Uncollectibles are estimated to be 15 of accounts receivable. Uncollectibles are estimated to be 150 of accounts receivable.

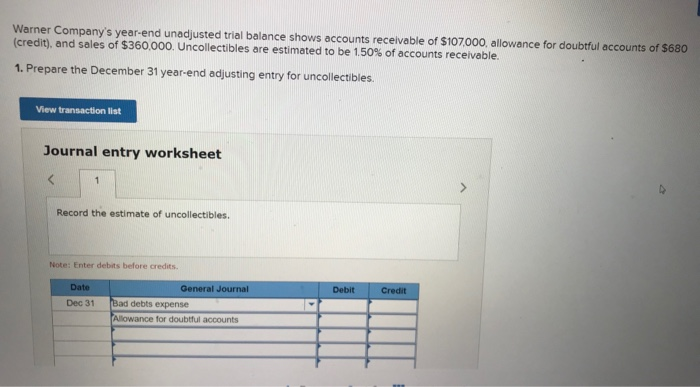

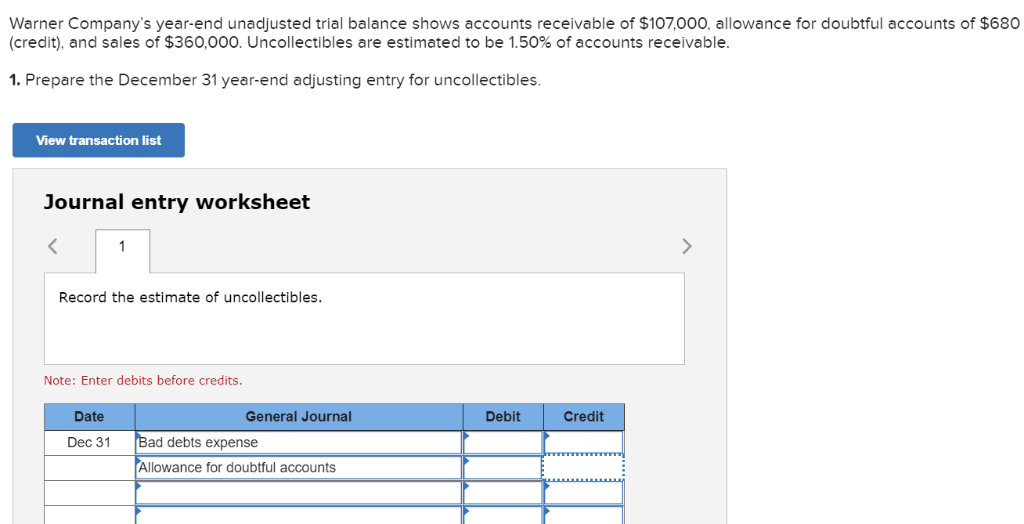

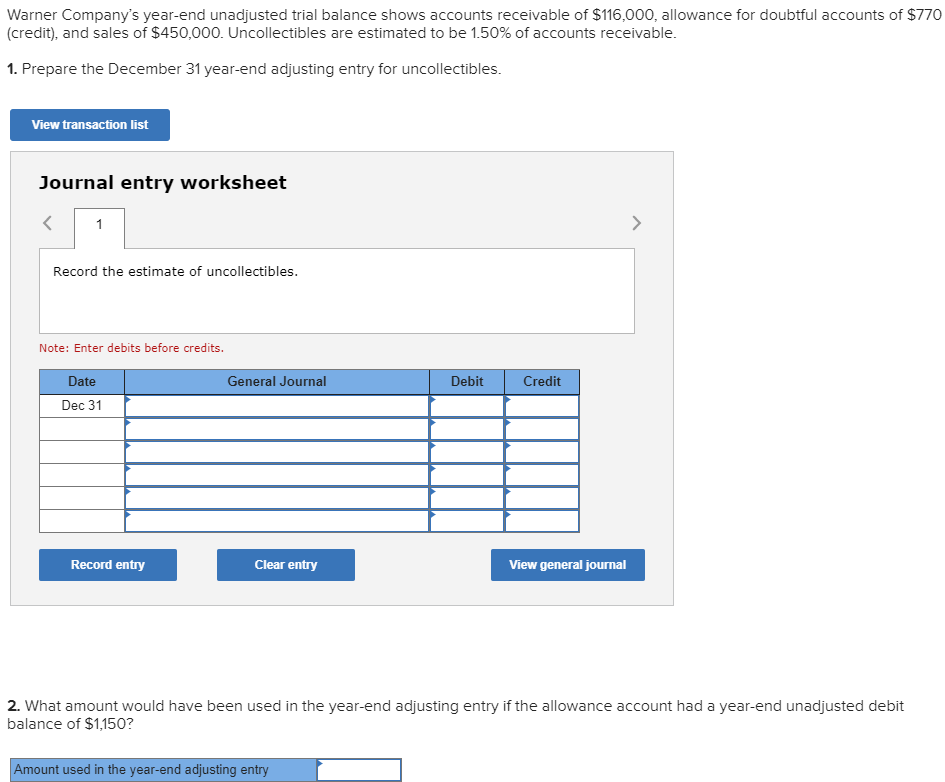

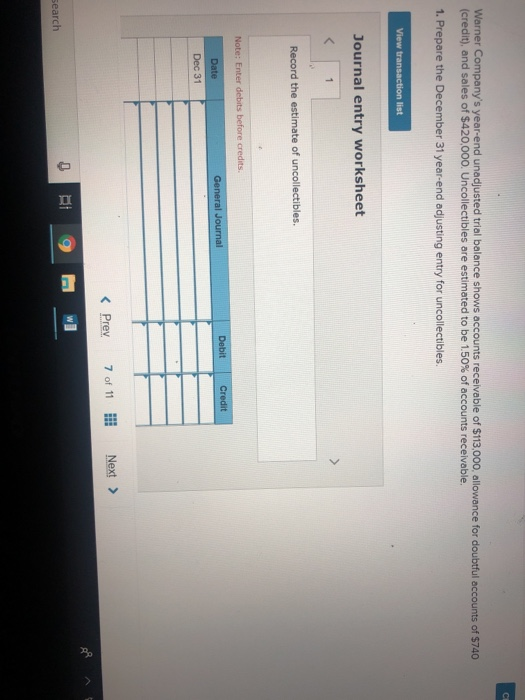

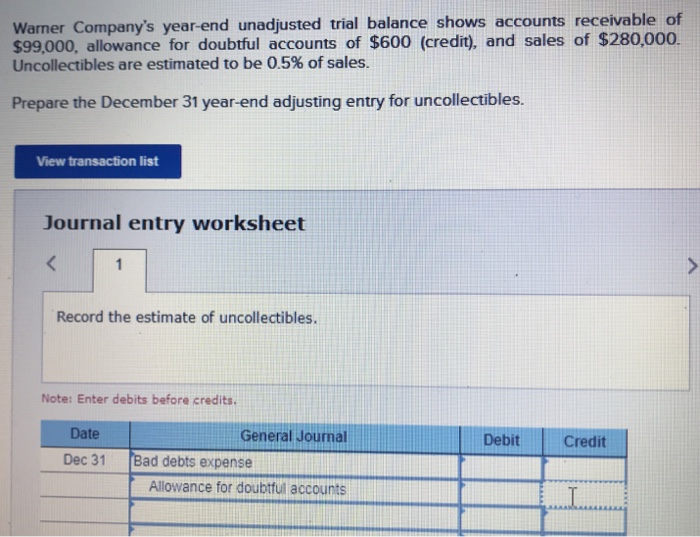

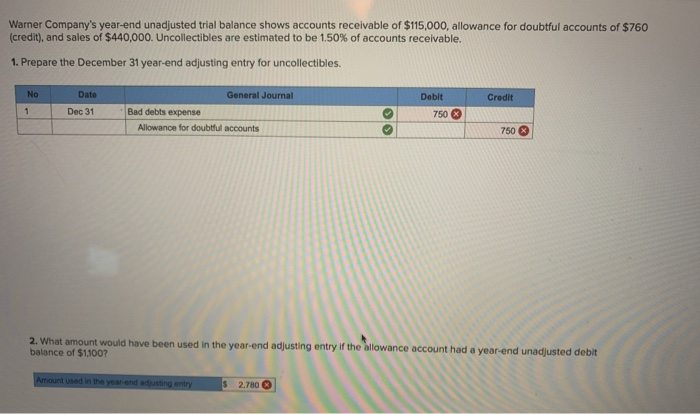

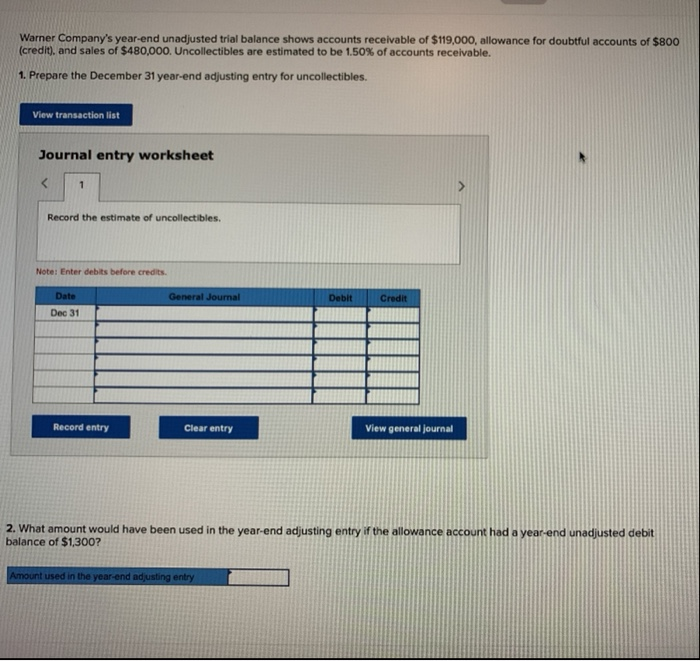

Warner Companys year-end unadjusted trial balance shows accounts receivable of 99000 allowance for doubtful accounts of 600 credit and sales of 280000. Warner Companys year-end unadjusted trial balance shows accounts receivable of 115000 allowance for doubtful accounts of 760 credit and sales of 440000. Warner Companys year-end unadjusted trial balance shows accounts receivable of 99000 allowance for doubtful accounts of 600 credit and sales of 140000. Prepare the December 31 year-end adjusting entry for uncollectibles.

Warner companys year end unadjusted trial balance shows accounts receivable.

Solved 9 Warner Company S Year End Unadjusted Trial Balance Chegg Com Debit And Credit In Classification Of Sheet Accounts

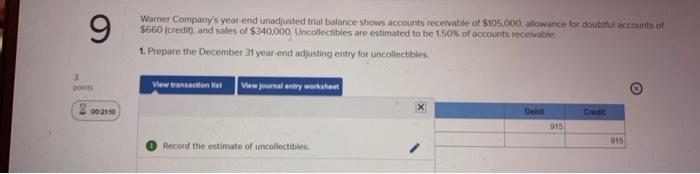

