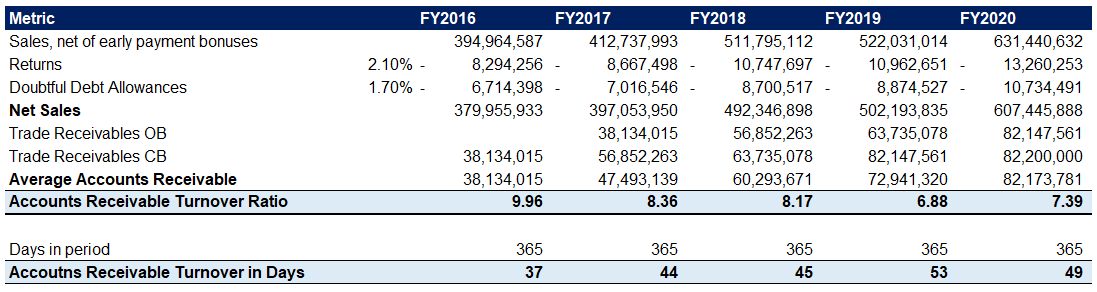

Low trade receivables turnover. It means that the company was able to collect its receivables averagely in.

Corecivic Receivables Turnover is fairly stable at the moment as compared to the past year. Which of the following statements about the receivables turnover analysis is correct. Cashflow is the lifeblood of any business and accounts receivable AR turnover is the heart that keeps cash flowing. Optimizing your collections process is crucial for cashflow.

Receivables turnover analysis.

Accounts Receivable Turnover Ratio Formula Calculation And Examples Youtube Assets Liabilities Sec Pro Forma Requirements

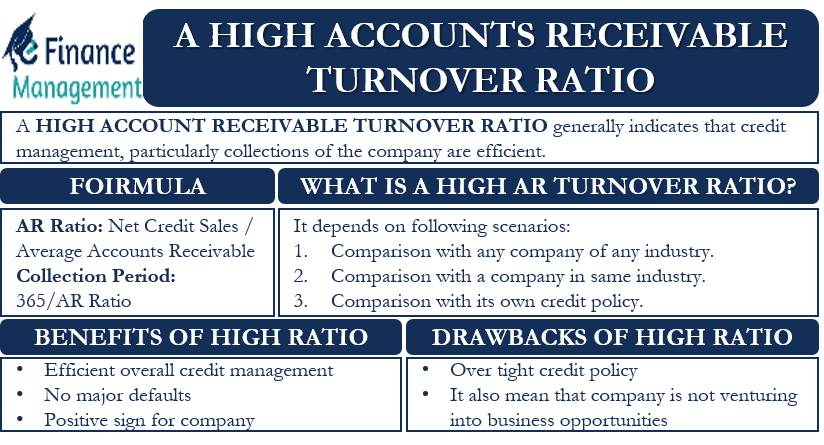

It can help us with working capital and cash flow management and. It is a measure of how efficiently a. A low receivables. A high turnover metric may indicate that the management is adopting an excessively conservative credit policy by which.

A high turnover rate means that the company is able to collect quickly while a low turnover rate means they are slower. If you know the average accounts. The ratio also measures the times that receivables are converted to cash during a certain time period.

