According to current accounting rules off-balance sheet financing is an acceptable accounting practice. So by the use of an operating lease the.

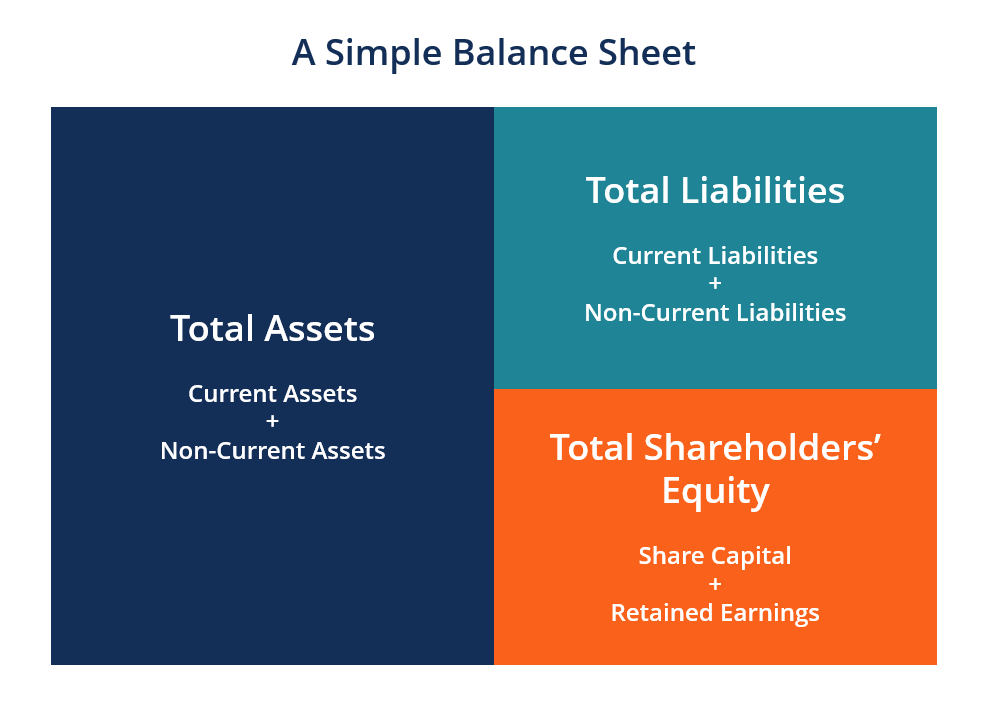

Read more whereas the company has to maintain certain. While there are some scenarios in which the direct write-off method makes more sense the. What is a Balance It represents the amount that is the same in both columns of an account. When using this method businesses wait until a debt is determined uncollectible before marking it as such in their.

Off balance accounting.

Allowance For Doubtful Accounts Meaning Accounting Methods And More Bookkeeping Business Education Paid In Capital Balance Sheet Fund Flow Statement Introduction

Key Takeaways The direct write-off method is an accounting method used to record bad debt. Examples of Off-Balance Sheet Financing. Off balance sheet liabilities are a particular concern since they might eventually result in substantial liabilities for and. Off-balance sheet accounting is beneficial to companies as it eliminates both assets and debt from the balance sheet improves companies liquidity ratios such as its current ratio and quick ratio and lowers leverage ratios such as debt to equity and debt to asset.

Off-Balance sheet transactions are not included in the companys balance sheets. Off-Balance Sheet OBS Also known as Off-Balance sheet items Off-Balance sheet assets or liabilities and Incognito Leverage. However these assets and liabilities still belong to the company though they may not be directly associated with the company.

Off-balance sheet items refer to those assets and liabilities that arent shown on a balance sheet. The write off process involves the following steps. Accounting for Written Off.

The Accounting Equation Learn Basics T2125 Business Income Close Of Financial Year Audit

Off-balance sheet financing can get itself into trouble when it is used to hide real debt and give the impression to investors that the company has less debt than it actually has. Some companies may have significant amounts of off-balance sheet assets and liabilities. Balancing off Accounts Process Total both the debit and credit sides of the ledger account Calculate the balance the difference between the total debits and total credits Add a one sided entry to make the totals on both sides of the account equal. Any company that offers a.

An OBS operating lease is one in which the lessor retains the leased asset on its balance sheet. Off-balance sheet transactions enable small businesses to manage cash flow and credit risks. Total return swaps are an example of an off-balance sheet item.

This means they dont impact any ratios like debt-to-equity ratio. This account holds all the receivable balances which may come from various customers. Balancing Off Accounts with A Credit Balance Remember that getting a credit balance on a companys financial report is only possible when the credit column totals a larger amount than the debit column.

