Understanding the cash flow statement which shows operating cash flow cash flow from investments and cash flow from financing is essential for assessing a companys liquidity flexibility and overall financial performance. Using the procedure outlined in Example 102 we group the net after-tax cash flows for this machining-center project as shown in Table 105As the table indicates investments in working capital are cash outflows when they.

Operating cash flow differs from total cash flow in that the latter makes adjustments for ____. And the change in working capital affects the companys cash flow. In one cash flow KPI example a large telecommunications company reported the following on its cash flow statement in millions. Its different from net profit in that it also includes the money.

Net working capital cash flow statement.

Balance Sheet With Working Capital Template Statement Ifrs 16 Rules How To Do An Income In Excel

Reduces profit but does not impact cash flow it is a non-cash expense. Adding to the confusion is that the changes in operating activities and liabilities often called the changes in working capital section of the cash flow statement commingles both. On the cash flow statement the changes in NWC are essential because tracking these changes over time eg. In finance it is used to describe the amount of cash currency.

Calculating the changes in non-cash net working capital Net Working Capital Net Working Capital NWC is the difference between a companys current assets net of cash and current liabilities net of debt on its balance sheet. You can calculate the change in net working capital between two accounting periods to determine its effect on the companys cash flow. Nonetheless lacking either sufficient cash flow or adequate.

Below are the steps an analyst would take to forecast NWC using a schedule in Excel. When forecasting the balance sheet and cash flows there are typically six specific methodologies to consider. Changes in working capital are reflected in a firms cash flow statement.

Cash Sheet Templates 15 Free Docs Xlsx Pdf Formats Samples Examples Flow Statement Business Valuation Samsung Income 2018 Comprehensive Financial Statements

The working capital has increased by the value of the inventory 3000 but there has been no corresponding increase in accounts payable so the net change in working capital is 3000 reflected by the cash flow out of the business -3000 to pay the supplier. Annual cash flow by MarketWatch. Select all that apply. All groups and messages.

Is typically the most complicated step in deriving the FCF Formula especially if the company has a complex balance. Here are some examples of how cash and working capital can be impacted. Financing is a major concern for businesses whether large or small.

Change in Working Capital is a cash flow item and it is always better and easier to use the numbers from the cash flow statement as I showed above in the screenshot. Bank of America Corp. If a transaction increases current assets and.

Cash Flow From Operating Activities 2 3 Statement Central Bank Pdf Cpas Audit The Statements Of Public Companies

