It is highly variable from one industry sector to another. Investors should ensure the EPS figure is growing faster than revenue numbers because it indicates company management is increasing the efficiency with which it runs the company.

Cipla ltd dr reddys lab year 2013 2013 current ratio 194 148 quick ratio 164 16 debt equity ratio 011 05 gross profit margin 2255 1833 net profit margin 1817 1274 return on assets 11232 37501 inventory turnover ratio 347 551 debtors turnover ratio 514 414 asset turnover ratio 094 133. F SHORT-TERM SOLVENCY OR LIQUIDITY MEASURES Current assets 1Current ratio Current liabilities 873701 264 Times 2017 330807 1081410 282 Times 2018 383222 1242663 2019 329 Times 377151 f SHORT-TERM SOLVENCY OR LIQUIDITY MEASURES. The most important ratio is Net Profit Margin percentage or Net margin. It tells us how much out of every sale CIPLA gets to keep after everything else has been paid for.

Ratio analysis of cipla.

Analysis Of Cipla Limited 2021 Research And Markets Financial For Startup Business Accounts On Balance Sheet

39 rows Liquidity Ratios. The EVEBITDA NTM ratio of Cipla Limited is significantly lower than its historical 5-year average. Operating Ratio Opex 4075. GO Apr 04 0957 BSE 101270 -225 -022 Volume 17607 Prev.

97169 Median Fair Value of CIPLA. 30 rows Margin Ratios. Ratio analysis ste1fire Follow ratio analysis cipla ltd 1.

Close 101495 Open Price 101900 Todays Low High 100400 102065 Bid. A SWOT Framework Analysis of Cipla Limited completes this in-depth company analysis. A short summary of this paper.

Cipla Financial Analysis Group 7 Shareholders Equity Section Of Statement Position R&d On Income

RATIO ANALYSIS OF CIPLA LIMITED FOR THE YEARS 2007 TO 2011 RETURN ON ASSETS. Product cover images may vary from those shown MORE A. It measures the efficiency of the use of total assets. Operating Cycle Ratio.

Compare with peers and industry. EBIT Margin 1222. Account Receivable Day.

BALANCE SHEET of 200720082009 PROFIT LOSS Statements. 3 Full PDFs related to this paper. Account Receivable Turnover Ratio.

Aromatherapy Market Analysis Report Share Trends And Overview 2019 2025 Organic Personal Care Living Essentials Oils Simple P&l Excel Template Cash Flow Ppt

Results performance stock scores and trends latest financials asset ratios and margins. Calculation of Ratios 3. This ratio is showing decreasing trend. RETURN ON INVERSTED CAPITAL RATIO.

Price Qty 101255 128 Offer Price Qty 101345 4 52 Wk Low High 80620 108315. The major competitors of Cipla Limited namely Aurobindo Pharma Dr. As on Apr 082022 the Intrinsic Value of CIPLA is Rs.

In Cipla the EPS growth was 644883053647508 which is bad for the company. Fixed Assets Turnover Ratio. Fair Value Median EV EBIDTA Model.

Indian Equity Investment Ideas By Rk Finament In 2022 Tips Investing Financial Literacy Sunpharma Statements Sgv Accounting Firm

Gross Profit Margin Revenue – Cost of Revenue Revenue. Full PDF Package Download Full PDF Package. Financial Charges Coverage Ratio Post Tax. Turn Over Ratio Stability Ratio 4.

Core EBITDA Margin 1505 1172 1295 1857 1692 1798. The current company valuation of Cipla Limited is therefore way below its valuation average over the last five years. Current Ratio X 379.

Download Full PDF Package. Financial Charges Coverage Ratio. Working Capital Turnover Ratio Working Capital ratio Cost of Goods soldNet Sales Average total assets This ratio establishes a relationship between cost of goods sold and average total assets.

