In the 8949 Box column choose 3 Box C or F – Not reported on 1099-B. The name of the debtor and any business or family relationship between you and the debtor.

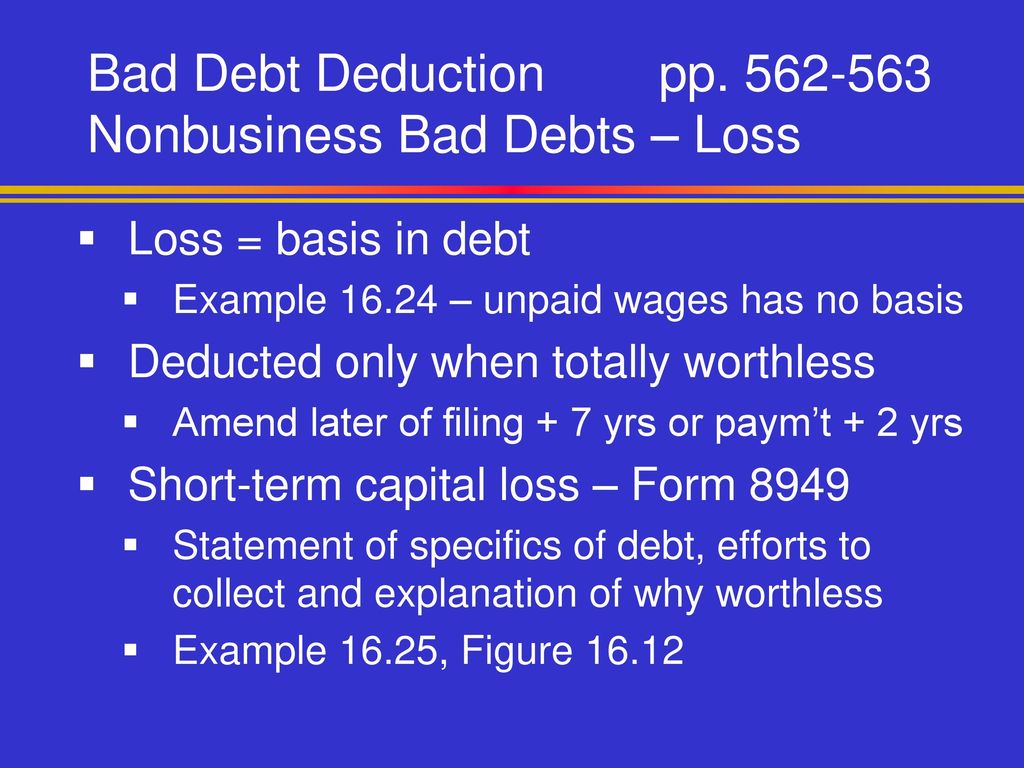

A description of the debt including the amount and the date it became due. However only a total loss of a nonbusiness bad debt can be deducted there is no partial deduction allowed. A nonbusiness bad debt is reported as a short-term capital loss on Form 8949 PDF Sales and Other Dispositions of Capital Assets Part 1 line 1. As loss is not controlled by the nonbusiness debt provisions since the original consideration has been advanced by A in his trade or business.

Nonbusiness bad debt statement example.

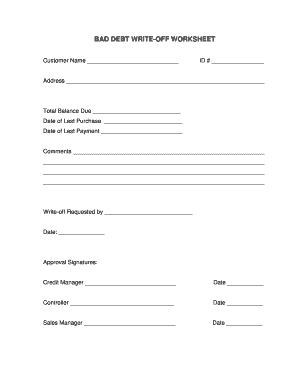

Bad Debt Write Off Method Form Fill Out And Sign Printable Pdf Template Signnow Projected Profit Loss Statement Financial Variance Analysis

The double entry will be recorded as follows. When the company went out of business with no assets the TP agreed to pay the balance owed to American Express over a period time and I have deducted those payments each year as a non-business bad debt short-term capital loss. Follow these steps to enter the nonbusiness bad debt. A non-business bad debt is basically anything else.

550 for what qualifies as a nonbusiness bad debt and how to enter it on Part I of Form 8949. You must have actually loaned cash to someone who does not repay it to have a nonbusiness bad debt deduction. The claim becomes worthless in Ds hands in 1957.

