By login in to your income tax filing account on the Income Tax departments e-filing website. Go to e-filing website eportalincometaxgovin. Click View Form 26AS and then select Confirm Click Proceed on the next page followed by selecting View Tax Credit Input View Type and Assessment Year and choose the format Click ViewDownload to finish […]

Ratio Analysis Of Wipro

PE Calculated based on EPS of 1971 Mar2021 – Consolidated Results. An ideal company has consistent profit margins. Wipro Quick Ratio Historical Data. 264 Comparatively low ROE of wipro can be attributed to its high equity financing. Return on Capital Employed 2426. Wipro Ratio Analysis 1. Ratio analysis of wipro. Bazaar Ka Gyan Share Market […]

Off Balance Accounting

According to current accounting rules off-balance sheet financing is an acceptable accounting practice. So by the use of an operating lease the. Read more whereas the company has to maintain certain. While there are some scenarios in which the direct write-off method makes more sense the. What is a Balance It represents the amount that […]

Sme Balance Sheet

Ad 1 Create Free Balance Sheet In Minutes 2 Print Export Instantly – 100 Free. A balance sheet is a financial snapshot of your business at a given date in time. You may have been paying an. Assets of the business having a life of less than a year. Fri 29 Jan 2021 – 746 […]

Reading A Pl Report

A PL is a financial statement or report that tells a narrative about your business over a specific period of time. A restaurant specific PL statement will usually consist of three main components. One of the most important financial tools that will help you understand the financial health of your company is your businesss profit […]

Cost Of Goods Sold In Financial Statement

Heres a formula you can use to calculate the costs of manufactured goods sold. Income statementQ3 Y3 Revenue Sales Other revenue Total operating revenue. COGS counts as a business expense and affects how much profit a company makes on its products. To determine the cost of goods sold in a manufacturing company like A manufacturing […]

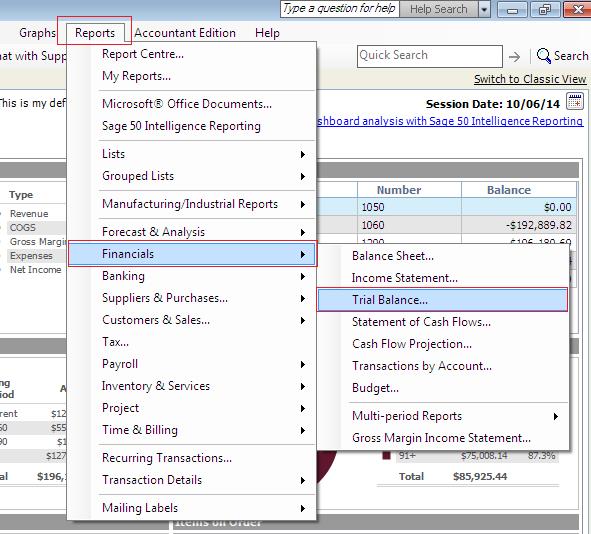

Sage Trial Balance Report

General Discussion Monthly Trial Balance Report. Open General Ledger GL Reports Trial Balance. This will recalculate the Dimension balances for the year youre experiencing issues in. Request a Demo Today. Learn About a Faster More Secure Reporting Process. The Standard report setting provides a set of default options. Sage trial balance report. How To Compare […]

Comparative Writing Examples

We have included the top 50 Quality Examples of Comparative Degree. Having the skills for essay writing you are good to go in writing your comparative analysis essay. A Comparative Essay Writing Example To critically evaluate the impact of powerful essay writing let us look at an example of comparative essay writing down below There […]

Meaning Pro Forma

Pro forma is a Latin phrase that means as a matter of form. For example if a company is considering acquiring another it may prepare a pro forma financial statement to estimate what effect the acquisition would have on its own financial circumstances. Accounting Taxation How is Pro Forma Used. The invoice will typically describe […]

Revenue Account Normal Balance

The revenue account sales has a normal credit balance. On a balance sheet assets must always equal equity plus liabilities. One of the basic accounting terms is a normal balance. It is a bit of a strange balance day adjustment so we thought it worthwhile to cover providing you with the correct information. The normal […]

.jpg)