Pin On Culture Bank Asia Financial Statement Budgeted Net Income

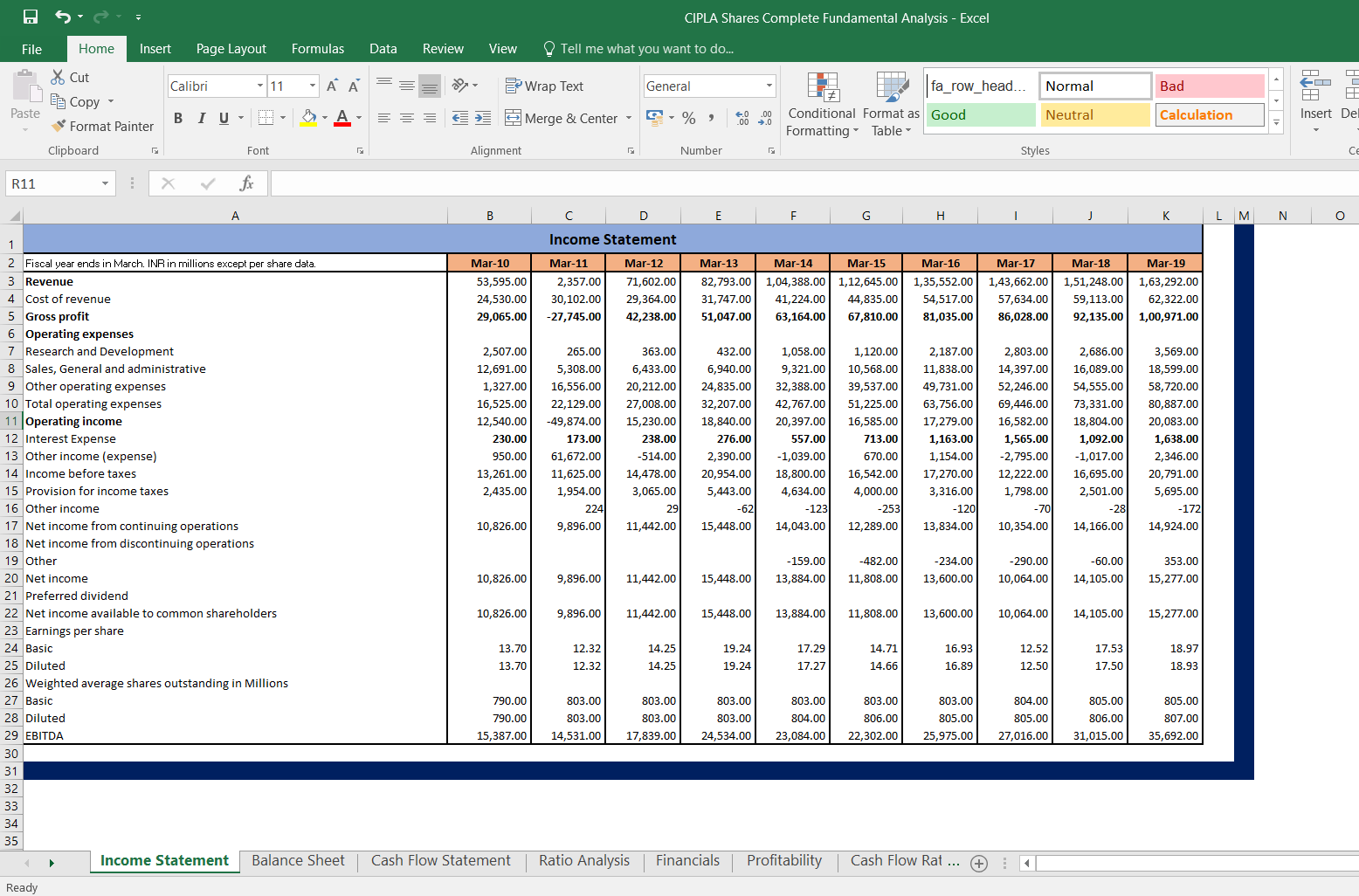

An ideal company has consistent profit margins. An economic analysis of Cipla Limited is also presented through ratio analysis profit and loss analysis presentation of. A COMPARATIVE STUDY ON FINANCIAL STATEMENT ANALYSIS OF CIPLA LIMITED. Sunpharma and Cipla emerge with most buying signal with investor psychology.

Ratio Analysis RATIO ANALYSIS You can view the ratio analysis for the last 5 years. Expiry Date Put Open Interest Call Open Interest PCR OI Signal Charts. An economic analysis of Cipla Limited is also presented through ratio analysis profit and loss analysis presentation of the company balance sheet and much more.

Open Interest Put Call Ratio of Cipla Ltd. Quick Ratio X 264. According to these financial ratios Cipla Limiteds valuation is way below the market valuation of its sector.

