This ratio is used to assess the company’s operating cash flow. The ratio measures the company’s ability to generate earnings before interest, tax, depreciation and amortization. This ratio is important as it is used to assess the company’s ability to cover its operating costs. The ratio is also used to assess the company’s ability to generate cash flow from its operations.

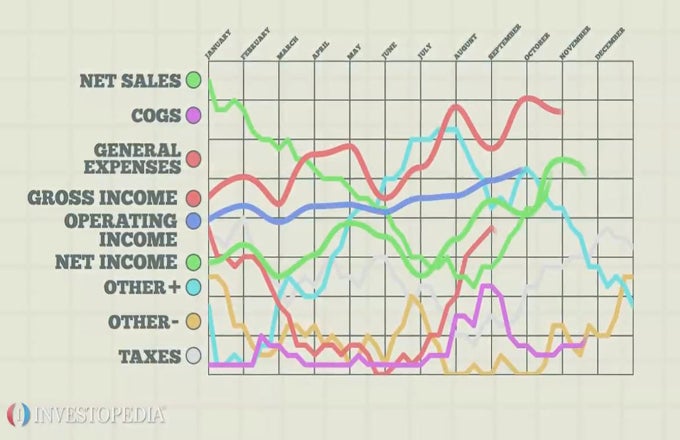

Operating Margin

This ratio is used to assess the company’s operating efficiency. The ratio measures the company’s ability to generate profits from its operations. The ratio is important as it is used to assess the company’s ability to cover its operating costs. The ratio is also used to assess the company’s ability to generate cash flow from its operations.

Profit Margin

This ratio is used to assess the company’s overall profitability. The ratio measures the company’s ability to generate profits from its sales. The ratio is important as it is used to assess the company’s ability to generate cash flow from its operations.

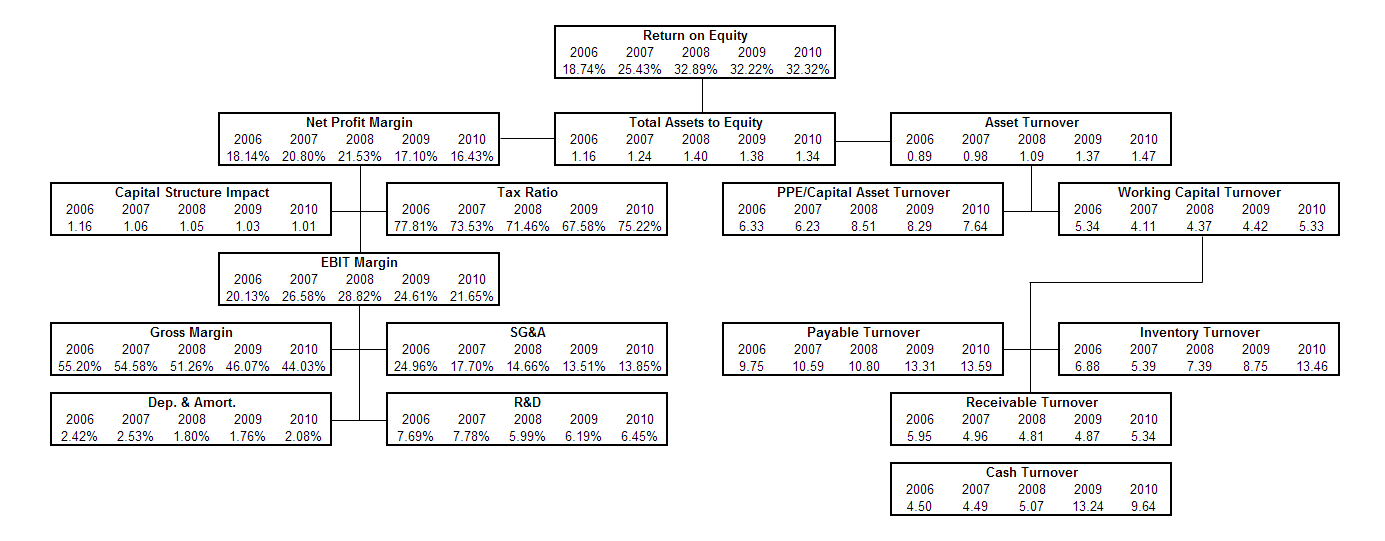

Specific ratio analysis.

