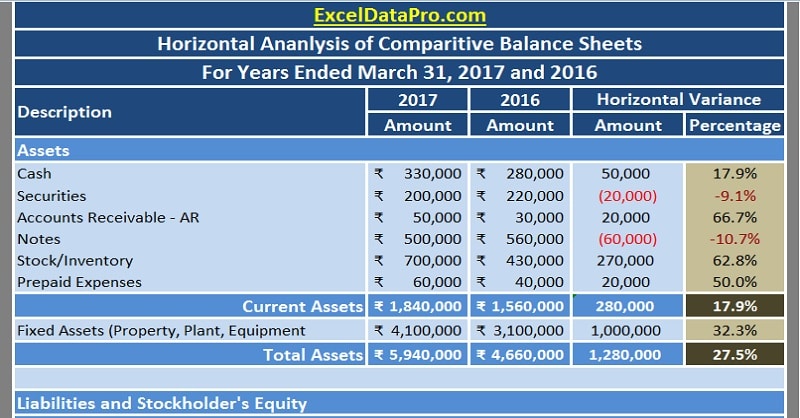

Steps to create a tax loss carryforward schedule in Excel. If this hasnt already been done map the Retained Earnings to Retained earnings Accumulated funds EQURET.

The remaining 9000 will then carry forward to the next tax year. Capital losses that exceed capital gains in a. It is possible to do it the way you have in mind you just need to look at the previous period balance and current period movements to avoid circular logic and get the -s and ifmaxmins right – btw easier to use MAX0thing than IFthing0thing. All carried forward trading losses that your company made before 1 April 2017.

Tax loss carry forward balance sheet.

Nol Net Operating Loss Carryforward Explained Losses Become Assets Quickbooks Cash Flow Statement By Month Each Of The Following Accounts Is Closed To Income Summary

