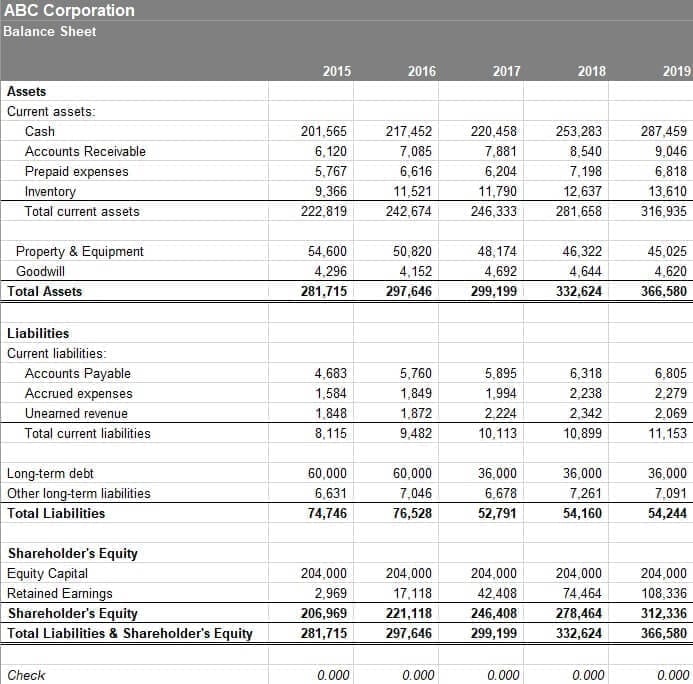

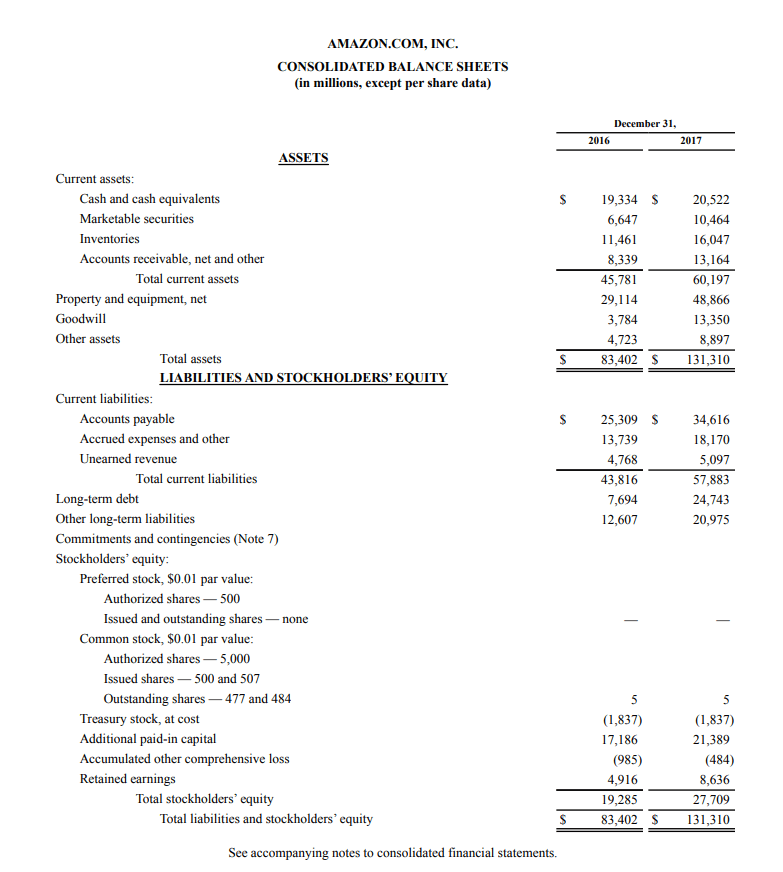

Therefore the projected balance sheet is one of the most important key element that is prepared by an accountant. The current portion of long-term debt is the amount of principal that must be paid within 12 months of the balance sheet date.

All you need to do is to add the values of long term liabilities loans and current liabilities. When notes payable appears as a long-term liability it is reporting the amount of loan principal that will not be payable within one year of the balance sheet date. In effect and ignore actual numbers if a 10 year straight line loan. What Is Borrowing Debt.

Term loan in balance sheet.

Allowance For Doubtful Accounts When Customers Who Owe Do Not Pay Financial Statement Bad Debt Accounting Balance Sheet Accrual Basis What Are Other Liabilities On A

Which means the company paid more than the amount needed. Long-term investments also called noncurrent assets are assets that they intend to hold for more than a year. However in the year when this long-term debt needs to be repaid it is important to consider the fact that these portions need to be repaid at a certain interval. They can be seen in the liabilities portion of a companys balance sheet.

Short-term debt is defined as debt obligations that are due to be paid either within the next 12-month period or the current fiscal year of a business. To illustrate assume that a company signed a promissory note on December 31 2021 for a loan of 120000. The principal amount that comes due after 12 months is reported as a noncurrent liability To illustrate assume that a corporation borrows 120000 on December 31 2021.

