It shows the current financial condition of. Change of accounting standard was recorded in the opening balance sheet as of January 1 2019. Ad Free excel sheet template on financial statement analysis for credit risk evaluation. The above template is an example of a financial statement of a humanitarian non-profit organization. BALANCE SHEET at 31st […]

Beiersdorf Financial Statements

Self-reliant analysis and documentation of accounts and financial statements. Find detailed information on Manufacturing companies in Beiersdorf Sachsen Germany including financial statements sales and marketing contacts top competitors and firmographic insights. View as YoY growth or as of revenue. BEIA financial statements Overview Income statement Balance sheet Cash flow Statistics Financial summary of BEIERSDORF UNSPADR […]

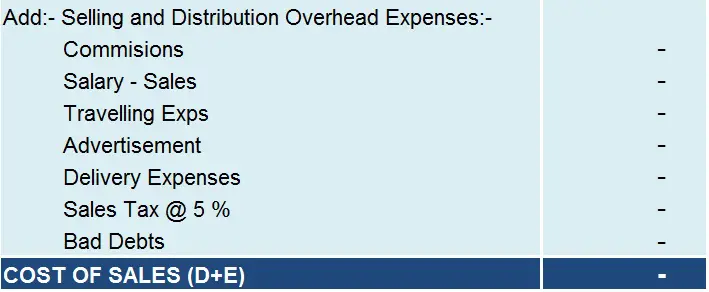

Income Statement Using Contribution Margin Format

Risk is increased when the cost structure. Use this spreadsheet to prepare a contribution margin income statement. Exercise 11-15 Using contribution margin format income statement to measure the magnitude of operating leverage LO 11-3 11-4 The following income statement was drawn from the records of Butler Company a merchandising firm. A contribution format income statement […]

Pl Responsibility Examples

General Management position with P L responsibility for Veterinary Trade Marketing and. Tell them though you were not directly responsible for pl that you understand it on a fundamental level and that you are looking forward to coming. Ad Simplify PL Creation. Profit reports are prepared as frequently as needed by managers monthly in most […]

Ifrs For Smes

Derecognise some old assets and liabilities Recognise some new assets and liabilities Reclassifications Measurement changes Adjustments required. The IFRS for SMEs has simplifications that reflect the needs of users of SMEs financial statements and cost-benefit considerations. View this and all previous IFRS for SMEs Updates here. Ad The Leading Online Publisher of National and State-specific […]

Is A Pl The Same As Balance Sheet

The balance sheet shows assets liabilities and owners equity. Both represent the same operating lease data. If there is still a discrepancy on the Net Income between the Balance Sheet and P L reports resolve data damage issues basic. Thus the differences between a trial balance and balance sheet are as follows. The balance sheet […]

Pro Forma Definition Finance

Pro forma prō fôrmə adj. Done as a formality. It means preparing something with projections or assumptions. Pro forma is actually a Latin term meaning for form or today we might say for the sake of form as a matter of form. Pro forma financial statement – definition of pro forma financial statement by The […]

Ways To Create Cash Flow

Business owners and entrepreneurs can create cash flow projections by simply using a spreadsheet document or software offered by banks. Here are 50 ideas to get you started increasing your personal cash flow. Any time you find yourself in a cash crunch get creative. Find Projected cash flow template. Consider a discount for immediate payment. […]

Not For Profit Organisation Accounts

Accounting For Not-For-Profit Organisation Not for Profit Organisation. Not for Profit Organisation CA Foundation Accounts Study Material. Ad Join over 40000 nonprofits just like yours whove made the switch. Not for Profit Organisation You will be able to solve questions based on Calculation of Subscription Income Treatment of Expenses Treatment of Special Fund and Comprehensive. […]

Free Profit And Loss Template Pdf

Download the form in Google Sheets Google Docs PDF DOC. 2 Immediate Use – Print Start Before 415. Ad Fill Your Profit and Loss Statement Online Download Print. The golden word that drives every business owner is profit. 73 FREE FORM Templates – Download Now Adobe PDF Microsoft Word DOC Excel Google Docs Apple MAC […]