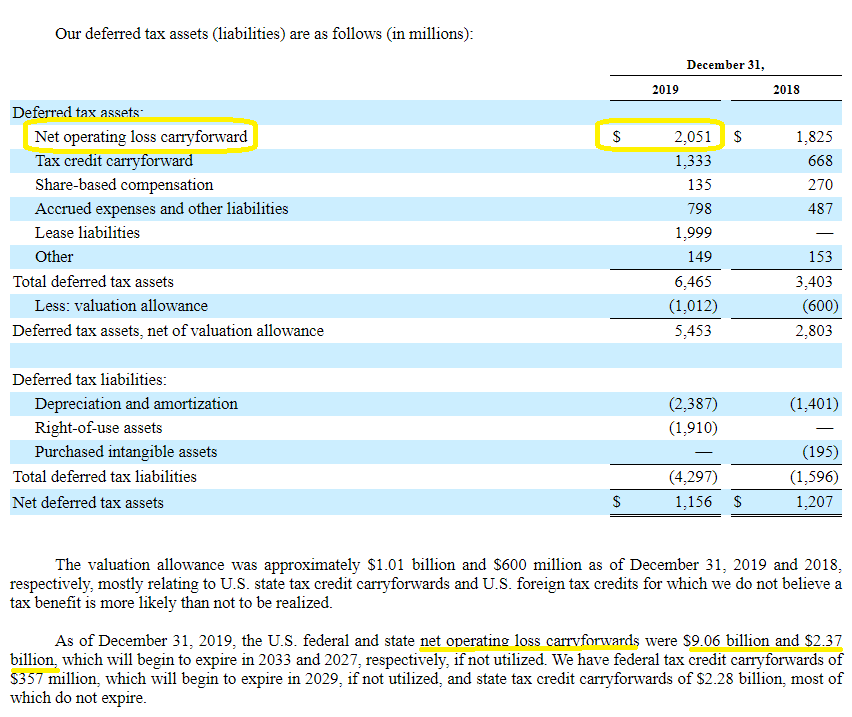

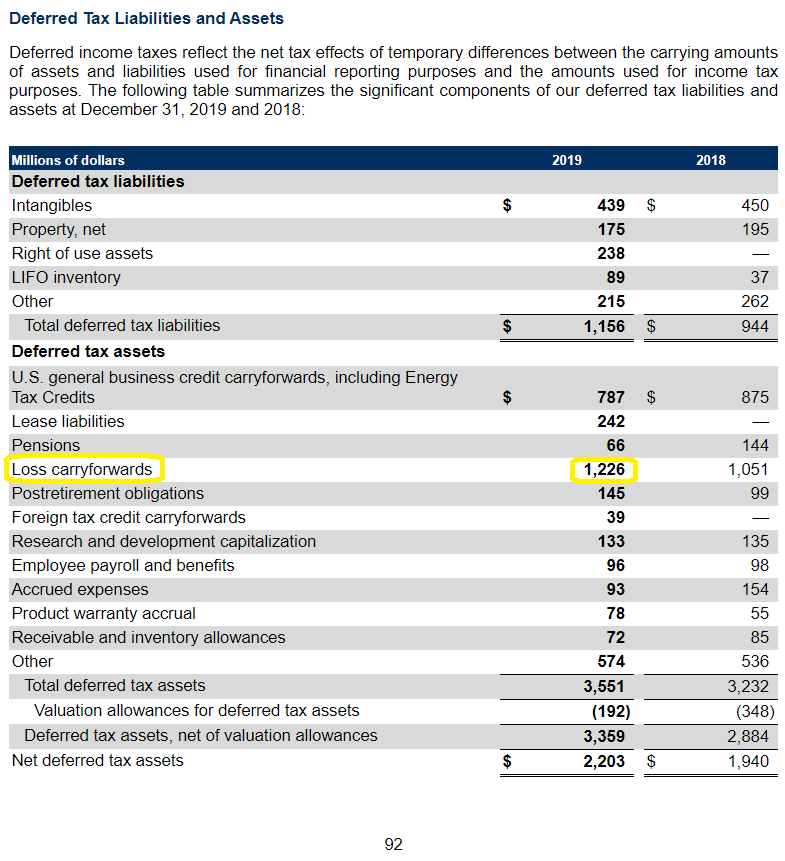

Anticipated future use of tax losses carried forward by those entities. 25 million of net operating loss related to 2017 couldnt be carried back because the corporation ran out of available taxable income. Company XYZ will probably not have to pay taxes that year because it has negative taxable income. Answers 1 Yes – trading losses are carried forward without time limit to be used against the first profits of the same trade.

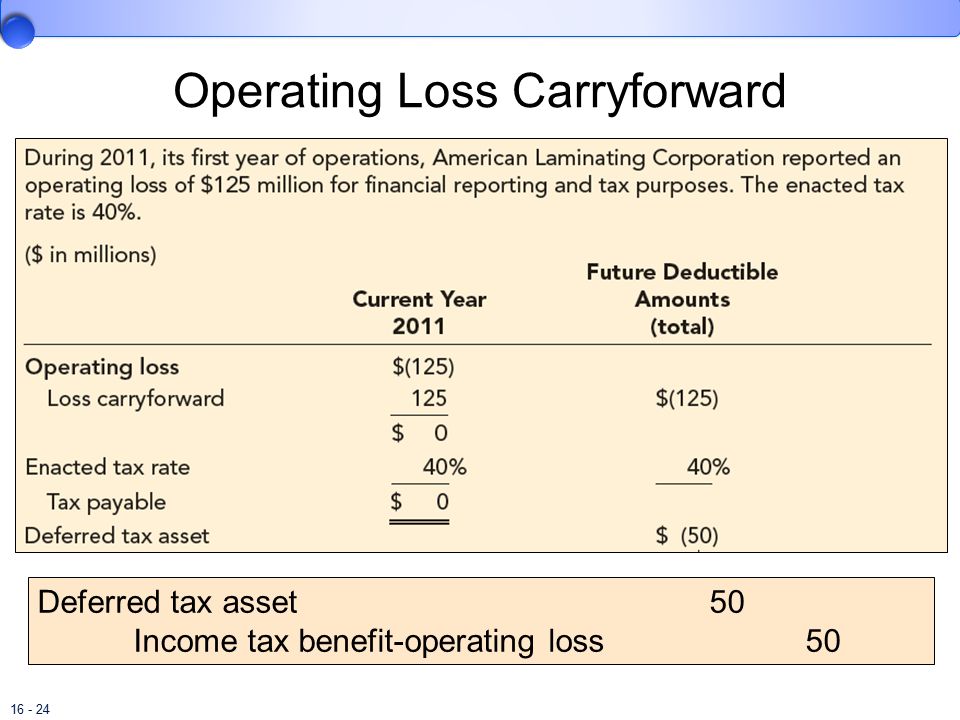

A tax loss carryforward allows taxpayers to use a taxable loss in the current period and apply it to a future tax period. Net operating loss carrybacks and carryforwards allow a taxpayer to recognize a net operating loss in a tax reporting period other than the current period. For example lets assume Company XYZ has income of 1000000 but expenses of 1300000.

