2 Preview Your Form. That means they will not have an increase in basis until the year the debt is forgiven.

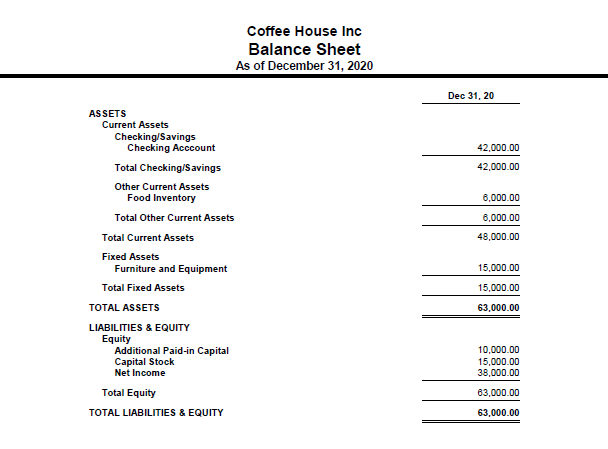

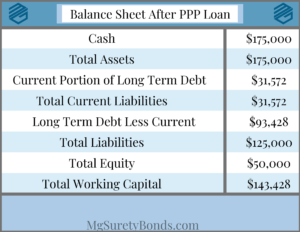

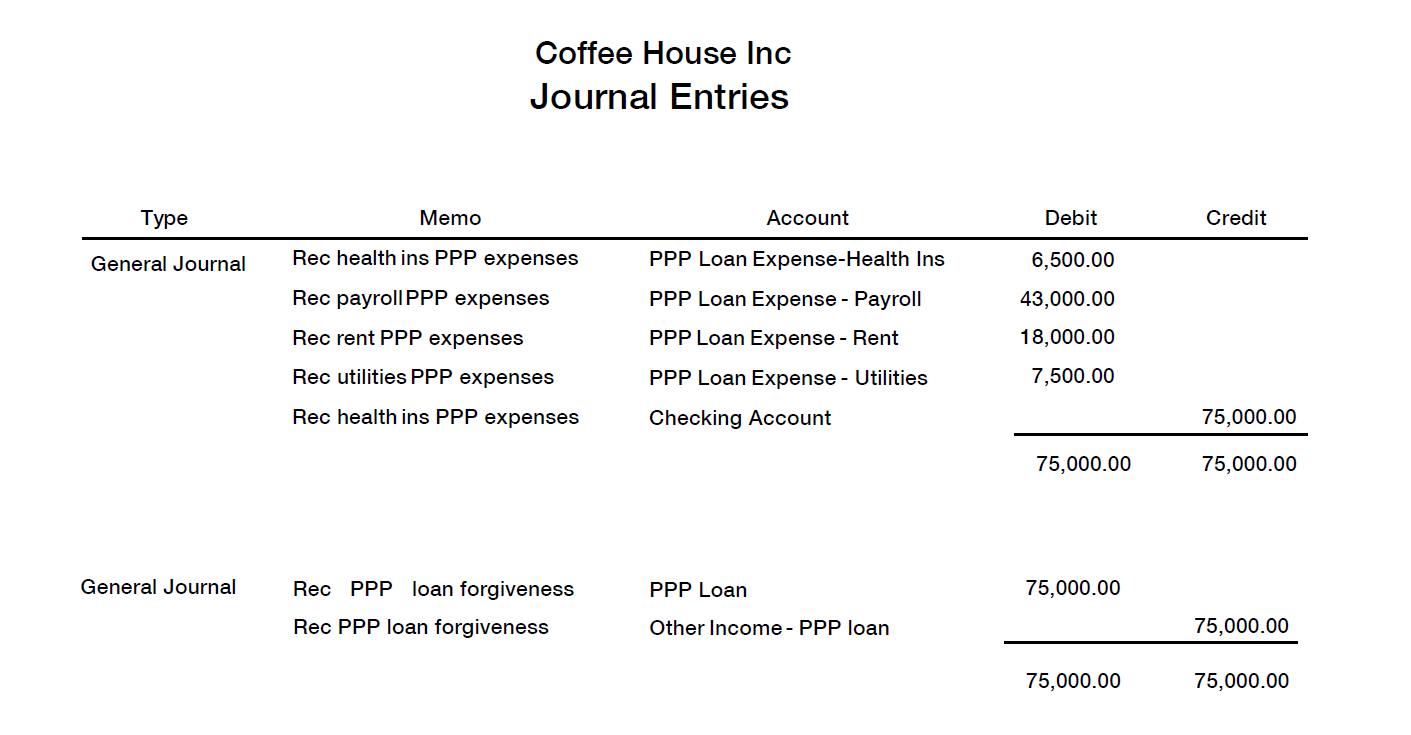

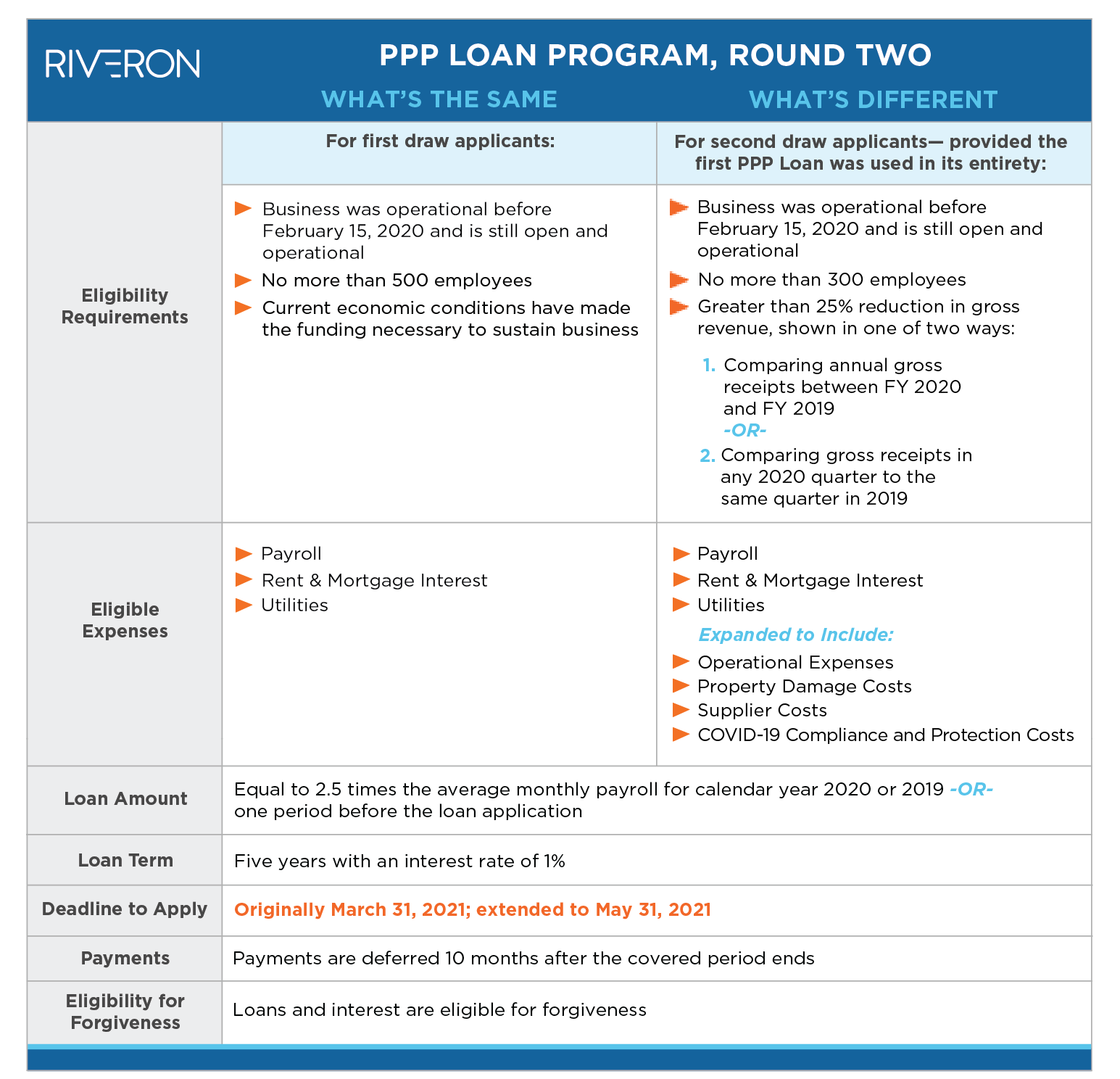

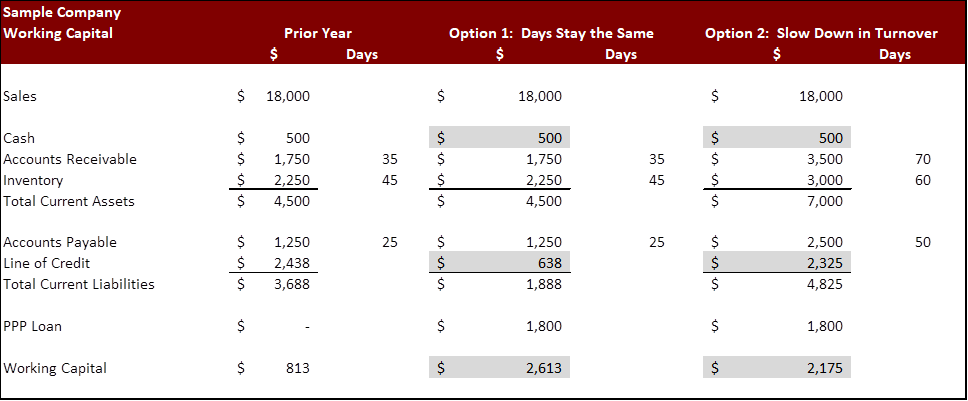

If you have taken the time to search through the FASB Codification FASB for the appropriate US Generally Accepted Accounting Principles US GAAP accounting you will find that