The bond pays interest every 6 months on June 30 and December 31. Ad Free Trial – Track Sales Expenses Manage Inventory Prepare Taxes More. Short-term investments and long-term investments on the balance sheet are both assets but they arent recorded together on the balance sheet. Get the balance sheet for Rapid Nutrition PLC which […]

Profit Tracking Spreadsheet

Inventory management is a requirement in any reseller spreadsheet to run your business. This is where you will be tracking all your Airbnb income. Click this link to open Stock Tracking Spreadsheet Go to File Make a Copy Rename and press OK to save to your account While youre at it you can also get […]

Exemption From Preparing Consolidated Financial Statements

The financial statements need to be lodged with ACRA with the annual return unless the company is a solvent exempt private company EPC. Exemption from preparing consolidated financial statements paras. The carrying amount of the parents investment in each subsidiary. Access to the complete content on Oxford Reference requires a subscription or purchase. One of […]

Income Statement New Name

An income statement is generally and officially called the Statement of Comprehensive Income. The name suggested by the standards for income statement was income statement then it was changed to profit or loss statement until it was changed again to statement of profit or l. Use this example income statement template as a guide to […]

Financial Projections Spreadsheet

See revision notes on last tab. About a project or event that is likely to take place in the near future. Get access to inventory spreadsheets financial projections and balance sheets for dental office practices. These are used in project management and financial projection business activities. Crossfit spreadsheet is created in the MS Excel spreadsheet. […]

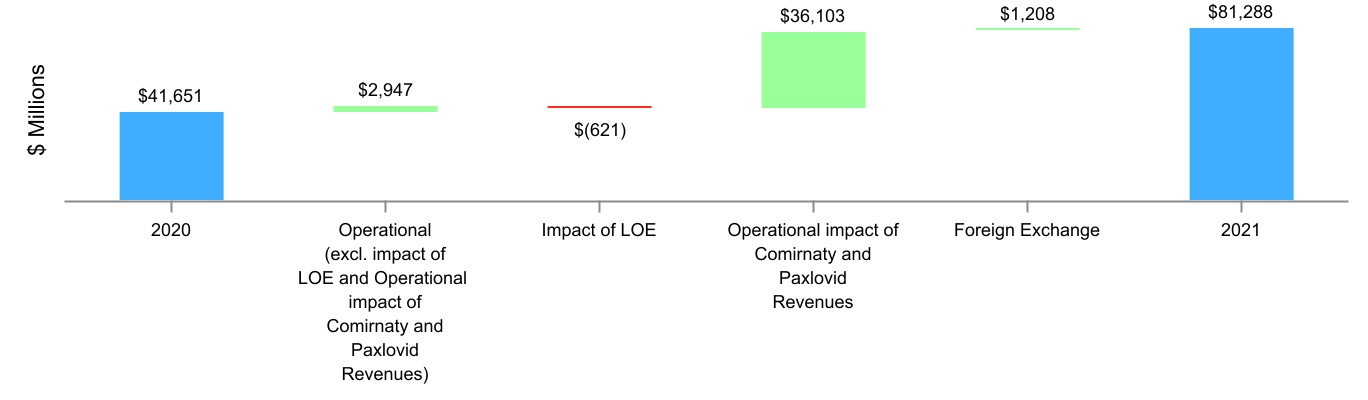

Pfe Balance Sheet

Annual balance sheet by MarketWatch. PFE lo que incluye detalles de activos obligaciones y patrimonio neto de los accionistas. View all PFE assets cash debt liabilities shareholder equity and investments. Balance Sheet data includes Assets Current Assets Fixed Assets Property Plant and Equipment PPE Inventory Intangibles Liabilities Current Liabilities Debt Capital Lease Obligations Common Stock […]

Governance And Management Audit Report

Key governance arrangements Audit and Risk Management Committee. A AA or AAA. The allocated budget resource for 202223 of 735000 is considered adequate to deliver the Internal Audit Charter 2022 and 202223 Audit Plan as described in this report. Data Governance Internal Audit Report. Governance Internal Audit Report Page 3 Executive Summary An enterprise risk […]

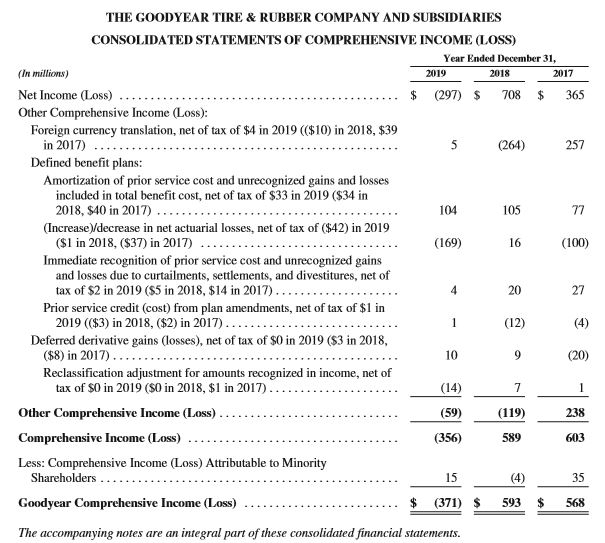

Goodyear Financial Statements

View and download Goodyears current and past annual reports from our archive. The auditors have issued an unmodified clean opinion of the City of Goodyears financial statements for the fiscal year ended June 30 2021. View and download The Goodyear Tire Rubber Companys current and historical financial information. Goodyear Tire Rubber Co. Public Fee and […]

Mindtree Financial Statements

0 0 The Balance Sheet Page of MindTree Ltd. The company has an Enterprise Value to EBITDA ratio of 3175. Report on the Standalone Financial Statements We have audited the accompanying standalone financial statements of MINDTREE LIMITED the Company which comprise the Balance Sheet as at March 31 2018 and the Statement of Profit and […]

Forecasting Cost Of Goods Sold

A Examining our competitors expenses and trying to match theirs. Usually when you forecast sales and cost of sales you use either the financial accounting or managerial accounting format. B Examining the historical of revenues these expenses comprise. Determine Direct and Indirect Costs The COGS calculation process allows you to deduct all the costs of […]