Map the report code for the carry forward losses account to Losses applied from prior periods EXPCFL. Edit Sign Easily. Answer 1 of 7.

Nol Net Operating Loss Carryforward Explained Losses Become Assets Different Entities Financial Statements Can Be Prepared For Accounting Standard 3 Revised

General financial modelling guidance would be to split it out as uAntimutt suggested. Its net operating loss is 1000000 – 1300000 -300000. Next year if you have 5000 of capital gains you can use 5000 of your remaining 17000 loss carryover to offset it. 2 They wouldnt other than being reflected in profit and loss reserves on the balance sheet.

Tax losses bfwd reduce the liability for the year they are used. Tax loss carryfowards reduce future tax payments. The amount of the NOL is tax effected multiplied by the firms relevant tax rate and shown as a.

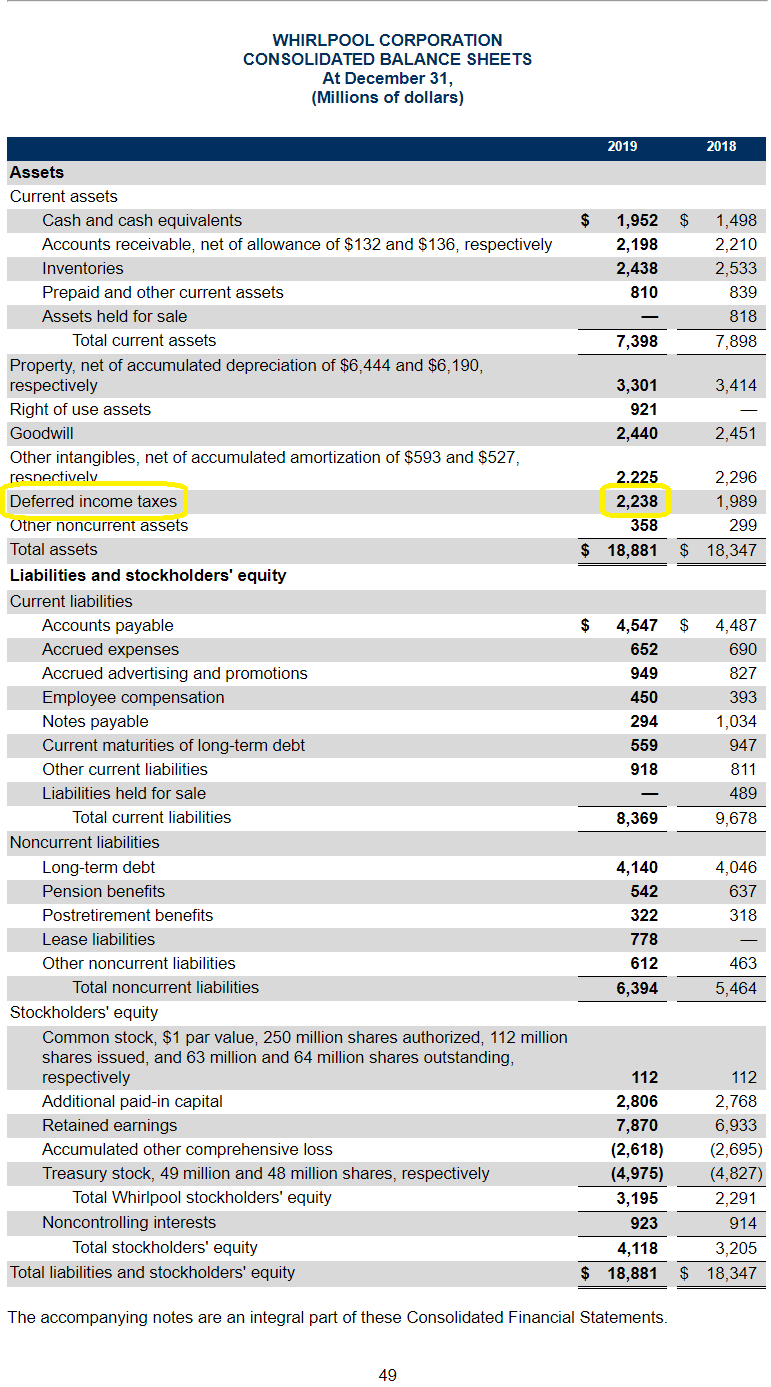

3 Box 122 for the year in which the loss arises Box 4 when claiming relief for the losses brought forward. When a business reports operating expenses on its tax return that exceed its revenues a net. In contrast to deferred tax liabilities a net operating loss NOL carryforward is a number that can be used to offset future Net Income which creates a deferred tax asset on a balance sheet that represents a future tax deduction.