Financial Ratios Top 28 Formulas Type Pub Profit And Loss Template Ratio Analysis Of Coca Cola Company 2018

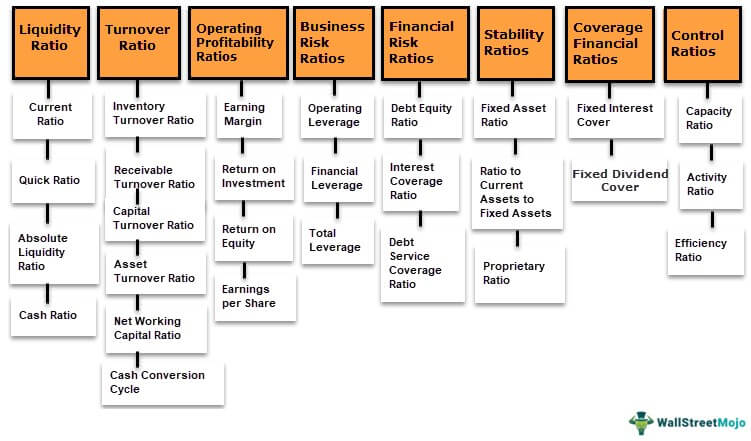

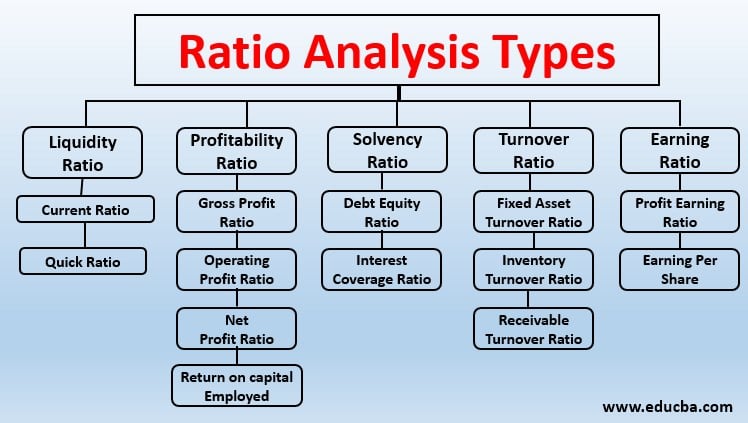

What are the types of ratio analysis?

There are two main types of ratio analysis, which are:

Financial Ratio Analysis

This type of ratio analysis is used to assess the financial performance of a company. Financial ratio analysis is important as it is used to assess the company’s financial health. Financial ratio analysis is also used to assess the company’s ability to generate cash flow from its operations.

Operational Ratio Analysis

This type of ratio analysis is used to assess the operational performance of a company. Operational ratio analysis is important as it is used to assess the company’s operational efficiency. Operational ratio analysis is also used to assess the company’s ability to generate cash flow from its operations.

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal Sample Multi Step Income Statement Business And Loss Form

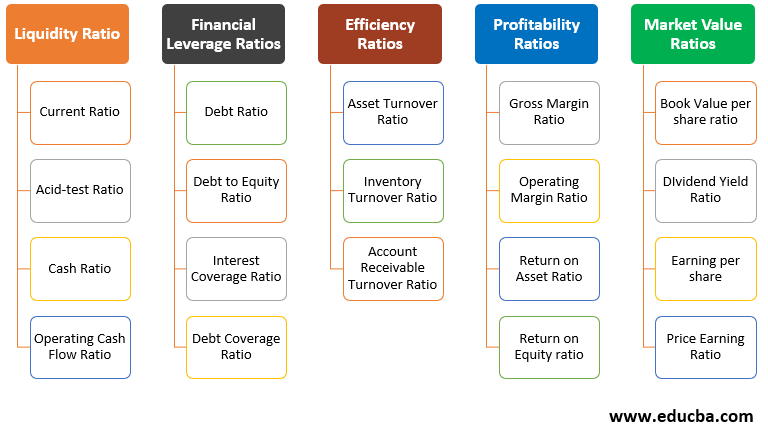

The ability of a business to settle its short-term loans as they fall due is gauged by its liquidity ratios. A financial ratio, also known as an accounting ratio, is a computation that illustrates the relative magnitude of particular numerical values obtained from a company’s financial statements. It is derived from those financial statements. It is a metric that can be used to assess the concern’s financial health and stability.