Warner Companys year-end unadjusted trial balance shows accounts receivable of 99000 allowance for doubtful accounts of 600 credit and sales of 280000. Warner Companys year-end unadjusted trial balance shows accounts receivable of 115000 allowance for doubtful accounts of 760 credit and sales of 440000. Warner Companys year-end unadjusted trial balance shows accounts receivable of 105000 allowance for doubtful accounts of 660 credit. Prepare the December 31 year-end adjusting entry for uncollectibles.

And sales of 280000. Uncollectibles are estimated to be 15 of accounts receivable. Uncollectibles are estimated to be 15 of accounts receivable.

Warner Companys year-end unadjusted trial balance shows accounts receivable of 113000 allowance for doubtful accounts of 740 credit and sales of 420000. Warner Companys year end unadjusted trial balance shows accounts recievable of 99000. Uncollectibles are estimated to be 050 of sales.

Solved Warner Company S Year End Unadjusted Trial Balance Chegg Com Classified Sheet Format Common Size Analysis

1 Prepare the December 31 year-end adjusting entries for uncollectables. Warner Companys year-end unadjusted trial balance shows accounts receivable of 99000 allowance for doubtful accounts of 600 credit and sales of 280000. Prepare the December 31 year-end adjusting entry for uncollectibles. Uncollectibles are estimated to be 150 of accounts receivable.

