Accounting Information Unaudited Financial Statements ACRA As per the compliance requirements a private limited company must table its audited unaudited financial statements Singapore to the AGM within 6 months of its financial year end. Financial Statements must be drawn up in accordance with the Singapore Law and filed with ACRA within 30 days from AGM and required for Tax Return.

If it is time for you to file unaudited financial statements for your Singapore company. Tax There are 3 components to the tax filing. PDF 334KB ACRA Annual Report 2016-2017. Our audit services include all financial statements designed specifically to comply with ACRAs and IRASs statutory requirements.

Unaudited financial statements acra.

Best Chartered Accountant Accounting Services Tax Fsa Analysis Business Income And Expense Sheet

Generally Unaudited Financial Statements are used internally by companies so as to save on auditors professional fees. ECI Estimated Chargeable Income must be filed with IRAS within 3 months of the end of financial year. Application from compliance with the Accounting Standards Section 20112 of the Companies Act A company is required to obtain the Registrars approval for exemption from non-compliance with the Accounting Standards 1 which includes preparing its financial statements using an accounting framework other than the Accounting Standards. Click here for the Financial Statements.

In a nutshell we use Unaudited Financial Statements in Singapore internally by companies who want to be cost-efficient and save some money on auditors fees. The unaudited Financial Statements can be used to obtain banking facilities apply for government grants and to meet regulatory requirements in specific industries. Under the Companies Act Exempt Private Companies EPCs with annual revenue below 25 million are not required to have their accounts audited for financial year beginning on or after 15 May 2003.

An unaudited financial statement is one that you have not subjected to an independent verification and review process by ACRA. Besides filing with ACRA and IRAS it is also important to get the compilation report or unaudited financial statements ready when tabled during the AGM. A the company fulfils the substantial assets test.

All In One Corporate Compliance Package S 100 Month Transparent Affordable Reliable Predictable Ac Financial Statement Cloud Accounting Quickbooks Online P&l Sheet Cash Flow Schedule

One must note however that unaudited reports do contain the same set of data which includes income cash flow and balance sheet. Financial Reporting Practice Guidance No. Areas of Review Focus for FY2020 Financial Statements under the Financial Reporting Surveillance Programme administered by ACRA PDF 488KB Financial Reporting Practice Guidance No. All Singapore-incorporated companies must have their financial statements filed with the Accounting and Corporate Regulatory Authority ACRA of Singapore.

Under the Companies Act you or your directors are accountable to present financial statements at your AGM that. 600 per year for the preparation of unaudited financial statements report in accordance with the Singapore Financial Reporting Standards SFRS Engage Us – your Professional Accountant. Why Do You Need Annual Financial Statements.

A dormant non-listed company other than a subsidiary of a listed company is exempt from requirement to prepare financial statements if. To uphold the principles of. Even for a company that is exempted from the audit requirement it is compulsory to prepare a full report of unaudited financial statements for the Accounting and Corporate Regulatory Authority ACRA.

Best Chartered Accountant Accounting Services Tax Cash Balance Sheet Warranty Expenses Are Reported On The Income Statement As

Unaudited Financial Statement ECI and Tax Computation. PDF 230KB ACRA Annual Report 2015-2016. Your financial statements remain unaudited until they are scrutinized and approved by a certified external auditor. Are in line with the Accounting Standards Councils Accounting Standards.

As you may understand Audited Reports are maximum transparent. Directors Statement Statement of Comprehensive Income Income Statement Statement of Financial Position Balance Sheet. Click here for the Financial Statements.

Represent the companys financial position and performance in a true and fair manner. An unaudited financial statement is an accounting report that has not been verified for accuracy by a certified external auditor. These financial statements are also regarded as being less accurate than audited ones.

Unaudited Financial Statements Can Be Turned Into An Audited Statement When It Will Certified By T Branding Services Balance Sheet For Ecommerce Business Disclosure Of Lawsuit

Unaudited Financial Statements contains. As such majority of these companies only require these 2 main components. Audited Financial Reports are usually required for the companies that are available for public ownership. As a small and medium enterprise most of the financial statements are unaudited.

