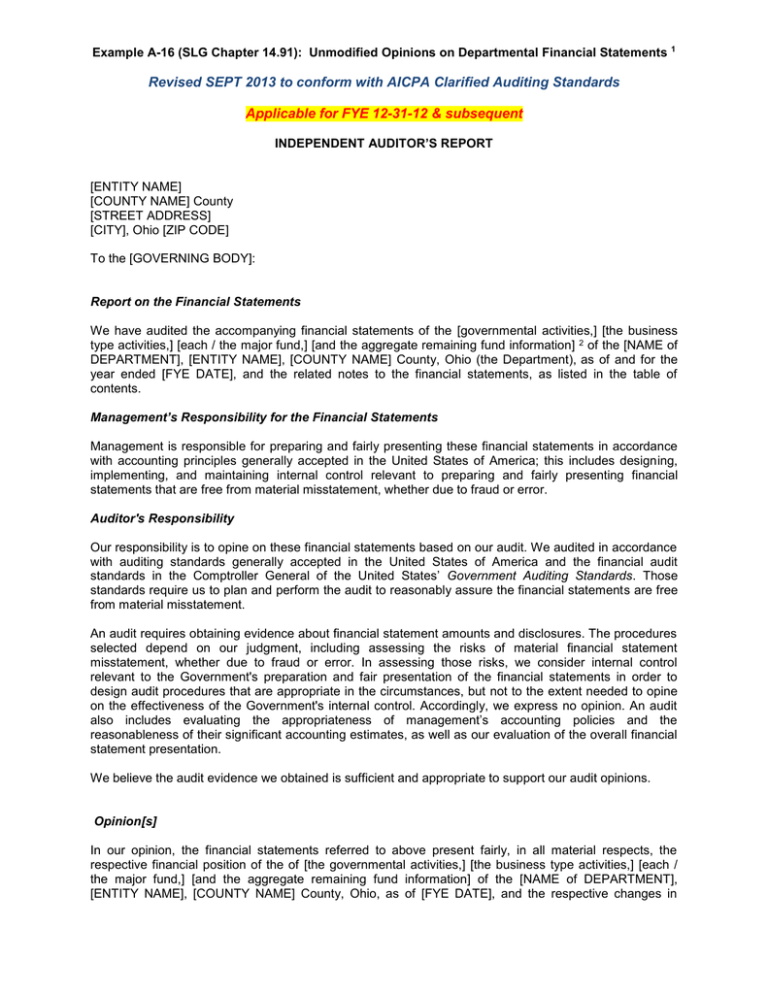

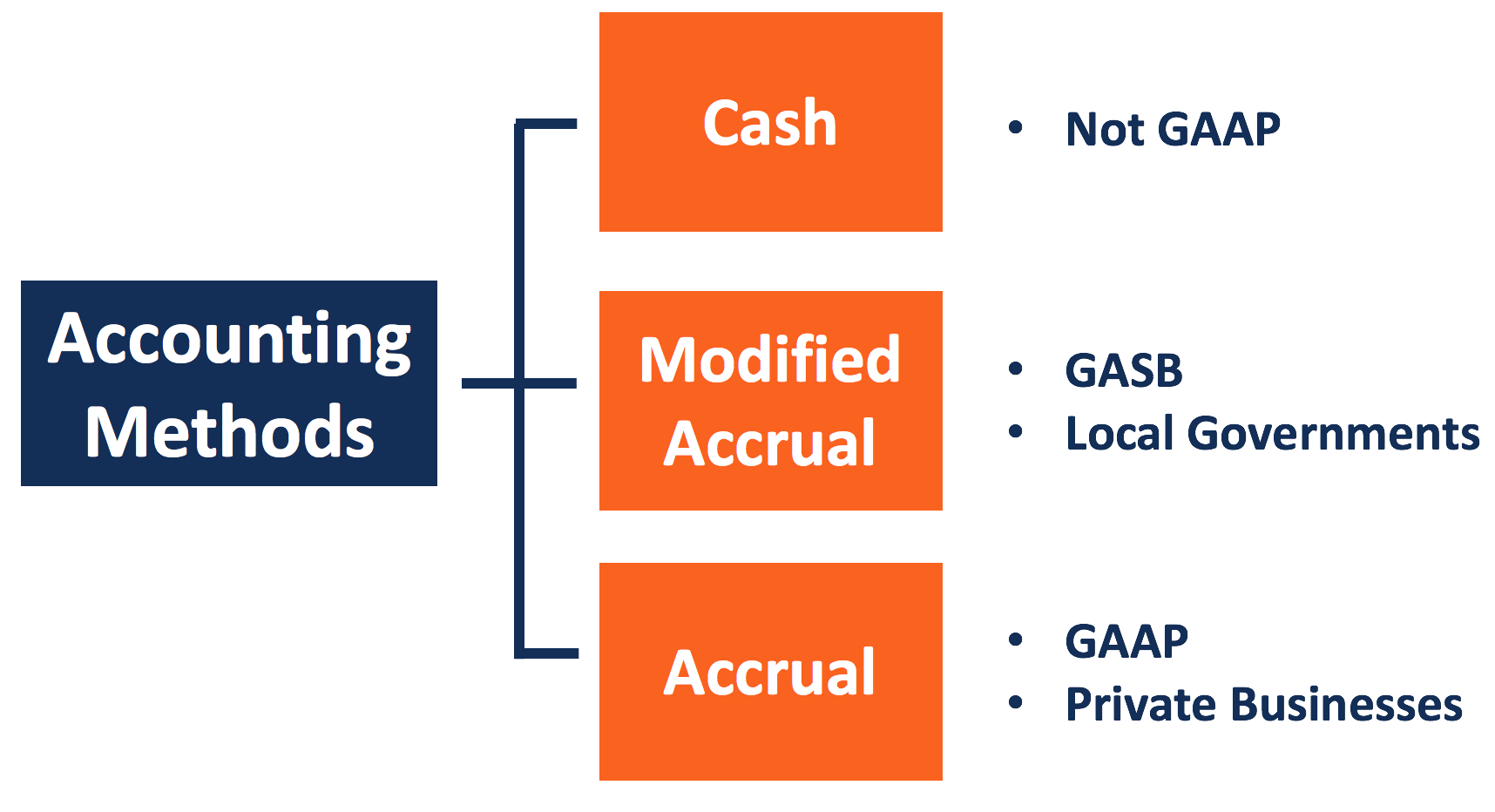

GAAP basis requires accruals. To avoid cash basis or modified cash basis statements being mistaken for GAAP financial statements different titles are used for them. Modified accrual accounting refers to an accounting method that combines cash-basis accounting and accrual-basis accounting.