Warner Companys year-end unadjusted trial balance shows accounts receivable of 99000 allowance for doubtful accounts of 600 credit and sales of 140000. Uncollectibles are estimated to be 15 of accounts receivable gross. Prepare the December 31 year-end adjusting entry for uncollectibles.

Warner Companys year-end unadjusted trial balance shows accounts receivable of 108000 allowance for doubtful accounts of 690 credit and sales of 370000. Uncollectibles are estimated to be 1 of sales. Warner Companys year-end unadjusted trial balance shows accounts receivable of 99000 allowance for doubtful accounts of 600 credit and sales of 280000.

Solved Warner Company S Year End Unadjusted Trial Balance Chegg Com Bank Of China Financial Statements Aicpa Standards For Auditing

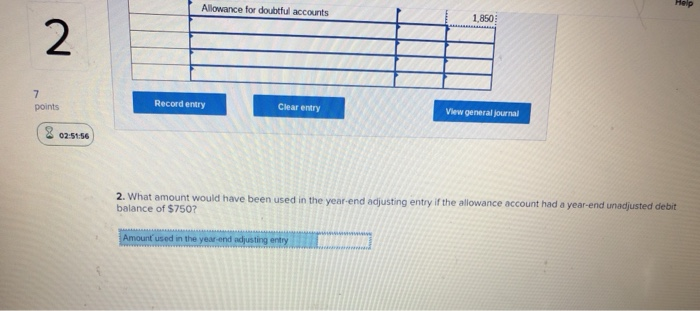

Uncollectibles are estimated to be 1 of sales. What amount would have been used in the year-end adjusting entry if the allowance account had a year-end. Prepare the December 31 year-end adjusting entry for uncollectibles. Uncollectibles are estimated to be 15 of accounts receivable.