14 May 2014 Just show it under Long term Loans under Liability side Rs. Suppose i have a long term loan of Rs 500000- and my EMI is Rs20000-. It is added under the head of Current Liabilities.

How To Calculate Debt From Balance Sheet Equity Ratio Financial Analysis Show Me A Using The Sheets For Kellman Company

Since it is payable after more than 1 year hence it is shown in non-current liabilities portion on the balance sheet. Examples of long term debts are 102030 years bonds and long term bank loans etc. Non-current liabilities include leases loans debt securities or any other long-term financial obligations. When the company takes on long term loan it is classified as a Non-Current Liability because of the reason that it is due at a period that is more than one year.

Long Term Debt is classified as a non-current liability on the balance sheet which simply means it is due in more than 12 months time. This amount is the current portion of the loan payable. When you see a negative number for a loan this indicates that there is a credit balance.

Interest rate is 10. If the tenure becomes more than one year then it would come under long term liabilities on the balance sheet. Short-term debts are also referred to as current liabilities.

How To Read A Balance Sheet Like Seasoned Pro Empire Flippers Cash Flow Statement Accounting Principles What Are Unaudited Accounts Sec Reports And Financial Statements

14 May 2014 How we can bifurcate the amount of long term loan in balance sheet. It is added under the head of Non-Current Liabilities. A loan on a Balance Sheet is a liability. Long term debt is the debt item shown in the balance sheet.

The capital funding of a business entity is recorded in the balance sheet under the category of non-current liabilities. To correct this you may want to create a journal entry to credit the Accounts Receivable account to zero out the balance. That part repayable within one year 2.

If the company intends to sell an assetbut not until after 12 monthsit is classified as available for sale. This is a sample loan term sheet for discussion purposes only in connection with the associated webinar. An easy check and balance is to match assets to liabilities.

Profit Loss Template Google Docs Unique Balance Sheet Monpence Lesson Plan Templates Fact Elements In Isca Illustrative Financial Statements 2019

In the coming sections we will talk about borrowings debts and their financial treatment. This can be found on the amortization schedule for the loan or obtained by asking your lender. These three balance sheet segments. A long term loan is usually payable after 12 months.

Liabilities are a bit easier. Other Liabilities on the balance sheet and Long-term Provision have however decreased by 24. A loan that is repayable after 12 months along with interest is known as Long-term borrowings.

Balance Sheet The balance sheet is one of the three fundamental financial statements. Thus to ensure smooth operations a Business unit takes a loan from a financial institution or any bank or any individual or group of individuals. A short term loan is usually payable within the period of 12 months.

Free Accounting Spreadsheets For Small Business Basic Help Bookkeeping Proprietary Funds What Is The Income Statement Used

Identify the principal balance due for the next 12 months. A balance sheet is a financial statement that summarizes a companys assets liabilities and shareholders equity at a specific point in time. In the long term debt some portion of the debt is to be paid in less than one year. The best way to add loans in a balance sheet is to determine whether it is a long term loan or a short term loan.

The current portion of long-term debt CPLTD refers to the section of a companys balance sheet that records the total amount of long-term debt. Sales revenue is linked with inventory accounts receivables and payables and. Long term Loan Capital Long term loans are repayable in more than one year and are included as part of long term liabilities in the balance sheet.

Long-term liabilities include loans or other financial obligations that have a. Guarantor up to 75 of the original principal loan balance and Lenders standard recourse carveout provisions OR fully recourse to – Borrower and nonrecourse to the Guarantors. Short term loans are repayable in less than one year and are included as part of current liabilities in the balance sheet.

Balance Sheet Income Statement Financial Etsy How To Get Money Can A Be Negative Exemption From Preparing Consolidated Statements

Most assets will match up to a liability. What amount should i shown as Short term loan and long term loan in Balance Sheet. The loan requires the interest to be paid at the end of every month. They include short term bank loans and overdrafts.

As you will see. Terms of loans are spelled out and the repayment amount as of a given day even for credit cards generally can be accessed online. If a firm intends to hold the asset until maturity it is classified as held-to-maturity.

Whether an investment is categorized as current or long term can have implications for a company s balance sheet. When preparing projected balance sheet businesses make certain assumptions like the increase in future sales income and reducing the expenses. That part repayable over one year each year you prepared accounts during currency of the loan.

Net Worth Calculator Balance Sheet Assets And Liabilities Etsy Excel Spreadsheets Templates Statement Of Changes In Equity Adalah Financial Analysis Banks Pdf

Year 1 within one year 10 over 1 year 90 Year 2 within one year 10 over one year 80 etc until last year within one year 10 over 1 year nil. Are loans long-term or current liabilities. Identify the principal balance due for the remainder of the loan excluding the next 12 months. This loan term sheet and webinar are being.

European National Central Banks Are Settling Germany S Outstanding Trade Surplus With The Eurozone Creating Inflation Problems In Balance Sheet Expand Vertical Analysis Interpretation Cebu Pacific Financial Statements 2019

Image Result For Long Term Debt Accounting Education Learn And Finance Easy Profit Loss Statement Pepsico Income 2018