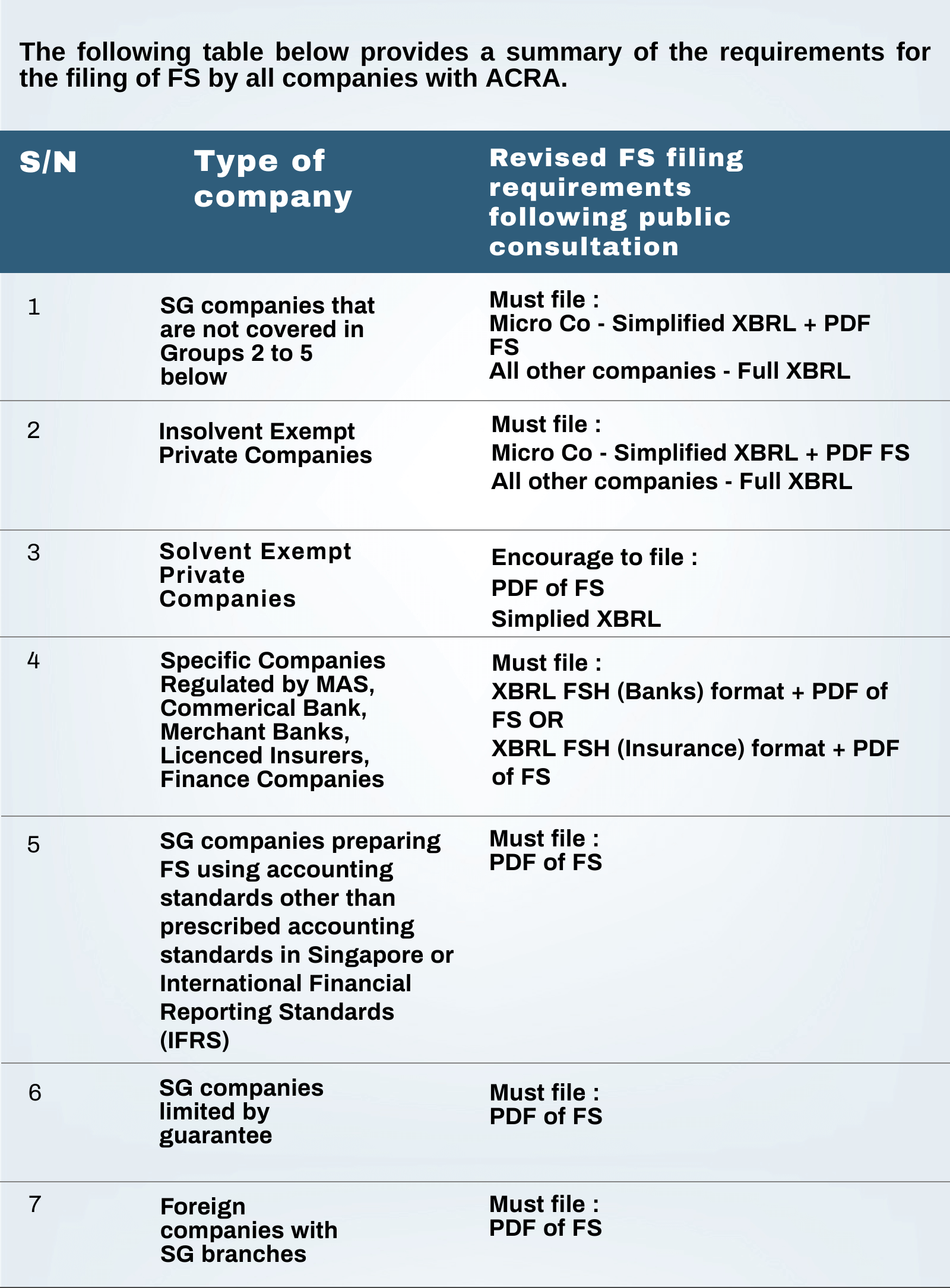

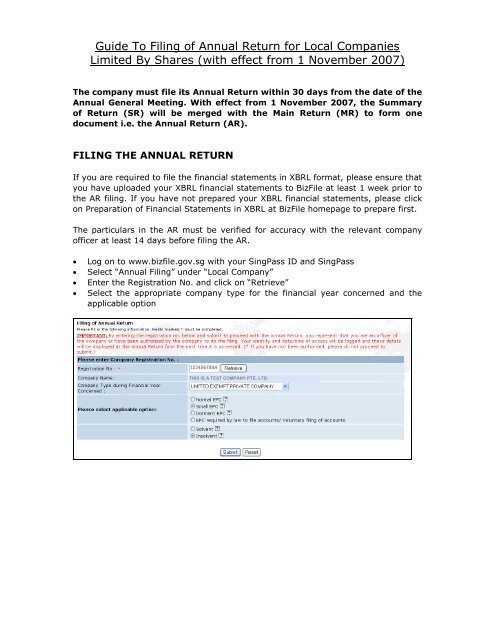

Click here for the Financial Statements. The full set of management accounts will be required to be submitted to IBF at point of Organisation Eligibility application. Some companies will file a full set of FS in XBRL format while some others will file key financial data in XBRL format and a full set of signed copy of the FS tabled at annual general meeting andor circulated to members AGM FS in PDF.

Unaudited financial statements are prepared by an accountant but not reviewed by external auditors. All Singapore SG incorporated companies are required to file financial statements FS with ACRA except for those which are exempted. A dormant company is exempted from the statutory audit requirements but is still required to prepare financial statements.

Accounting Services In 2022 Tax Secretarial Toyota Motor Corporation Financial Statements Magna

PDF 655MB ACRA Annual Report 2014-2015 PDF 326MB. A set of audited financial statements increases creditor and investor confidence in the companys transparency and integrity. Ravi Co provides full account services drafting of unaudited financial reports for exempt companies and offering audit service through our associated audit firms. Proposed Areas of Review Focus by Directors on the Financial Statements Affected by the COVID-19.

An unaudited accounting report is required by the government bodies of Singapore namely ACRA and IRAS. PDF 165MB ACRA Annual Report 2017-2018. Financial statements reflect the companys performance and financial status.

