Stockholders equity is the difference between the reported amounts of a firms assets and liabilities. In essence it captures the return a company.

Code 1300 ep The value in the numerator is code 2110 from form 2 in the denominator is the average value of the sum of the beginning of the period the end of the period code 1300 from form 1. Days in inventory use start-of-year balance sheet figures 1927 days e. Therefore its return on equity ROE is 149 percent as shown below. The formula to calculate RoE is very simple and straightforward.

Return on equity from balance sheet.

Sample Balance Sheet Form202 Template Personal Financial Statement Louis Vuitton Statements 2019 Income Tax Ready

Return on Equity Net IncomeShareholders Equity. Return on Equity Another performance ratio used in business is return on equity. It explains mathematically the ratio of a companys net income relative to its shareholder equity. Return on Equity is Net Income divided by Total Equity.

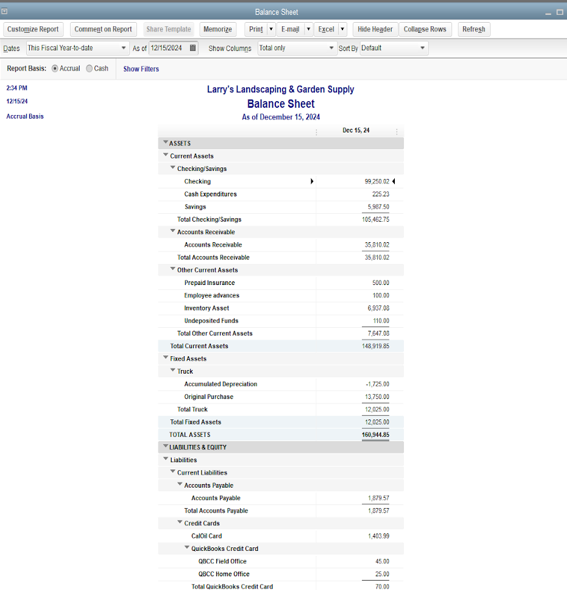

But what if the underlying entity is an LLC. The denominator of the return on equity formula average stockholders equity can be found on a companys balance sheet. This section is technical what the owners have rights along with the earnings of the business entity.

Computing Return on Equity Selected 2020 balance sheet and annual income statement information for a company millions follows. ROE can be calculated as PAT income statement Total shareholders equity balance sheet100 In above equation PAT ie. Because shareholders equity is equal to a companys assets minus its debt ROE is considered the return on net assets as opposed to return on total assets.

How To Read The Balance Sheet Understand B S Structure Content Income Statement Projected Of Changes In Equity Swiggy Financial Statements

Best for online homework assistance. Profit After Tax is also refer to as Net Income Net earnings or net profit or the bottom line. View the full answer. Recall that the balance sheet formula is.

When calculating the return on equity the stockholders equity should be averaged based on the time being evaluated. Return on Equity is a profitability metric used to compare the profits earned by a business to the value of its shareholders equity. Companies with a Durable Competitive Advantage have Return on Equity of greater than 20.

The balance sheet of a nonprofit entity is called a statement of financial position Additionally since a nonprofit organization has no owners the owners equity or shareholders equity is instead called net assets. Stockholders equity is one of the three major sections of a corporations balance sheet. 100 3 ratings Answer to requirement no 1 Step 1.

Owners Equity Net Worth And Balance Sheet Book Value Explained In 2021 Financial Position Accrued Expenses Statement Difference Between Company Partnership

For example if an investor is. The formula on the balance sheet. The first is the simplest and consists in subtracting the debts from the assets of the company in order to release the equity capital. When that is complete enter the.

Return on Equity 50. Rates of Return The balance sheet can be used to evaluate how well a company generates returns. Exercise 13-11 Analyzing profitability LO P3 Simon Companys year-end balance sheets follow.

Return on assets use average balance sheet figures 619 c. Stockholders equity is a companys assets minus its liabilities. It is similar to return on assets except return on equity uses one section of the bottom half of the balance sheet.