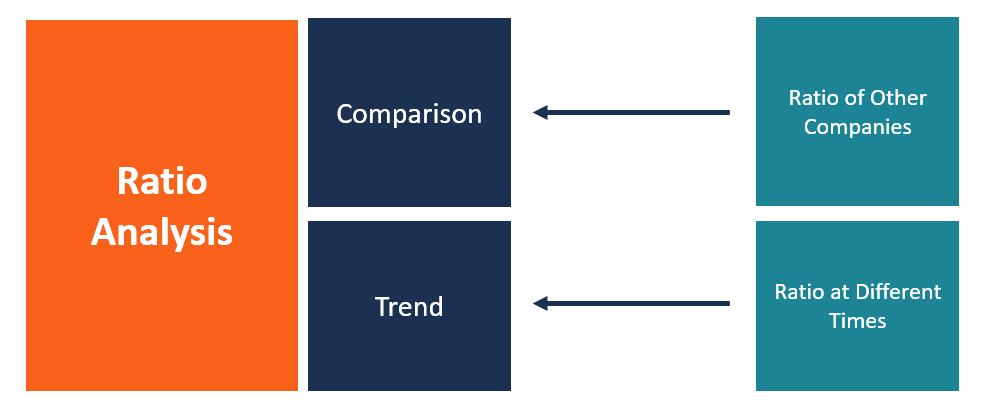

3 comparisons of each sector’s revenue. Ratio analysis allows for the creation of two different kinds of comparisons. 13C12C 2H1H or a contamination with 37Cl35Cl.

Ratio analysis refers to the act of figuring out and displaying how different items and groups of items relate to one another in financial statements. 21 research objectives 4 computation of each segment’s degree.

Limitations Of Ratio Analysis Ratios Are Popular Learn About The Problems Lufthansa Airlines Financial Statements Gaap Accounting For Factoring

Guidelines for the Class 12 Accounting Project from CBSE for 2020–21. As well as preparation, source document gathering is used to record accounting transactions utilizing vouchers. Several financial ratios, including the current ratio, net profit margin, and others Project PDF for a specific segment analysis.

5 comparisons of each sector’s profit. A business can assess its performance against that of its competitors by comparing its own performance to that of the industry. Comparing capital employed at six.

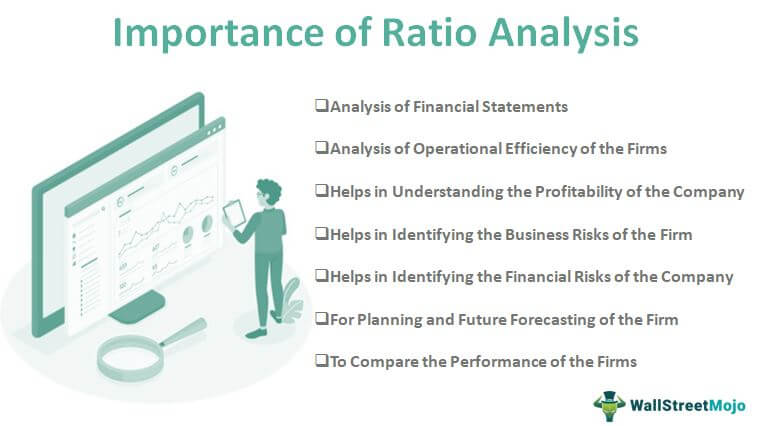

By correctly establishing the relationship between the various components of the balance sheet and profit and loss account, it is possible to identify the financial strengths and weaknesses of the company and gain a meaningful understanding of its financial situation and performance. 8 study’s interpretation. Ratio analysis is the cornerstone of credit risk assessment, pricing, and fundamental business value.

