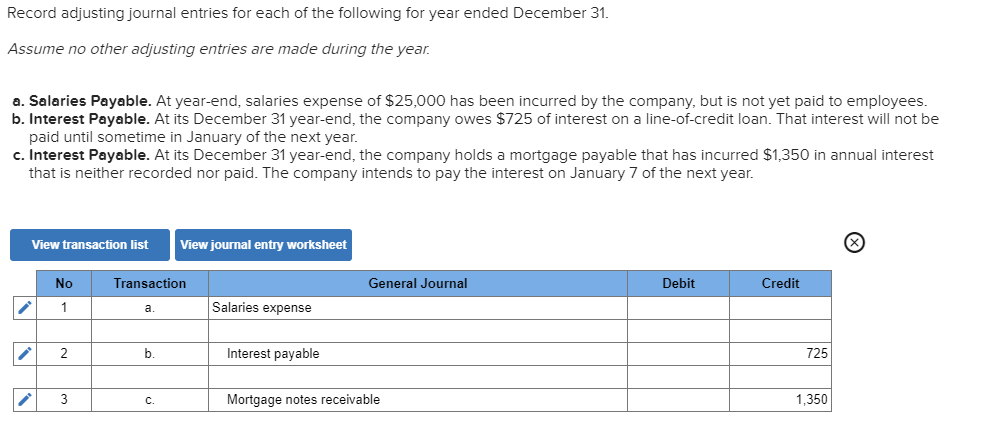

Step 2 Transferring partners salary to Profit Loss Appropriation Ac. For a five-day workweek 900 5 days daily salaries are 180. Creating an adjustment will allow us to comply with the matching principle by matching expenses with revenues earned for the period month. Salaries payable is a balance-sheet short-term liabilities account. An adjusting journal entry […]

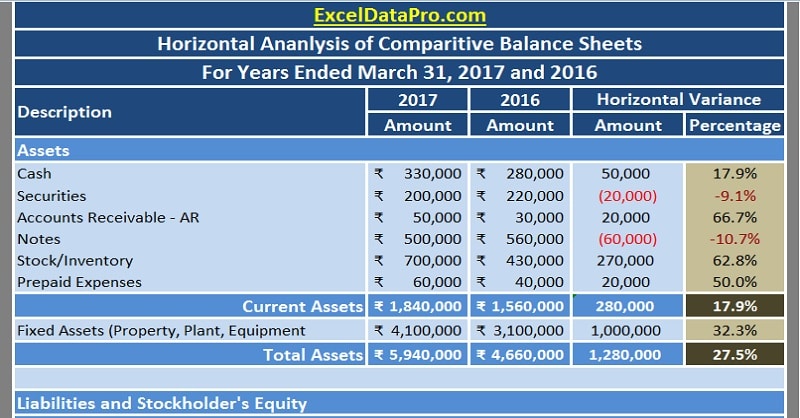

Understanding Balance Sheet Pdf

Ad Fill Out Easy Questions. Save Print Instantly – 100 Free. The balance sheet is a summary of the financial position of a business individual or operation at a given point in time. A balance sheet depicts the businesss assets and liabilities along with their respective values as at the end of an accounting period. […]

Ratio Analysis Formula In Excel

It can help you to get a common denomination for both of the values and then by using little concatenation you can calculate the ratio. And to calculate the ratio insert the below formula into the cell and hit enter. By its nature liquidity addresses the short term but it is not a trivial matter. […]

Sample Multi Step Income Statement

Operating Income Gross Profit Operating Expense This formula calculates your operating income on your multi-step income satement. Its an alternative to the single-step income statement that allows users of the statement to better determine the profitability of the company and how much of it is contributed by the core operations. Chelseas Fine Boutique Income Statement. […]

Objectives Of Consolidated Financial Statements

The purpose of consolidated financial statements is to help investors understand how secure the company is as a profitable enterprise. The financial statement is to give accountants a comprehensive view of the company as a whole including holdings and subsidiary companies. Get A Personal Financial Statement W Our Drag Drop Builder- Easy Reliable Templates. It […]

Three Types Of Cash Flow

3 Cash-Flow from Financing Analysis. Net Change in Cash The change in the amount of cash flow from one accounting period to the next. The three types of activities in a cash flow statement are. There are three types of cash flow that contribute to the cash flow of your business. This article throws light […]

Trial Balance Month To

What you would need to do is run the trial balance month by month. When you do the following. Do not select Summarize retained earnings values the report shows the Sales Income ledger account balance of 500 for the current month and 300 in the Beginning Balance column. You select This Month in the Period […]

Is Income Statement And Profit Loss The Same

PL is short for profit and loss statement. Finances to use your profit and loss the same as income statement. Actually in the income statement it would be Gains and Losses. Both are showing all the revenue expenditures and incomes. Its a snapshot of a companys financial health and business. The profit or loss is […]

Ago Audit Report 2019

During the year ended 31stDecember 2019 I concluded a total of 4496 audits which included 4211 financial audits comprising of 108 MDAs 114 Commissions Statutory Authorities and State Enterprises 97 projects 4 Production Sharing Agreements and 3888 Local Governments and Tertiary Institutions. Audit of GAOs Fiscal Year 2020 Fourth Quarter DATA Act Submission. It is […]

Ssm Financial Statements

TTM Cash from operating activities Funds from operations Changes in working capital Cash from investing activities. The Directors Strategic Guide to Corporate Govern. SSM Health Care Corporation SSMHCC. MBRS refers to the submission platform based on the eXtensible Business Reporting Language XBRL format. A current report that contains basic information of a company such as […]