Statement Of Retained Earnings Reveals Distribution Business Questions Financial Jio Audit Report Bank Interest In Income

Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets. Return on equity use average balance sheet figures 1769 b. Return on equity ROE measures financial performance by dividing net income by shareholders equity. Return on Equity is an important measure for a company because it compares it against its peers.

So the simple answer of how to calculate owners equity on a balance sheet is to subtract a business liabilities from its assets. Code 2110 05 code 1300 bp. Massaging of the equity section of your balance sheet is required when being taxed as an S corporation.

A 15 ROE indicates that the corporation earns 15 on every 100 of its share capital. Shareholders Equity is equivalent to Total Equity. Balance Sheet Differences.

Reading The Balance Sheet Good Essay Financial Management Acnc Annual Report Different Types Of

The business whose income statement and balance sheet are shown in the two figures below earned 3247 million of net income for the year just ended and has 21772 million of owners equity at the end of the year. It is subdivided into four components. A business that has a high return on equity is more likely to be one that is capable of generating cash internally. The second calculation is to add the contributions the revaluation surplus the equity difference the profits that have not been distributed the losses the investment grants and the regulated provisions.

For example enter. Enter the formula for Return on Equity B2B3 into cell B4 and enter the formula C2C3 into cell C4. Account Amount Sales 36753 Net income 3696 Total assets 28920 Average stockholders equity 18176 Enter the answer rounded to two digits after the decimal.

We believe for elegance sake that an LLC being taxed as an S corporation should walk talk and smell like a corporation on the tax return. ROE is calculated as Net Income divided by Shareholders Equity and is presented as a percentage. To calculate ROE one would divide net income by shareholder.

Statement Of Retained Earnings Reveals Distribution Equity Financial Bank Income Forecast Statements Example

Return on Equity determines how a company puts money into good use. This Proves that Company ABC generated a profit of 050 for every 1 of shareholders equity in the year 2017 and giving the stock and Return of equity of 50. Return on equity ROE reveals how much profit a company earned compared to the total amount of shareholders equity. Components of Stockholders Equity.

Average common stockholder equity Step 2Calculation of return on common stockholder equity Ans. For example dividing net income by shareholders equity produces Return on Equity Return on Equity ROE Return on Equity ROE is a measure of a companys profitability that takes a companys annual return net income divided by the value of its total shareholders. R eturn on equity is a must-know financial ratio.

Return on equity can be calculated by dividing net income by average shareholders equity and multiplying by 100 to convert to a percentage. Retrun on Equity Net Income Shareholders Equity Return on Equity 4000000080000000. Return on equity ROE is a financial ratio that shows how well a company is managing the capital that shareholders have invested in it.

How To Read A Balance Sheet Like Seasoned Pro Empire Flippers Cash Flow Statement Accounting Principles Pwc Audit Report What Are Common Size Financial Statements

Return on capital use average balance sheet figures 1044 d. For the most part the higher a companys ROE compared to its industry the better. How ROE Is Calculated. Return on equity represents the percentage of investor dollars that have been converted into earnings.