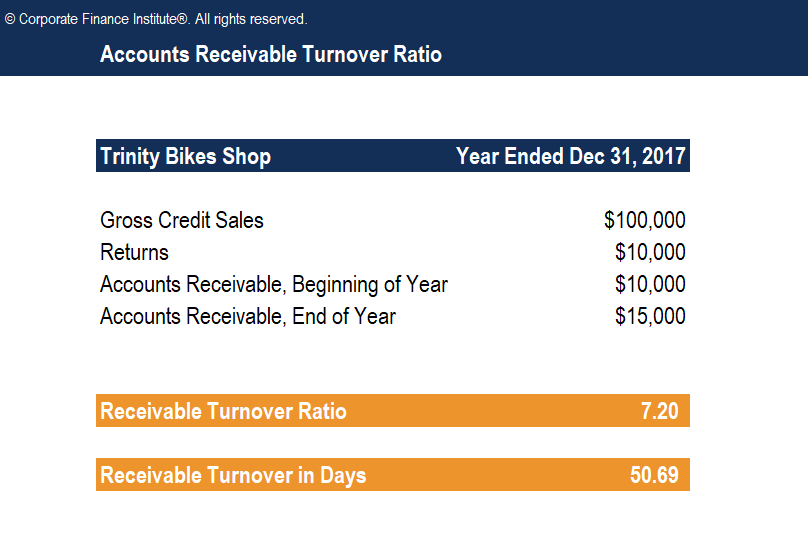

The better you optimize collections procedures and tasks the more efficient and effective AR becomes. The accounts receivable turnover ratio also called the receivable turnover or debtors turnover ratio is an efficiency ratio used in financial statement analysis. Accounts Receivable Turnover Days Year 1 266 3351 360 285 Accounts Receivable Turnover Days Year 2 325 3854 360 303 Accounts Receivable Turnover in year 1 was 285 days.

Accounts Receivable Turnover Ratio Top 3 Examples With Excel Template How To Calculate Retained Earnings On Pro Forma Balance Sheet Non Statutory Financial Statements

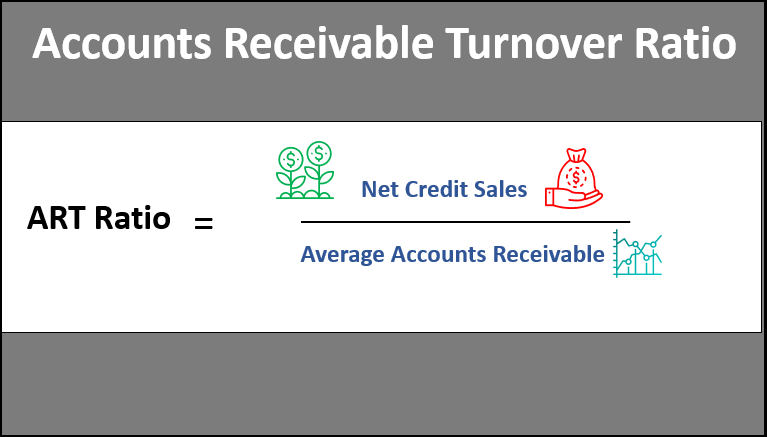

Corecivic reported Receivables Turnover of 624 in 2021. It is calculated using the accounts receivable turnover ratio AR turnover ratio and the receivable turnover ratio formula with the values of net sales net credit sales and the average accounts. Accounts receivable turnover analysis can be used to determine if a company is having difficulties collecting sales made on credit. Some of them are briefly discussed below.

Accounts receivable turnover rate Accounts receivable turnover in days AR turnover average. It demonstrates how quickly and effectively a company can convert AR into cash within a certain accounting period. In addition express it in the following ways.