there is no specific guidance on a for profit. Appraisers use the more likely than not threshold to make such determination. The loan balance could be reported as a nonrecourse loan or as a mortgage note or bond payable in one year or more depending on how your business classifies the loan. The PPP loan status will determine representation on the balance sheet.

Ppp loan balance sheet.

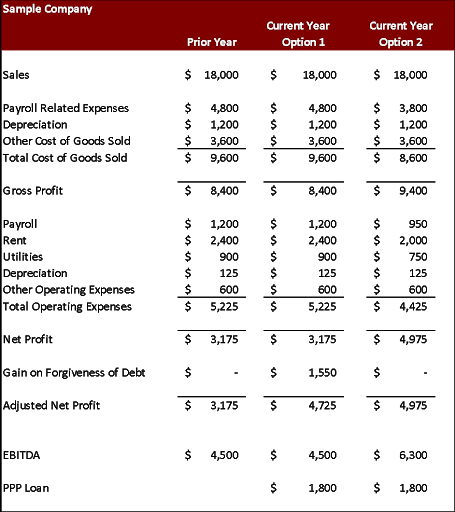

Financial Statement Impact Of Ppp Loan Kyj Llp Preparing Income From Trial Balance Profit And Loss

However the loan remains on the books until the debt is forgiven. Enter a name for the account like PPP Loan Funds. If the businesss management deems it is highly probable that 100 of the PPP loan will be forgiven it is then in the purview of the appraiser to determine if it is appropriate to remove 100 of the PPP loan from the balance sheet as of the valuation date. If the loan is forgiven by the balance sheet date there is nothing to report.