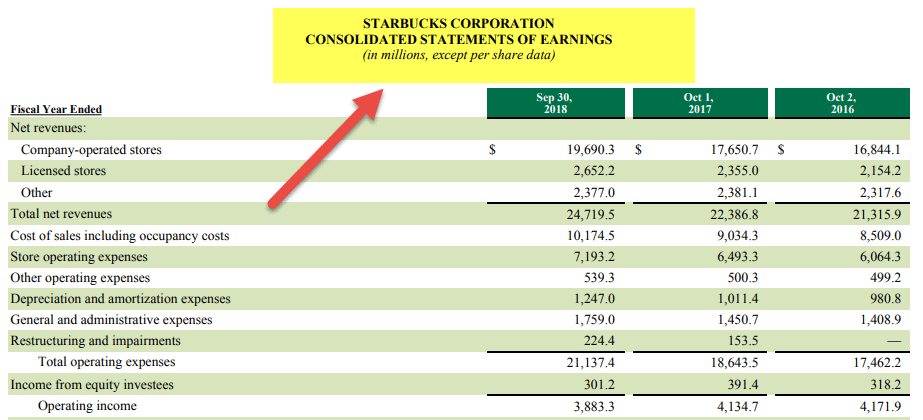

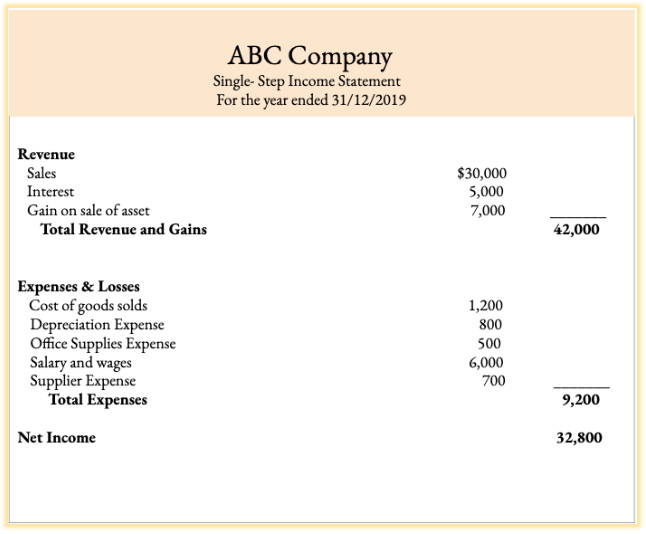

An income statement example for a business.

Direct Indirect Labor Overhead Costing In Budgeting And Reporting Income Statement Directions Financial Project Example Gross Sales On

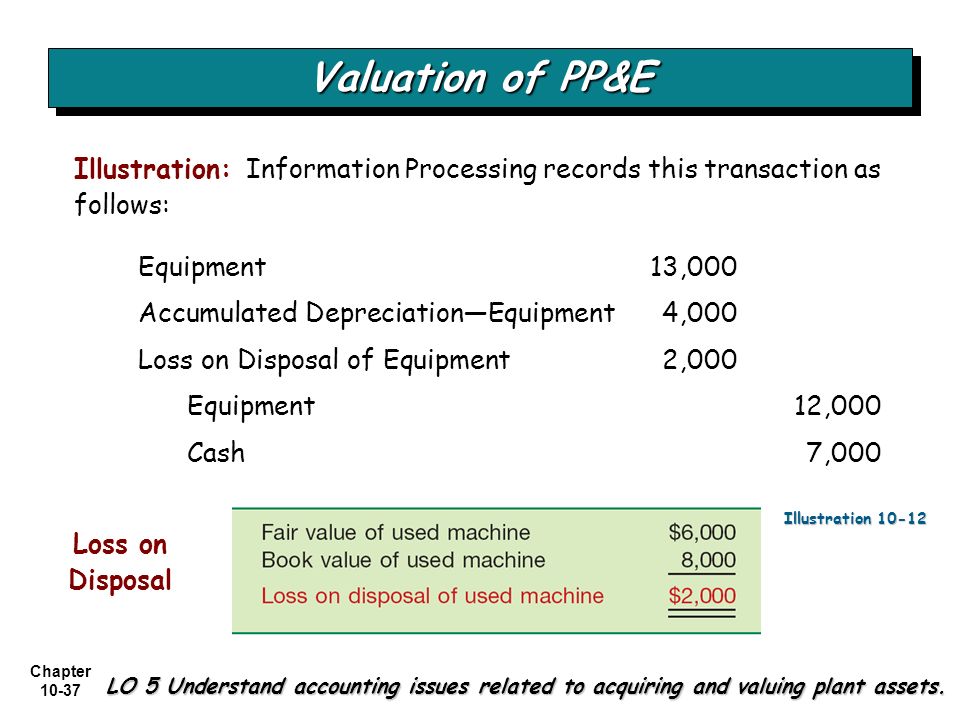

Depreciation Turns Capital Expenditures Into Expenses Over Time Income Statement Cost Accounting Internal Audit Letter To Management Revised Balance Sheet Format