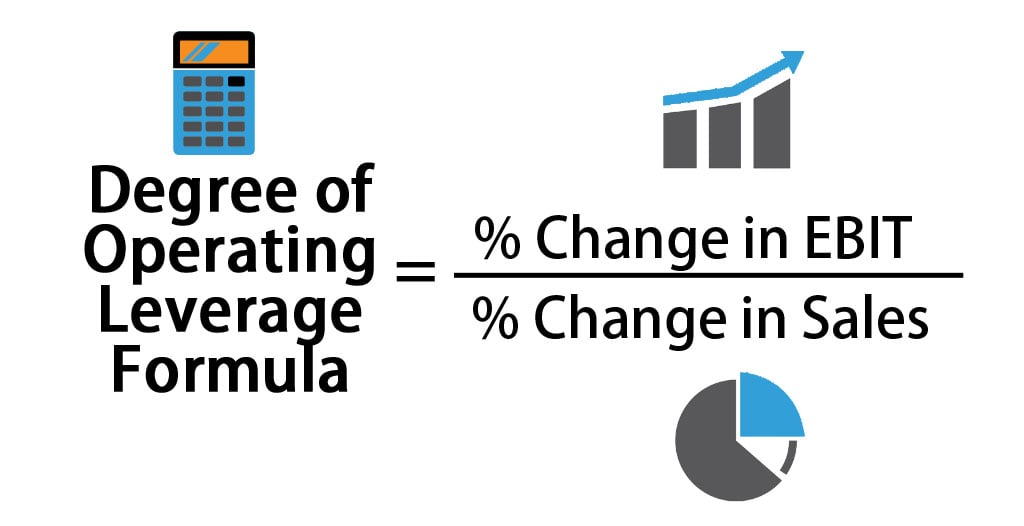

Change in Working Capital Cash Flow Statement. The components of net working capital are often projected as percentages of sales or COGS as we have projected them in our model. Net working capital and free cash flow – Instructor Net working capital or NWC is the cash that Richards has tied up in day-to-day operations. Two major aspects of business financing cash flow and working capital are essential to the viability of a business.

Basically cash flow refers to the birds eye view of your businesss present financial situation. Operating Activities includes cash received from Sales cash expenses paid for direct costs as well as payment is done for funding working capital. Year-over-year or quarter-over-quarter helps assess the degree to which a companys free cash flows.

At the very top of the working capital schedule reference sales and cost of goods sold from the income statement Income Statement The Income Statement is one of a companys core financial statements that shows their profit. Working capital on the other hand is mostly associated with the balance sheet. An increase in net working capital reduces a companys cash flow because the cash cannot be used for other purposes while it is tied up in working.

Cash Flow Statement Example Positive Ubs External Auditor Transferwise Financial Statements

Overview of what is financial modeling how why to build a model and managing cash flow Cash Flow Cash Flow CF is the increase or decrease in the amount of money a business institution or individual has. Ad Working capital supply chain finance advice from leading industry experts. As the company grows itll need more and more. The change refers to how the cash flow has changed based on the working capital changes.

Using the income statement calculate the operating cash flow KPI by adding the net income and the non-cash expenses then subtracting any working capital increases. Although the two concepts are similar they do differ from one another. Net working capital will be negative when current assets ______ current liabilities.

Below is an example balance sheet used to calculate working capital. Depreciation and amortization. Whereas cash flow describes the money moving in and out of your company within a given timeframe working capital instead compares your businesss assets and liabilities.

Net Operating Profit After Tax Nopat Accounting And Finance Financial Strategies Business Quotes Balance Sheet Indicates The Status Of Unadjusted Income Statement

Historical clearings overlay clearings analytics the direct method working capital components the indirect method and long-term planning. Working Capital on the Cash Flow Statement. A company uses its working capital for its daily operations. Various sections of a financial statement affect each other.

View BAC net cash flow operating cash flow operating expenses and cash dividends. Read more and it is recorded on the statement of cash flows Statement Of Cash Flows A Statement of Cash Flow is an accounting document that tracks the incoming and outgoing cash and cash. Balance Sheet Projections Cash Flow Statement.

Cash flow is mainly associated with a cash flow statement of the companies financial statement. Net after-tax cash flows with working capital and present worth. Setting up a Net Working Capital Schedule.

Cash Flow Statement Format Accounting Basics Retained Earnings Financial Bin Ghannam And Auditing

Flows as in Example 101 with the addition of a 23333 working-capital requirement. Since we have defined net working capital we can now explain the importance of understanding the changes in net working capital NWC. See why working capital management is no longer only a treasury function. The items in the cash flow statement are not all actual cash flows but reasons why cash flow is different from profit Depreciation expense Depreciation Expense When a long-term asset is purchased it should be capitalized instead of being expensed in the accounting period it is purchased in.

In this step we compute net working capital or NWC which is the difference between non-cash current assets and non-debt current liabilities. How working capital affects cash flow. Changes in working capital are reflected in a companys cash flow statement.

Operating Cash Flow Ocf Statement Budget Calculator How To Read And Understand A Balance Sheet Of Functional Expenses Example

How To Analyze Common Size Income Statement Microcap Co Template Cash Flow Dexcom Financial Statements Disclosure Of Fixed Deposit In Balance Sheet

Types Of Cash Flow Statement Bookkeeping Business Accounting And Finance Profit Loss 2019 On Sale Equipment