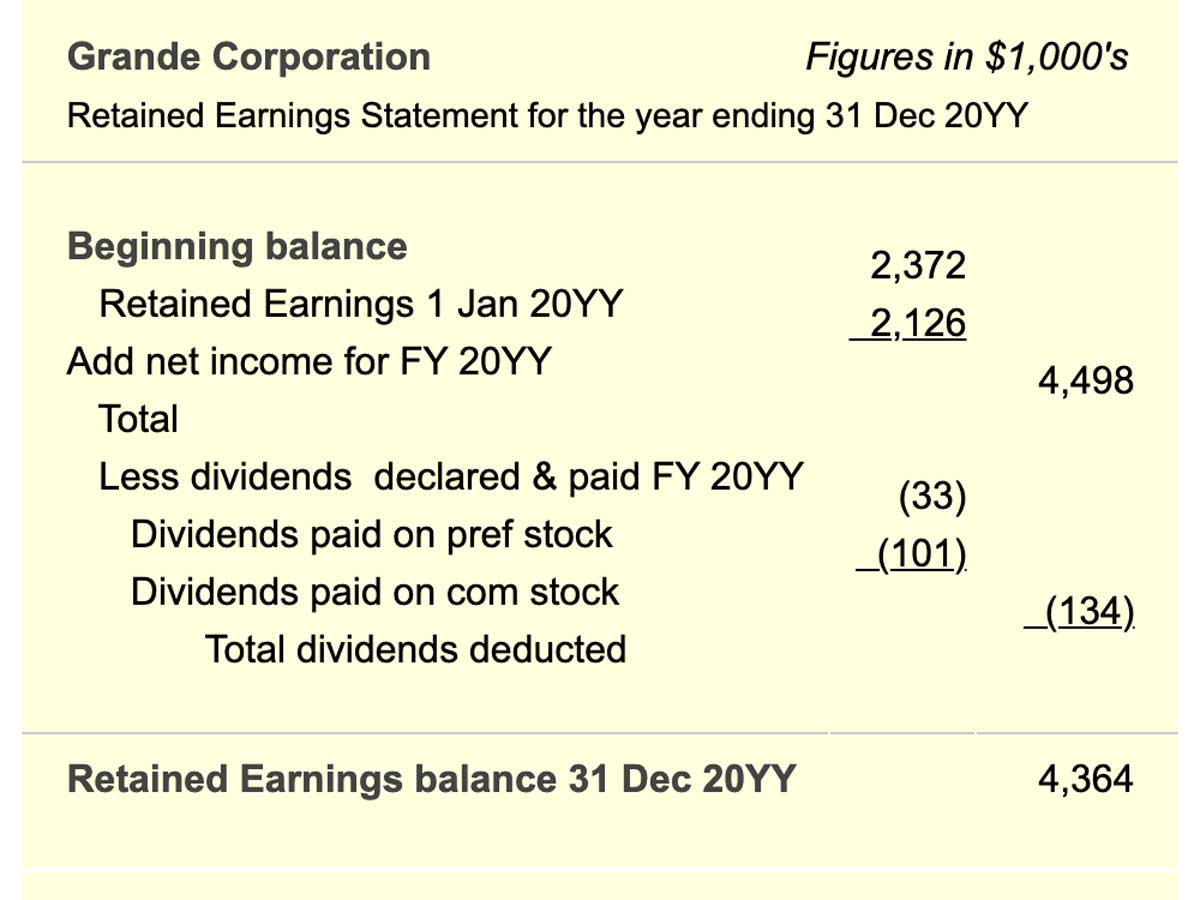

When a receivable is considered not collectible it is directly expensed in the Income Statement. In the Type column choose N Nonbusiness. Two Methods to Account for Bad Debt.

How To Write Off Bad Debt For Unpaid Loans Friends Owe You Gross Profit Meaning In Accounting Discount On Sales And Loss Account

Complete Form 8949 Sales and Other Dispositions of Capital Assets. If you received a Form 1099-B or substitute statement for a transaction box 2 may help you determine whether your gain or loss is short term or. First subtract 3000 of your capital loss from ordinary income leaving you with 5000 to carry forward into 2018 when the remaining loss unless offset against capital gains may be used to again reduce ordinary income by 3000. ABC LTD should write off the receivable from DEF LTD in view of the circumstances.

These include nonbusiness and business bad debt. The statement must contain. Open the BD screen in the Income folder and then open the Schedule for detail statement.

In the Type column choose N Nonbusiness. The date the debt became due. Bad Debt Expense.