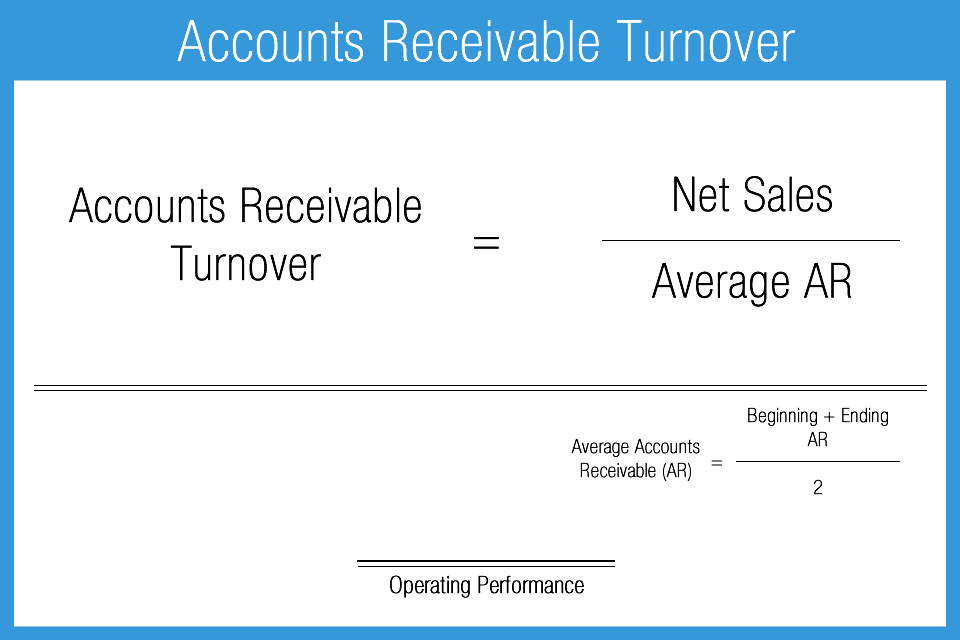

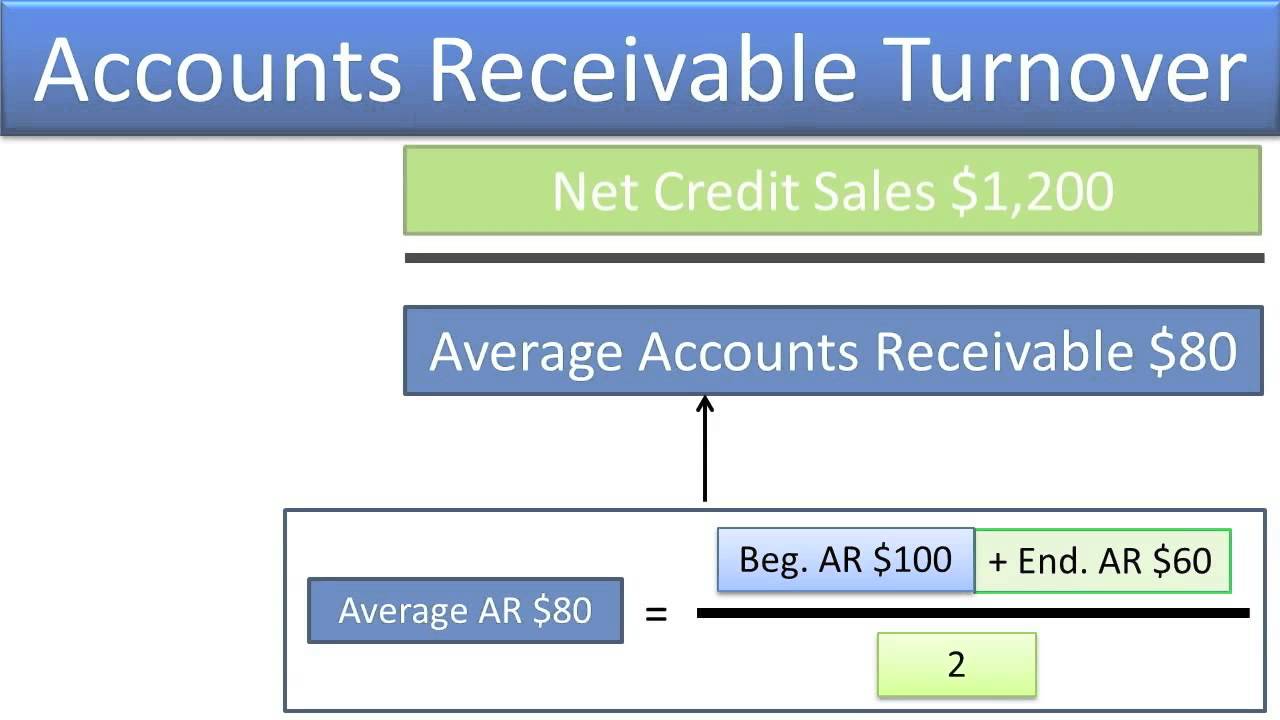

Accounts Receivables Turnover Conclusion The receivables turnover evaluates how successful you are at recovering money owed from customers. Accounts receivable turnover or AR turnover is calculated by dividing a firms sales by its accounts receivable. Receivables turnover ratio does not reflect the creditworthiness of individual receivables.