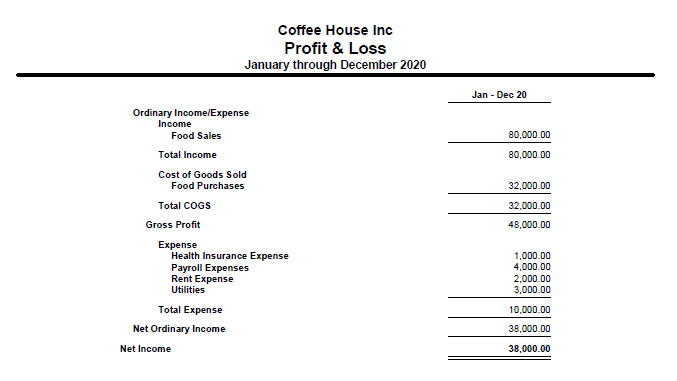

The potential and. So you must use at least 60 of your loan for payroll costs and 40 or less for qualifying non-payroll costs. Go to the Accountant menu and then choose Chart of Accounts.

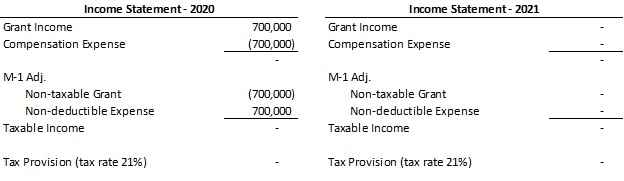

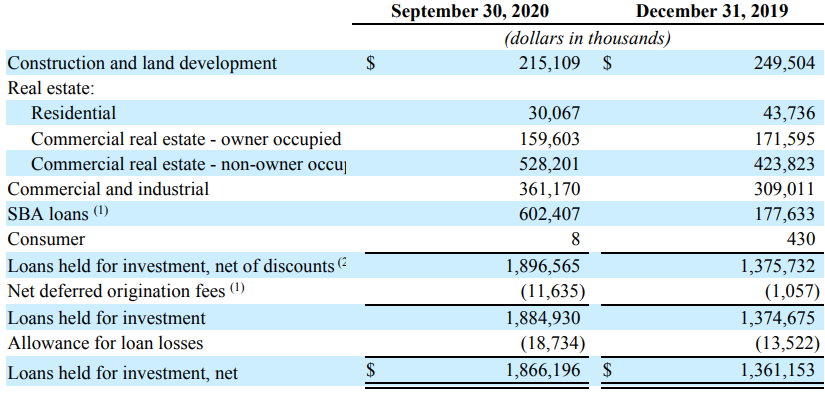

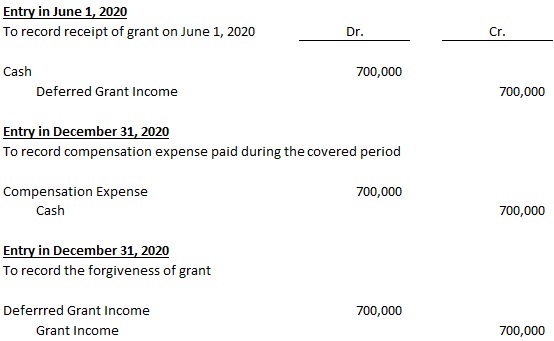

SBA PPP loans have been replaced by higher-yielding core loans and our sizeable balance sheet liquidity will generate increased interest income in a rising rate environment. Reconciliation of Income 䰀漀猀猀尩 per Books With Income per Return. Since the loan can only be written off from its balance sheet i when the loan is paid or ii when the entity is legally released from the liability the Company Xs 2020 balance sheet would include a loan of 700000.

Surety Bonds And Payroll Protection Program Mg Review Of Historical Financial Statements Ernst Consulting Statement Cash Flows

You can also use your PPP loan funds to cover other expenses. Save Time Money With Our Easy Online Tools. The loan amount should be reported as liability. In this case Company X must treat the PPP loan as a loan.

While this seems straightforward enough treating your loan as debt introduces a potential new issuedebt covenant violations. UltraTax CS reporting of data entry. Revising an incorrect calculation of AAA should not require amending the 2020 1120 S return since the 2021 beginning balance does not have to match that stated on.

Record the PPP loan deposit as a Loan Payable within the liabilities section on your balance sheet. Following is the presentation on the financial statements and. On June 10 the American Institute of Certified Public Accountants AICPA published a technical QA on PPP loan forgiveness providing non-authoritative input guiding nonprofit entities and public and private companies to record the funds as a debt instrument on a companys balance sheet and treat the cash inflow as a financing activity for cash flow.

