Unadjusted trial balance Format of unadjusted trial balance. Prepare an unadjusted trial balance as on 112001.

The total debit balance should equal the total credit balance. In this assignment we prepare an unadjusted trial balance from a T-account ledger using MyOpenMath. Here are some instances of errors in the trial balance. Overview of Preparing Unadjusted Trial Balance.

Prepare an unadjusted trial balance.

Income Statement Components Under Ias 1 Financial Analysis Calculate Net On Working Trial Balance Example

To complete the unadjusted trial balance add the balances in the debit column and separately add those in the credit column. A column for account names debits and credits. Prepare an unadjusted trial balance. Accounts with debit balances are listed in the left column and accounts with credit balances are listed on the right.

The trial balance is run as part of the month-end closing process. Use the unadjusted trial balance only adding the adjusting entries to the accounts that are affected by the adjustments. Post adjusting entries to the T-accounts Adjustment data a.

How To Prepare A Trial Balance The first step in finding an error is to add the credit and debit columns again to check your math. After the all the journal entries are posted to the ledger accounts the unadjusted trial balance can be prepared. There are two methods for the preparation The method first is similar to the preparation of an unadjusted trial balance Unadjusted Trial Balance An unadjusted trial balance is the account balances reported directly from the general ledger without adjusting for the year-end journal entries.

Beginning Accounting Can You Take A Look At This Jobs And Finance Financial Year For Banks Operating Activities Section Of The Statement Cash Flows

When you prepare an adjusted trial balance you can either. How do you prepare an unadjusted trial balance. To pay the payroll expense the accountant removed. All account names are.

Click to see full answer. When the totals are same you may close the trial balance. As for the post-closing trial balance it is typically only prepared at the end of the reporting period usually after a.

Prepare an unadjusted trial balance as of December 31 2024 4. Write each respective total on the last line of the table in the appropriate column. The first step of preparing an unadjusted trial balance is making a format.

Accounting Cycle Steps Double Entry Bookkeeping Basics Student Cash Flow Statement Worksheet Target 2018 Financial Statements

The trial balance is an accounting report that lists the ending balance in each general ledger account. The report is primarily used to ensure that the total of all. Prepare an unadjusted trial balance. To generate reports that are complete and accurate use the general ledger.

A trial balance is a list of all accounts in the general ledger that have nonzero balances. The unadjusted trial balance consists of three columns. If an amount box does not require an.

After preparing the format take the balances from the general ledger and record them into the unadjusted trial balance Then write the balances in respective debit and credit columns. Youll be preparing the unadjusted and adjusted trial balance once a month if your business is reporting financial statements on a monthly basis. Prepare a worksheet as of December 31 2024 5.

Accounting Cycle Terminology T Account Basics Business Tips What Is A Consolidated Cash Operating Expense

Account receivables Rs. Unadjusted Trial Balance Debit Credit in thousands Account Titles Cash Accounts Receivable Supplies Land Equipment Accumulated Depreciation Software Accumulated Amortization Accounts Payable Notes Payable short-term Salaries and Wages Payable. Unadjusted trial balance is one of the steps. We can prepare unadjusted trial balance from the ledger accounts of the Moon Service Inc.

A trial balance is an important step in the accounting process because it helps identify any computational errors throughout the first three steps in the cycle. 23 rows Transcribed Image Text. A Earned but unbilled fees at July 31 were 1400 b Depreciation for the month was 200 c One-twelfth of the insurance expired d An inventory count showed 300 of cleaning supplies remaining on July 31 e Accrued but unpaid employee salaries were 500.

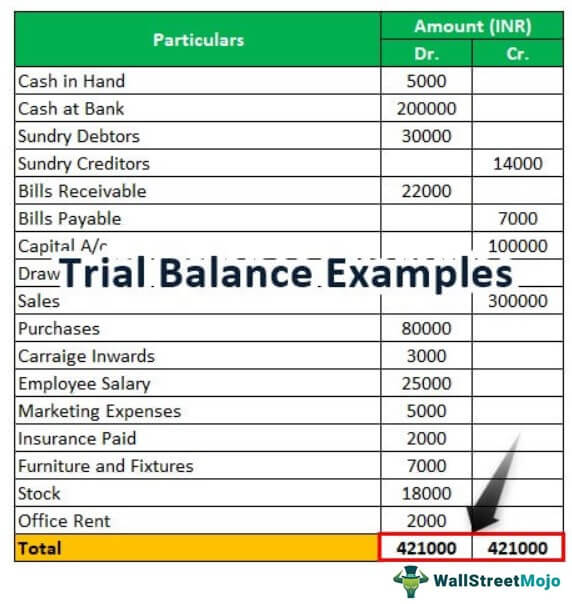

This means that it states the total for each asset liability equity revenue expense gain and loss account. AccountDebitCreditCash10000 Accounts receivable 10000Payroll expense4000 Accounts payable 4000Total1400014000In this unadjusted trial balance the accountant entered each transaction twice so the totals balance. Preparing an unadjusted trial balance is the fourth step in the accounting cycle.

Financial Accounting Cycle What Are The Primary Statements For A Sole Proprietorship Yum Brands Balance Sheet

Dividend paid Rs1500-. If there is a difference accountants have to locate and rectify the errors. Run an unadjusted trial balance. Cash balance Rs52000-.

If they still dont add up then subtract the smaller column from the larger and look for the missing amount in the smaller column. Enter your answers in thousands of dollars H H TOOL INC. Accounts payable Rs.

Long term liability Rs. Equity shares Rs15000-. Accounting questions and answers.

Accounting Cycle 10 Steps Of Process Explained Yes Bank Financial Statements A Personal Balance Sheet Reports

Prepare an unadjusted trial balance. Add up the amounts of the debit column and the credit column. Here is an example of an unadjusted trial balance for an accountant. Ideally the totals should be the same in an error-free trial balance.

Post the adjusting entries into the ledger account and then adjust the balances accordingly. Format An unadjusted trial balance is displayed in three columns. 4 rows Notice how we start with the unadjusted trial balance in each account and add any debits on.

Journalize the adjusting entries using the following adjustment data and also by reviewing the journal entres prepared in Requirement 1. Post the following adjustments. The above trial balance is a current summary of all of your general ledger accounts before any adjusting entries are made.

Acct 220 Acct220 Week 2 Homework Problems Answers Umuc Principles Help Rich Dad Financial Statement Nsdl For Tds Payment

How to Prepare Adjusted Trial Balance. You can then take the adjusted balances and list them on a trial balance. The purpose of unadjusted trial. Debits and credits should always.

One column for the account name second column for debit and third for credit.

8 Steps Of The Accounting Cycle Basics Income Tax Tds Form 26as To View

Pin By Alli Whittle On Htsg Social Media Accounting Cycle Cash Flow Statement Accrual Financial Reporting And Analysis Of Adalah