Profitability Ratios Calculate Margin Profits Return On Equity Roe Cash Flow Statement Indirect Method Prepaid Rent Balance Sheet Classification

Solvency ratios, which are also known as financial leverage ratios, compare a. has a 196 current ratio. A potent technique for financial analysis is ratio analysis. Since the adjusted estimates are weighted averages of the strata, they are significantly closer to the stratum-specific estimates of the relative risk and odds ratio as a result of the age adjustment.

given that they are better off financially. The role statistical technique and potential applications of SSLR analysis are discussed in this study with reference to a total hip arthroplasty (THA) scenario. Typically, a current ratio of two is appropriate.

The current ratio demonstrates the company’s short-term financial stability. Isotope analysis of particular compounds The ratio of stable isotopes, such as, is measured by the CSIA analytical technique. Students can use the download link below to access the class 12 accounting project pdf.

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal Cash Flow Statement Reporting Aspe Illustrative Financial Statements Pwc

24 performance analysis. The studies were conducted using an engine speed of N and an equivalency ratio of 1, with the spark timing set to the time for the maximum brake torque. ITC and HUL have a debt-to-assets ratio of zero, which highlights their dominant position in the sector. Debt to asset ratio All of the companies’ gearing ratios are below 05, which denotes lower risk for the businesses.

By comparing its current performance to previous years’ performance, a business can monitor changes over time. section 2 on segment analysis. Here are the three primary project work options available to students taking Accounts 12 in 2020–21.

14 the probability ratio The likelihood ratio (lr) integrates both the sensitivity and specificity of the test and offers a direct assessment of how much a test result will alter the likelihood of having a condition. Ratio of likelihood that a stratum exists Recently, benchmarks with a considerable value advantage at the hospital or surgeon level have been defined using SSLR analysis. With the value of their current assets, they will be able to pay their long-term obligations in the future.

Importance Of Ratio Analysis Categories And Intangible Assets On The Balance Sheet Adidas Financial 2019

23 analytical instruments. When a chemical is broken down, the ratios of stable isotopes fluctuate in predictable ways, such as when chlorinated ethenes are broken down. Ratio analysis gives essential performance indicators for organizations on a standard basis for comparison. Benchmarking within a certain industry sector is made easier by ratio analysis.

The age-stratified analysis’s risk ratios, RR 143 and 144, are comparable to one another but lower than the crude risk ratio. Ratio analysis also aids in comprehending long-term trends.

Ratio Analysis Types Type Of With Formula Two Income Statement The Permanent Accounts Appear On Which Financial

The following are the precise guidelines that CBSE has published for the Accounts 12 project 2020–21. Depending on the type of the firm, different current ratio standards apply.

A higher current ratio indicates a stronger ability to pay current obligations. The impacts of an assumed specific heat ratio on the heat release analysis of engine pressure data in a spark ignition engine running on gasoline and natural gas are examined in this study. are widely utilized and pertinent to all businesses. has a 172 current ratio.

Importances Of Ratio Analysis Top 8 Uses Impairment Cash Flow Statement Vertical On Income

Additionally, the specific Class 12 Accounts segment analysis study is included in the second pdf. Ratios specific to Specialized Industries Financial ratios are proportions and relationships between several pieces of data, both financial and non-financial, that can offer insight into any area of a company’s operations. In Japan, a community-dwelling population was screened for depression using a stratum-specific likelihood ratio analysis. The CES-reliability D’s is validated, and SSLR analysis is advised due to its usefulness in identifying people in the Japanese population who are at risk for MDD. Ratio Analysis Category Examples 1.

As a result, ratios are extremely useful nowadays and have many uses. Ratio analysis is a helpful management tool that will enhance comprehension of financial outcomes. You can find all the information about the accounting project for class 12 CBSE 2021–22 in the pdf.

By dividing the continuous likelihood ratios into 15, sslrs are computed. It is a crucial financial analysis technique. To get these categories, stratum-specific likelihood ratios, or sslrs, could be utilized.

Ratio Analysis Overview Uses Categories Of Financial Ratios Consulting Revenue On Balance Sheet What Is Comprehensive Income