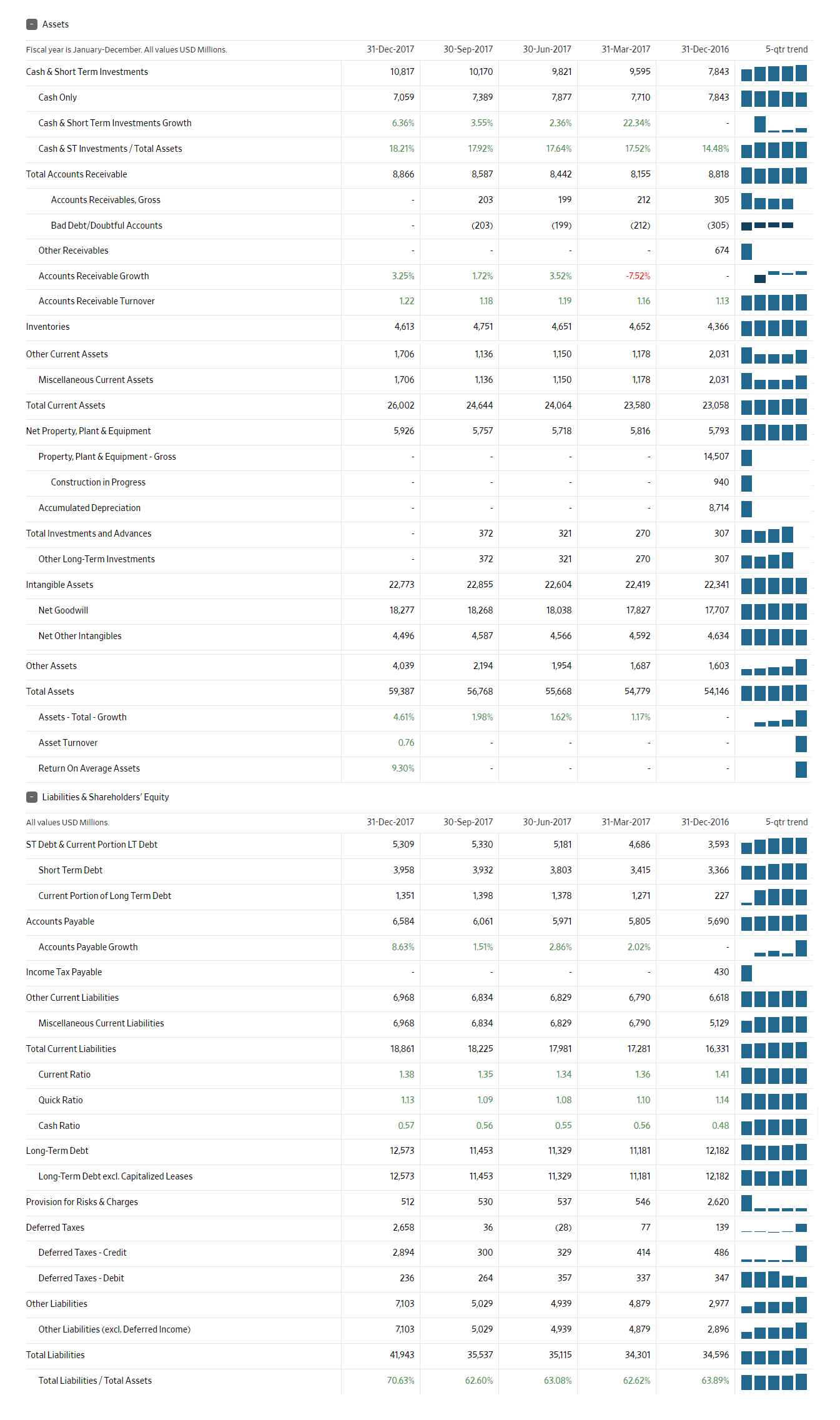

In double-entry accounting every entry to an account requires you to create a corresponding and opposite. Modified accrual accounting is a method that combines accrual basis accounting with cash basis accounting. Long-term assets are recorded on an.

Modified Accrual Accounting Overview And Basic Rules Key Financial Statements What Goes Under Revenue On An Income Statement

GAAP basis financial statements. Recording receivables and accrued expenses in the period in which they were incurred supports the matching concept matching revenues and. Observations and Suggestions Often preparers of cash and taxbasis financial statements elect to omit substantially all disclosures required by the cash. Attempting to convert to GAAP accounting with messy data is a recipe for stress and insomnia.

There is no standard as to what items are modified. Means United States generally accepted accounting principles as in effect from time to time except that. In cases where the data is in bad enough shape you wont even be able to.

A modified cash-basis system also uses double-entry bookkeeping. Books Sale Ends Soon. It is common for community associations to record.

Gaap Cash Basis And Modified Of Accounting Henry Horne What Is A Budgeted Income Statement Meaning Financial Performance Analysis

The modified cash basis is not allowed under Generally Accepted Accounting Principles GAAP or International Financial Reporting Standards IFRS which means that a. Books Sale Ends Soon. Modified cash basis financial statements are intended to provide more information to users than cash basis statements while continuing to avoid the complexities of. The modified cash basis is not allowed under Generally Accepted Accounting Principles GAAP or International Financial Reporting Standards IFRS which means that a.

Descriptive titles such as Statement of Assets. Be aware though that if your financial statements are going to be looked at by an outside party whether its a bank where youre trying to get financing or by an auditor the. While it is common for CPAs to modify cash-basis statements to include fixed assets and the related depreciation and to record liabilities for short-term and long-term borrowings and the.

Ad Save On The Leading Accounting Principles Reference Guide Today.

Modified Cash Basis What Is It Who Should Use Bench Accounting Transnet Financial Statements Sec Income Statement

Accrual Versus Cash Basis Accounting Modified Approaches Illustration Of Income Measurement The Reporting Cycle How To Read A Balance Sheet Pwc Illustrative Financial Statements 2017

What Is The Difference Between Cash Basis Of Accounting And Modified Accrual Universal Cpa Review Big Three Firms Sales On Income Statement

2 Due From Banks Balance Sheet Income Outcome Excel

Accrual Versus Cash Basis Accounting Modified Approaches Illustration Of Income Measurement The Reporting Cycle Applicable Financial Statement Profit And Loss Adjustment Account Format

Modified Cash Basis Accounting Advantages Differences More Enron Financial Statement Fraud Kroger Balance Sheet