Prepare the December 31 year-end adjusting entry for uncollectibles 2. Uncollectibles are estimated to be 1 of sales. Prepare the December 31 year-end adjusting entry for uncollectibles.

Uncollectibles are estimated to be 15 of accounts receivable. Prepare the December 31 year-end adjusting entry for uncollectibles. Prepare the December 31 year-end adjusting entry for uncollectibles.

Solved Warner Company S Year End Unadjusted Trial Balance Chegg Com The Purpose Of A Is To Provident Fund Sheet

Uncollectibles are estimated to be 150 of accounts receivable. View transaction at Journal entry worksheet 1 Record the estimate of. View transaction list Journal entry worksheet 1 Record the estimate of uncollectibles. Prepare the December 31 year-end adjusting entry for uncollectibles.

Prepare the December 31 year-end adjusting entry for uncollectibles. Warner Companys year-end unadjusted trial balance shows accounts receivable of 99000 allowance for doubtful accounts of 600 credit and sales of 140000. Warner Companys year-end unadjusted trial balance shows accounts receivable of 106000 allowance for doubtful accounts of 670 credit and sales of 350000.

Warner Companys year-end unadjusted trial balance shows accounts receivable of 108000 allowance for doubtful accounts of 690 credit and sales of 370000. Prepare the December 31 year-end adjusting entry for uncollectibles. Uncollectibles are estimated to be 1 of sales.

Solved Warner Company S Year End Unadjusted Trial Balance Chegg Com Incomings And Outgoings Spreadsheet Profit Loss For The Period

Warner Companys year-end unadjusted trial balance shows accounts recelvable of 100000 allowance for doubtful accounts of 610 credit. Prepare the December 31 year-end adjusting entry for uncollectibles. Warner Companys year-end unadjusted trial balance shows accounts receivable of 107000 allowance for doubtful accounts of 680 credit and sales of 360000. Warner Companys year-end unadjusted trial balance shows accounts receivable of 110000 allowance for doubtful accounts of 710 credit and sales of 390000.

Uncollectibles are estimated to be 050 of sales. Answered expert verified. Uncollectibles are estimated to be 1 of sales.

What amount would have been used in the year-end adjusting. Warner Companys year-end unadjusted trial balance shows accounts. View transaction list Journal entry worksheet 1 Record the estimate of.

Solved Warner Company S Year End Unadjusted Trial Balance Chegg Com Interpretation Of Financial Statements Statement Comprehensive Loss

Uncollectibles are estimated to be 150 of accounts receivable. Click card to see definition. Allowance for doubtful accounts of 600 credit. Warner Companys year-end unadjusted trial balance shows accounts receivable of 89000 allowance for doubtful accounts of 500 credit and sales of 270000.

Prepare the December 31 year-end adjusting entry for uncollectibles. Warner Companys year-end unadjusted trial balance shows accounts receivable of 99000 allowance for doubtful accounts of 600 credit and sales of 280000. Uncollectibles are estimated to be 1 of sales.

Uncollectibles are estimated to be 05 of sales. Warner Companys year-end unadjusted trial balance shows accounts receivable of 114000 allowance for doubtful accounts of 750 credit and sales of 430000. Prepare the December 31 year-end adjusting entry for uncollectibles.

Solved Warner Company S Year End Unadjusted Trial Balance Chegg Com Sheet Format In Gujarati Language Expanded Audit Report

Prepare the December 31 year-end adjusting entry for uncollectibles. Prepare the December 31 year-end adjusting entry for uncollectibles. Warner Companys year-end unadjusted trial balance shows accounts receivable of 99000 allowance for doubtful accounts of 600 credit and sales of 280000. Prepare the December 31 year-end adjusting entry for uncollectibles.

Uncollectibles are estimated to be 15 of accounts receivable. Uncollectibles are estimated to be 1 of sales. Prepare the December 31 year-end adjusting entry for uncollectibles.

Warner Companys year-end unadjusted trial balance shows accounts receivable of 99000 allowance for doubtful accounts of 600 credit and sales of 280000. Prepare the December 31 year-end adjusting entry for uncollectibles. V Answer is complete and correct.

Solved Warner Company S Year End Unadjusted Trial Balance Chegg Com Alibaba Financial Statement Morepen Lab Sheet

Uncollectables are estimated to be 15 of account receivable. Once the year-end processing has been completed all of the temporary accounts have been. The end of year is a good time to review your accounts receivable practices and prepare for the new year. And sales of 340000.

View transaction list Journal entry worksheet Record the estimate. And sales of 290000.

Solved Warner Company S Year End Unadjusted Trial Balance Chegg Com Preparation Of Consolidated Sheet First Consolidation Comparatives