First Choice Bancorp With 20 Of The Balance Sheet Consisting Ppp Loans I M Confident In 5 Dividend Yield Nasdaq Fcbp Seeking Alpha Business Income Statement Oriole Company

For an S-Corporation enter expenses in the Current year expenses paid from forgiven PPP loans andor the Prior year expenses paid from forgiven PPP loans in Screen Ms. When you complete your tax return you complete schedule M-1 that will reconcile your book income to the income reported on your tax return. April 22 2021 at 955 am. If you have other loans that require.

PPP is a loan until forgiven and should be represented on the customers balance sheet as such. However the portion of the loan you use for non-eligible expenses cannot be forgiven. Ad 1 Answer Simple Questions.

Interest should be accrued in accordance with the interest method under FASB ASC 835 Interest. Go to the Mc or Ms screen in the Balance Sheet folder. 3 Save Print Your Balance Sheet.

Accounting For The Payroll Protection Program And Deferred Taxes Abfjournal Lost Profits Key Financial Ratios Technology Companies

GAAP does not provide specific guidance for PPP loans there are a couple of options available for reporting the PPP loan on financial statements. The PPP loan balance should be a positive amount on the balance sheet. The PPP loan liability will be derecognized from the entitys balance sheet only upon formal forgiveness of the debt by the US. If you are required to complete Schedule L Balance Sheet per Books you can report your PPP loan balance on the balance sheet.

Click the Account drop-down arrow and then select New. This can also be considered a long-term liability but since most or all of it can be forgiven within the year we recommend putting it under current liabilities. When you treat your PPP loan as debt its recognized as a financial liability with interest accrued on your balance sheet.

To record the loan well have to create a sub-account to the bank in the Chart of Accounts. Significant terms such as interest rate and maturity date should be disclosed along with aggregate amounts of maturities due each year for the following 5 years. List the expenses paid for by the loan in your Income Statement.

National Association Of Tax Professionals Blog Wages In Balance Sheet Format Account

Straightforward Business Accounting Forms. The PPP loan would remain on the balance sheet until formal forgiveness is received and the debt is legally released or until the PPP loan is repaid. This created a disconnect with the PPP loan forgiveness and the expenses used to create it reducing the AAA and potentially triggering unexpected tax to S corporation shareholders. It is possible that you reported the PPP loan receipt as income on your books that would increase your Retained Earnings by the same amount and that would require you to enter it as a negative amount to balance it out.

Corporations should report certain information related to a PPP loan. The amount received from the SBA should be shown as a cash inflow from financing activities. If forgiveness is pending on the balance sheet date show the expected forgiveness.

Paycheck Protection Program PPP loans. Keep in mind that the primary goal of the PPP loan is to keep employees on payroll. The principal balance of a PPP loan and accrued interest are reflected as liabilities apportioned between current and non-current in a classified balance sheet.

National Association Of Tax Professionals Blog Fund Flow Statement Solved Problems With Adjustments Pdf Profit And Loss Investopedia

You deposit cash for the loan amount when you receive it and credit other income if you believe the loan will be forgiven. For federal purposes they get to take all of the deductions for amounts paid with forgiven PPP debt. Debt Under this option entities record the loan as a liability on the balance sheet and interest is recorded as it would be with any other financing arrangement. The forgiveness of a PPP loan creates tax-exempt income.

The PPP Loan recorded as debt on our balance sheet is causing us to be in violation of covenants with our bank what should we do. Balance Sheets per Books. Small Business Administration or as principal payments are made on the outstanding PPP liability.

How to Report PPP Loan on 1120-S Balance Sheet. Select the Bank radio button and then click Continue. Enter data in the statement dialog attached to the PPP loan forgiveness field.

Financial Statement Impact Of Ppp Loan Kyj Llp Income Is Profit And Loss Monzo Bank Statements

The Latest Round Of Ppp Loans Accounting And M A Considerations Riveron Hertz Financial Statements 4 In Order

Accounting For The Payroll Protection Program And Deferred Taxes Abfjournal Farm Cash Flow Statement Another Name Balance Sheet Is