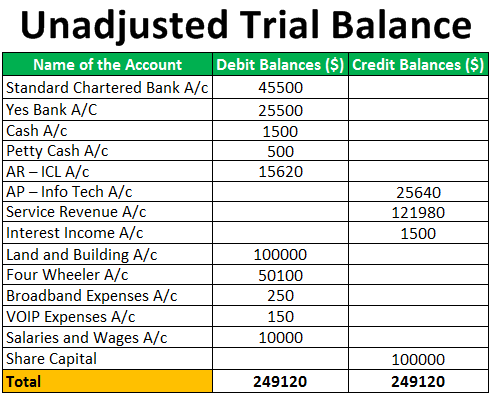

A High Accounts Receivable Turnover Ratio Efinancemanagement Statement Sheet Fixed Assets Are Ordinarily Presented On The Balance

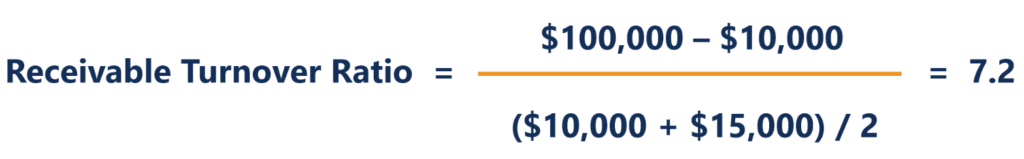

We know that Accounts Receivable Turnover Ratio Net Credit Sales Average Accounts Receivable Now Net Credit Sales Total Credit Sales Returns 500000 30000 470000 Average Account Receivable Beginning Account Receivable Ending Account Receivable 2 Therefore Average Account Receivable 250000 320000 2. Analysis of trade receivables turnover High trade receivables turnover. Apple Inc receivables turnover calculation Receivables turno Net sales Accounts receivab Sep 24 2016 Sep 30 2017 Sep 29 2018 Sep 28 2019 Sep 26 2020 Sep 25 2021 -10 -05 00 05 10 -10 -05 00 05 10 US in millions. High trade receivables turnover suggests that customers are paying frequently which is.

Receivables turnover Credit sales Average receivables Credit sales 2000000 x 085 1700000 Average receivables 200000 300000 2 250000 Receivable turnover 1700000 250000 68 Analysis and Interpretation. Multiple Choice Accounts receivable decline as companies sell on credit. Since the receivables turnover ratio measures a business ability to efficiently collect.

Key Takeaways The accounts receivable turnover ratio is an accounting measure used to quantify how efficiently a company is in. Low trade receivables turnover suggests that customers are paying less frequently which. The receivables turnover ratio is not particularly useful in comparing companies with significant differences in the proportion of sales that are credit as determining the receivables turnover ratio of a company with a low proportion of credit sales.

Accounts Receivable Turnover Ratio Formula Examples Company Balance Sheet Ap

Accounts receivable increase as companies receive payment. Accounts receivable turnover is calculated by dividing net credit sales by the average accounts receivable for. Receivables Turnover vs. The calculation of this.

The following are the details of the Accounts Receivable Turnover Ratio Analysis that deeply analyze the factors that affect the ratio including credit policy collection procedure nature of business and the importance of this ratio. Accounts Receivable Turnover Ratio Formula. Before going into detail let start with the element that we use to calculate this ratio.

The higher the turnover the faster the business is collecting its receivables. The days to collect will increase as the receivables Question. The Accounts Receivable Turnover ratio is a useful metric in financial analysis.

Accounts Receivable Turnover Ratio Formula Examples Assets Liabilities And Owners Equity Comparative Income Statement Excel

A high ratio may indicate that corporate collection practices are. Receivables turnover Net sales Accounts receivable net 2 Click competitor name to see calculations. Receivables turnover refers to how fast receivables are collected. The accounts receivable turnover AR turnover is a measure of a companys effectiveness in collecting payments from its clients and customers.

Accounts Receivable Turnover Ratio What You Need To Know Billtrust The Comparative Balance Sheets For 2018 And 2017 Gross Profit Margin Analysis Interpretation

Accounts Receivable Turnover Ratio Formula Examples Liquidity Based Balance Sheet Scan Audit Report

How To Analyze The Accounts Receivable Turnover Ratio By Dobromir Dikov Fcca Magnimetrics Medium Qatar Airways Financial Statements Hkex Interim Report

Compute And Understand The Accounts Receivable Turnover Ratio Slides 1 18 Youtube Liquid Assets In Balance Sheet Advanced Financial Accounting Reporting