The revenue threshold was raised to 5 million for EPCs with financial year beginning on or after 1 June 2004. Compiling of Accounts and Preparation of Unaudited SFRS Financial Statements at end of the financial year We can prepare the unaudited SFRS financial statements for your business regardless of business entity types. IBF accepts unaudited financial statements only if your company is exempted from audit under ACRA.

Bizfile Eguide On Filing Of Annual Return Acra Costco Wholesale Financial Statements 1120 Balance Sheet

However not all must have the statements audited. Click here for the Financial Statements. Profit and Loss Balance Sheet. Submitting Unaudited Financial Statements in the Wrong Format.

If a company fulfills the requirements for audit exemption outlined by ACRA it will be allowed to submit unaudited financial statements. The Directors Report and Statement Profit and Loss Balance Sheet and Compliance Notes for companies. The compilation report or unaudited financial statements is to be tabled when performing Annual Return Filing with ACRA and income tax filing with IRAS.

Our team prepare the financial statements using the regulatory framework of the SFRS and Singapore Companies Act Chapter 50.

Best Accounting Services In Singapore Tax Format Of Profit And Loss Account Company Show Me A Balance Sheet

10 Things Investors Want To See In Financial Statements Before Making An Investment Format Of Balance Sheet Non Profit Organisation T Mobile

Limitations Of Financial Statements Statement Accounting And Finance Life Hacks What Are Current Assets On A Balance Sheet Type Account Is Owners Equity