Balancing Off Accounts Business Person Accounting Account Liabilities Reported On The Balance Sheet Include Cpa Reviewed Financial Statements

Usually a write-off will reduce the balance of accounts receivable together with the allowance for doubtful accounts. In an operating lease the company records only the rental expense for the equipment rather than the full cost of buying it outright. Under a leaseback agreement a company can sell an asset such as a piece of property to another. Off balance sheet refers to those activities of assets or debt or financing liabilities of the company that belongs to the companys balance sheet but do not appearpresent in the balance sheet ie.

Its a good way to mask long-term debt. When the company writes off accounts receivable such accounts will need to be removed from the balance sheet. Off-balance sheet or incognito leverage usually means an asset or debt or financing activity not on the companys balance sheet.

Lower debt and total liabilities. Determine the Amount of the Write-Off. Accounts receivable is an account in the balance sheet that represents the amount owed by customers to a company.

Balancing Off Accounts Business Person Accounting Account Pwc Illustrative Financial Statements Supplemental Cash Flow

They are either a liability or an asset which are not shown on a companys balance sheet as the business is not a legal owner of the respective item. For example financial institutions often offer asset management or brokerage services to their. If the debit consists of the larger figure the balance is called a debit balance. Offbalance-sheet entities that are the focus of the change typically i are thinly capitalized ii have no independent management and iii have their administrative functions performed by a designated trustee or other intermediary whose activities are controlled by service agreements.

Or could the change complicate the economic recovery by damaging bank balance sheets. Some people call this incognito leverage. This is the case in which the company uses the allowance method for an estimate of losses from bad debt.

For most companies this account also represents the total credit sales made by a customer with pending payments. More streamlined accounting Under ASC 840 accounting for an operating lease was not as complicated as it was for a. What are examples of off balance sheet items.

Making Sense Of Your Balance Sheet Learn Accounting Small Business Bookkeeping Education Financial Samsung Ratios 2018

When this happens the process for balancing accounts with a credit balance follows the same process as those without credit balances. These give a picture of their assets and liabilities at any given time. Off-Balance sheet and OBS financing are allowed under the GAAP GAAP GAAP Generally Accepted Accounting Principles are standardized guidelines for accounting and financial reporting. A write off is needed whenever the fair value of an asset is below its carrying amount.

Companies record most of their transactions on their balance sheets. When a company buys it outright it records the asset the equipment and the liability the purchase price. Here are two benefits that off-balance-sheet leases would have presented to businesses.

In case amounts do not match you should put the difference in the column with a lesser amount. The activities that are not recorded in the balance sheet but company has the rights and obligations for those activities and has the impact on its. The Sarbanes-Oxley Act was in part created to prevent future misuse of off-balance sheet financing methods such as hiding debt in special purpose entities.

Balancing Off Accounts 2 Capital Account Accounting Business Person Financial Statement Ratios Debit Sheet

If there is any asset in which we have no right it will be the asset of our off balance sheet. When the value of an asset has declined some portion of its carrying amount should be written off in the accounting records. Is the timing right. To be considered for publication submissions should include your name title affiliation and.

Off-Balance sheet items are generally shown in the notes to accounts along with the. This is referred to as the balance carried. Balancing off means matching figures of debits and credits of the account.

What Are Some Types of Off-Balance Sheet Assets. Send us your thoughts. Off balance sheet refers to those assets and liabilities not appearing on an entitys balance sheet but which nonetheless effectively belong to the enterprise.

Horizontal Balance Sheet Capital Assets Business Person Financial Analysis Of Axis Bank Pdf Loss On Disposal Account

Selected submissions will be published. For showing an asset in balance sheet we should have right on it or we have invested money in it or we have counted this as our businesss financial resource. You are a new accountant for a company and have discovered that the company. These items are usually associated with the sharing of risk or they are financing transactions.

Are the new off balance sheet rules effective January 2010 needed. The accounting balance sheet – in general an asset will be on this balance sheet if the accounting principles it uses to prepare its financial statements requires it to be included or will be off this balance sheet if those accounting principles do not require that asset to be included in its financial statements. Off Balance sheet means list of assets and liabilities which are not in the balance sheet of company.

It S Important For All Board Members To Understand The Financial Statements Presented Them This Post Will Statement Accounting Basics Indirect Method Cash Flow Format Explain A Balance Sheet

Allowance For Doubtful Accounts When Customers Who Owe Do Not Pay Financial Statement Bad Debt Accounting Quickbooks Profit And Loss Detail Report Formula Return On Common Stockholders Equity