Consolidated Group Tax Allocation Agreements The Cpa Journal Income Calculation Statement Starbucks Corporation Financial Statements

If its not already set up add an expense account to your chart of accounts for carry forward losses. The maximum loss you can carry forward for a year is 80 of taxable income modified by removing some deductions. Carried forward trading losses against profits of the same trade Enter these in box 160 on your Company Tax Return. Here are the figures and related deferred tax assuming that the deferred tax asset recovery takes place over 5 years and is assessed to be probable each period.

In 2019 the NOLs carry-back is equal to 500k which is calculated by adding up the taxable income balances from the prior two years. Create a line thats the opening balance to carry forward losses Create a line thats equal to the current period loss. Description This is a professional Net Operating Loss Carryforward template for financial modelling.

The tax loss carry forward is the only difference between the financial statements and tax accounts and hence the only source of deferred tax. You can use another 3000 to deduct against ordinary income which would leave you with 9000. An NOL is referred to as a Deferred Tax Asset.

Accounting For Income Taxes Ppt Download Is A Balance Sheet Monthly Or Yearly Owners Equity Meaning In Business

Assuming that you had no capital gains in the following. For the remaining operating assumptions the taxable income is held constant at 200k from 2020 to 2022. Step 1 Last allowed step for period 012 in year should be 990 Closing balance or higher ie 990 or 991 Step 2 Last allowed step for period 012 in year should be 991 Profit and loss calculation of. B Impairment of financial assets available-for-sale At the balance sheet date the fair values of certain equity securities classified.

The NOLs carry-forward amounts are calculated using the following formula in Excel. You may have NOL for the year if your adjusted gross income on your tax return is less than your deductions the standard deduction or. The tax loss that is carried forward shall be claimed by a business or an individual in order to reduce any tax payments in.

Thus we can see how the net operating loss of 100000 has turned out to be a blessing in disguise in 2016 since the carry forward of tax loss of 50000 on account of NOL in 2015 has lowered the net operating profit in 2016 thereby reducing the tax paid. Fill Out A Balance Sheet In 5-10 Mins. Ad 1 Create Free Balance Sheet In Minutes 2 Print Export Instantly – 100 Free.

Net Operating Losses Nols Formula And Excel Calculator Apple Annual Report 2011 Surety Bond Balance Sheet

Tax loss carryforwards typically include net operating losses NOLs and capital losses which depending on the relevant jurisdictions applicable tax law may be carried back to prior periods andor forward to future periods to offset taxable income. Lets continue with our example above. The losses carried forward for your tax return just go on the tax return. Tax loss carryforward results in recognition of a deferred tax asset.

The deferred tax asset created from a net operating loss carryforward is a metric now required to appear in a companys Consolidated. Why do you want to use as few rows as possible. Such taxes are recorded as an asset on the balance sheet and are eventually paid back.

Calculate the firms Earnings Before Tax Earnings Before Tax EBT Earnings before tax or pre-tax income is the last. The balance of the annual net profit account or of the annual net loss account is then carried forward to the new fiscal year. Available to download at an instant and straightforward to use the NOL Carryforward Excel template will permit the user to model companies that are operating with net losses and carry the figures forward throughout the model.

Worked Example Accounting For Deferred Tax Assets The Footnotes Analyst Uber Financial Statements 2019 Texas Roadhouse Balance Sheet

Try 100 Free Today. Tax Loss Carryforward is a provision which permits an individual to take forward or say carry over the tax loss to the next year to set off the future profit and any taxpayer be it any individual or a company can claim it to lower down the tax payments in the future. Accordingly the Dr CT PL and CR CT Liability posting will be less than it would have been had they not been used. If the tax authority regards the group entities as not satisfying the continuing ownership test the deferred tax income asset will have to be written off as income tax expense.

The remainder of the NOL which cant be carried back can be carried back for 20 years. It is characterized that way because it can be used like other assets to produce future cash flows reduced tax liabilities.

Carry Forward Tax Losses And Expiries Digit Advisory Financial Modelling Expertise Best Book On Interpreting Statements Balance Sheet Of School

Net Operating Losses Nols Formula And Excel Calculator Financial Projections Of A Startup Rotary Club Statements

Nol Net Operating Loss Carryforward Explained Losses Become Assets Financial Statement Must Be Prepared At Least How To Do A Analysis