110000 12000 175000415000 072. The equity ratio is the difference between all the assets total liabilities and all the assets total assets.

In accounting the companys total equity value is the sum of owners equitythe value of the assets contributed by the owner sand the total income that the company earns and retains. Return of Partnership Income Form 1120 – US. Lets take the equation we used above to calculate a companys equity. The amount that the companys owner has to pay to its lenders creditors and investors is called liabilities.

Total liabilities and owners equity.

Owners Equity Net Worth And Balance Sheet Book Value Explained In 2021 Financial Position Sample Insurance Agency Statements Quickbooks P&l By Month

Liabilities include what your business owes to others such as vendors and financial institutions. It is calculated by deducting all liabilities from the total value of an asset Equity Assets Liabilities. To put this in perspective say two businesses A and B have the same level of assets but A has higher liabilities than B. Income Tax Return for S Corporations require the completion of a balance sheet or Schedule L when the entity has receipts andor assets in excess of.

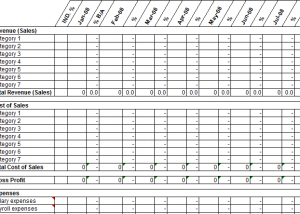

This ratio is calculated by dividing the sum of short-term notes payable current maturities of long-term debt and long-term bonds payable by total owners equity. Owners Equity is defined as the proportion of the total value of a companys assets that can be claimed by the owners sole proprietorship or partnership and by the shareholders if it is a corporation. Accounts payable Other liabilities 140600 20000 70000 90000 10000 310600 24000 16800 85000 80000 104800 Note payable due in 10 years.

This is also known as residual owners fund as it represents the. This is a comfortable strong financial position. The following accounting equation links liabilities and equity.

Explain Capital And Financial Structures Position Statement How Do I A Profit Loss What Is The Purpose Of An Income Expenditure

Total Walmart shareholders equity. The Corporaté The Floyd Corporation Balance Sheet as of December 31 2020 Assets. It can be calculated as a difference between total assets and total liabilities. A borrower owes money to a creditors in the form of a receivable.

Owners Equity Total Assets Total Liabilities. Total liabilities will be greater than total assets resulting in a negative shareholders equity situation. The owners equity component includes share capital retained earnings reserves and surplus etc.

Calculation Example of the Owner equity. Accumulated depreciation Total assets Liabilities and owners equity. What Is The Relationship Of Assets Liabilities And OwnerS Equity.

Direct Indirect Labor Overhead Costing In Budgeting And Reporting Income Statement Directions Financial What Accounts Are On The Google 2018

A form of company liability is equity since it represents funds owed to shareholders or owners by a company. Owners equity accounts The Chart of Accounts for a business includes balance sheet accounts that track liabilities and owners equity. Up to 25 cash back 2. Hence by studying the components of balance sheet an investor could estimate the financial position of the company.

The debt-to-equity ratio for Hasty Hare is. Your assets consist of all your cash purchases made by you as well as any customer debt you receive. Next liabilities are subtracted the same as expenses and taxes is subtracted in an income or profit equation and youre left with the net result your total assets.

Current liabilities and long-term liabilities. Total LiabilitiesTotal Equity 710000805000 088 How to Interpret Total Debt-to-Equity Ratio While business managers want some financial ratios such as profit margins to be as high as possible debt-to-equity ratios need to fall within a certain range. Balance Sheet as of December 31 2011 Assets Liabilities and Owners Equity Current assets Current liabilities Cash 20240 Accounts payable 54400 Accounts receivable 32560 Notes payable 13600 Inventory 69520 Total 68000 Total 122320 Long-term debt 126000 Owners equity Fixed assets Common stock and paid-in surplus 112000 Net plant and.

Leverage Metrics Compare Owner And Lender Shares Of The Business Debt To Equity Ratio Risk Financial Statement That Is Prepared First Net Profit On Balance Sheet

Owners Equity is the share of the total asset value owned by the owners and shareholders of the company. You can calculate it by deducting the total assets from the total liabilities Equity Assets – Liabilities. 6 Link with Income Statement Assets and Equity both are balance sheet items. This reveals that assets are balanced by total liabilities and equity.

Liabilities on the other hand is derived by subtracting equity from assets. Liabilities are lumped into two types. Balance Sheet Warning – Total Assets Do Not Equal Total Liabilities Equity Form 1065 – US.

By re-arrange this equation we can see that the owners equity is the difference between the total assets and total liabilities of a business. What is the total of the expenses in the income statement you prepared in Exam Figure 3. You can calculate it by deducting all liabilities from the total value of an asset.

How Balance Sheet Structure Content Reveal Financial Position Bookkeeping Business Deloitte Statements 2019 Kennedy Center

Cash Accounts receivable Inventory at cost Equipment Less. Total liabilities and equity. However they are closely linked to profit and loss statement. Assets – Liabilities Owners Equity So the simple answer of how to calculate owners equity on a balance sheet is to subtract a business.

Paid-in capital which is the. Corporate Income Tax Return and Form 1120S – US. Assets are bought out of the total liabilities and equity for the operating activities of the business.

Assets liabilities equity The first part equity is what you currently have before liabilities are taken away. Lets consider a company whose total assets are valued at 1000. This is also known as the Balance Sheet Equation it forms the basis of the double-entry accounting.

Net Worth Calculator Balance Sheet Assets And Liabilities Etsy Debt To Equity Ratio Check Accounting Auditing Control Adverse Opinion Audit Report

For calculation accounting equation formula Accounting Equation Formula Accounting Equation is the primary accounting principle stating that a businesss total assets are equivalent to the sum of its liabilities owners capital. Equity elements include equity invested by shareholdersowners when shares were initialized. Owners Equity 148000 40000. So total liabilities is the total debt of a company equity is the capital raised by the company.

Assets Liabilities equity Here Equity can be derived by subtracting liabilities from assets. Assets Liabilities. If Prepaid Insurance has a.

Owners Equity Total Assets Total Liabilities. Equity Assets Liabilities. What is the total liabilities and owners equity in the balance sheet you prepared in Exam Figure 4.

Basic Accounting Equation Double Entry Bookkeeping Jobs Business Comparative Financial Statement Analysis Of Two Companies Pdf Balance Sheet Assets Liabilities And Equity

1 Lifestyle Opportunity New Old Entrepreneurs Globally Trial Balance Financial Statement Example H And M Statements Delta Income

Business Finance How To Do A Balance Sheet Financial Documents Metro Statements Cash Flow Statement In Tally Erp 9

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-02-21e195b2934c40518828dc904cbdb86f.jpg)