Financial Analysis Of Cipla By Usersunix Issuu Frs 102 Illustrative Statements 2019 Kpmg Kroger

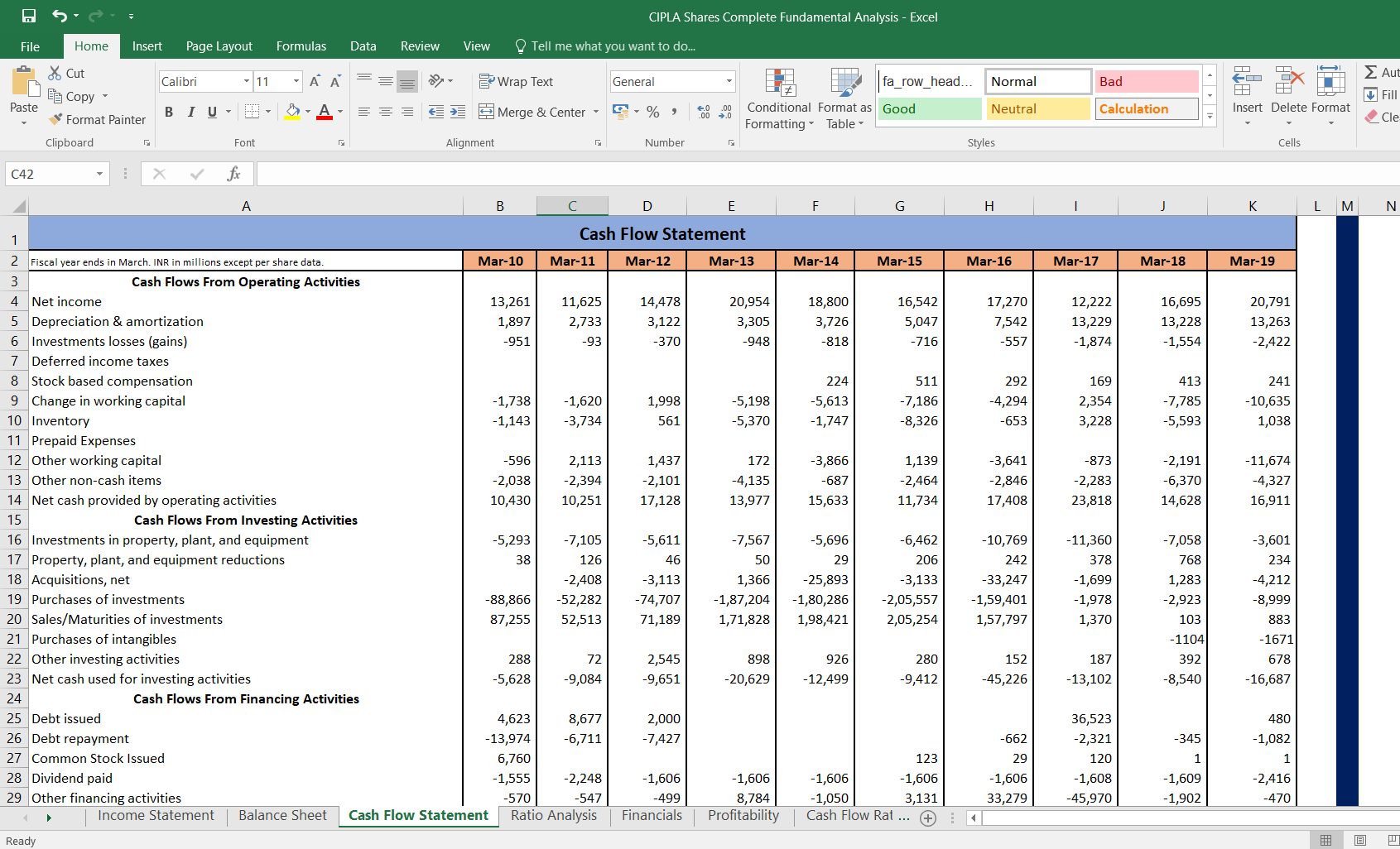

94454 Fair Value Median EV Sales Model. 97522 Fair Value Median Price Sales Model. Reddys Laboratories Limited Pfizer and Sun Pharmaceutical are analyzed through a company profile in-depth business segment analysis a financial analysis and SWOT analysis. FINANCIAL STATEMENT To get a better idea about the current financial status of Cipla we went through following financial statements.

This ratio is decreasing from 2007 to 2009 and increased in 2010 because total assets are increasing faster than profit after tax. 31 rows Quick Ratio. It also measures the per rupee sales generated by the rupee of total assets.

The name of the Company was changed to Cipla Limited on 20 July 1984. Intraday AnalysisScreener are on Real Time updated every 5 Mins and End of Trade days Value expected tto be updated. Cipla has a Debt to Equity ratio of 0 which is a strong indication for the company.

Financial Analyst Workshop 108 Slide Powerpoint Flevy Analysis Habitat For Humanity Statements Sgv Audit Firm

Financial statement and ratio analysis. 97169 determined based on Median of the 3 historical models. Days In Working Capital.

Cipla Ltd Shares Complete Fundamental Analysis Eloquens Restaurant Pro Forma Template Cash Balance Financial Statement

Cipla Ltd Shares Complete Fundamental Analysis Eloquens Net Loss Shown In Balance Sheet Preparation Excel