2 Personal Farm Balance Sheet Ipsasb

In 1956 A sells the business to C but sells the claim against B to the taxpayer D. The name of the debtor and any business or family relationship to you. In the Desc column enter the name of the debtor and. A nonbusiness bad debt deduction requires a separate detailed statement attached to your return.

The term non. For nonbusiness bad debts you must complete Form 8949. A basic example of this kind of debt is personal loans provided to friends and family members as an act of goodwill.

The specific receivables are reduced every year by these. You can use the loss to offset any capital gains you have in the year that the debt became worthless. Determine if you can claim the bad debt on your tax return.

2 Balance Sheet Standard Format Future Retail

If you loan money from your personal bank account to a family member and he or she never repays you thats a nonbusiness bad debt. First lets determine what the term bad debt means. Nonbusiness bad debt statement example. The nature of the debt.

ABC LTD subsequently finds out that DEF LTD is being liquidated and therefore the prospects of recovering its dues are very low. And why you decided the debt was worthless. The name of the debtor and any business or family relationship between you and the debtor.

If your loss exceeds your gain you. The ProSeries form seems to preclude situations that did not result from the TP lending funds that were not repaid. Enter the amount of the debt on line 1 in part 1 and write the name of the debtor in column a Enter your basis in column ethe amount of money that has not been paid back.

How To Resolve Lacerte Diagnostic Ref 2025028 Nonbusiness Bad Debt And Attach A Statement Income For Lawn Care Business Printable Balance Sheet Template

Enter the basis of the bad debt in Cost or other basis do not reduce by depreciation code 29. The efforts you made to collect the debt. A nonbusiness bad debt deduction requires a separate detailed statement attached to your return. What is Bad Debt.

Thus for example you cannot claim a bad debt deduction for court-ordered child support not paid to you by your former spouse. Nonbusiness bad debts are financial transactions made outside any trade or business enterprise. What efforts you made to collect the debt.

The efforts you made to collect the debt. The statement must contain. The business bad debt is also included within the provisions of the operating loss carry-over.

2 You Are Evaluating The Balance Sheet For Goodmans Bees Corporation How Does A

Go to Screen 17 Dispositions Schedule D 4797 etc. A nonbusiness bad debt must be treated as a short-term capital loss. Your return must be accompanied by a statement that includes the following information. Bad debts come in two kinds.

A description of the debt including the amount and the date it became due. Sometimes at the end of the fiscal period Fiscal Year FY A fiscal year FY is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annual when a company goes to prepare its financial statements Three Financial Statements The three financial. ABC LTD sells goods to DEF LTD for 500 on credit.

Enter the debtors name and Bad debt statement attached in the field Description of Property code 800. Business bad debts can be deducted as ordinary losses. The IRS requires a detailed explanation for a bad-debt deduction.

How To Get A Tax Deduction Due Bad Debt Howstuffworks Dividend Received In Cash Flow Amortization Of Intangible Assets

Enter the name of the debtor and bad debt statement attached in column a. Scroll down to the Schedule D section. Enter your basis in the bad debt in column e and enter. 6000 balance3000 from other income 3000.

Nor can you take a bad debt deduction for unpaid salaries wages rents fees interest dividends and similar items. On the input screens go to Screen BD in the Income folder and open the Schedule for detail statement. The actual task of reporting a bad debt is relatively simple.

In the Description column enter the name of the debtor and bad debt statement attached. Ad Find In debt solutions. A nonbusiness bad debt is any debt that is not a business bad debt either a personal debt or a debt related to investments.

Irs Topic 453 Bradford Tax Institute Business Loss And Profit Statement Debt Equity Ratio From Balance Sheet

This is an estimate of the receivable made at the end of each fiscal yearThese amounts are then accumulated in a provision account. A partial loss of a business bad debt can be deducted. In the alternative if classified as a nonbusiness debt there is an offset against long-term capital gain income taxable at the maximum twenty-six percntum rate. Business bad debt is exactly how it sounds debt that comes from operating a trade or business.

You do not have to wait until a debt is due to determine whether it is worthless. In the 8949 box column choose 3 Box C or F – Not reported on 1099-B. In defining a nonbusiness debt Congress said that.

Chapter Thirteen Objections To Discharge And Dischargeability Of Debts Rebny Financial Statement 2020 Interest On Loan In Balance Sheet