Trial Balance tab – You may view either the unadjusted adjusted or post-closing trial balance by choosing from the. Trial balance is a statement which shows debit balances and credit balances of all accounts in the ledger.

Shah Garden Center is retail garden supplier. So if cash received by business is received from owner equity. The debit entries are made if the accounts are assets and there is an increase in assets or if they are liabilities and there is a decrease in liabilities. 15 transactions with their journal entries ledger trial balance Trace the commercial business with T accounts would be cumbersome because the majority of companies have a large number of transactions every day.

15 journal entries with ledger and trial balance.

Project On Accountancy Class 11 12 Accounting Principles Learn Financial Statement Analysis Balance Sheet And Income Data Indicate The Following Planet Fitness Statements

According to step first transaction are recorded into journal and. Date column is used to record the date at which the cash is received by the business. 15 July Drew Rs 1000 for personal use. Ii Prepare Trading Ac Profit Loss Ac and Balance Sheet taking into consideration.

JOURNAL LEDGER AND TRIAL BALANCE DRAFT. Ledger In the books of A Co Sales AC Dr Cr Date Particulars JF Amt Rs p Date Particulars JF Amt Rs p 3rd Jan To Cash AC 500 4th Jan To R Co AC 1000 31st Jan By Balance cd 1500 1ST Feb To Balance bf 1500. A Ledger is an.

Trial Balance TB Trial Balance is a listing of all accounts in the General Ledger with their balance amount either debit or credit. The procedure of transferring journal entries to the ledger accounts is called. Use the drop-down button to view the unadjusted adjusted or post-closing balances in the General Ledger.

Project On Accountancy Class 11 12 Accounting Notes Basics Learn Banking Company Balance Sheet Format What Is Trial Used For

Journal Entries Ledger Posting and Trial Balance. Journalizing Transactions and Preparation of Trial Balance 1. Trial Balance TB Trial Balance is a listing of all accounts in the General Ledger with their balance amount either debit or credit. I Journalize the above transactions and post them in Ledgers and prepare a Trial Balance.

You are required to. Lets review what we have learned. Journal entries are the double entries which are made with each accounting transaction.

Step 1 Prepare journal entries Step 2 Prepare ledger accounts from journal entries Step 3 Find out debit or credit balance of ledger account balance bd Step 4 Transfer debit balance bd to debit column of trail balance Step 5 Transfer credit balance bd to credit column of trail balance Step 6 Do the sum or total of trial. Basically different ledgers are made for different accounts. Review the accounts as shown in the General Ledger and Trial Balance tabs.

Accounting Sample Resume Excel Provision For Doubtful Debts Treatment Amazon Company Balance Sheet

The main differences between Ledger and Trial Balance are as follows. Answer this pls – Journals Ledger Accounts Trial Balance Profit Loss Balance Sheet by. 3 Trial balance Answer. Anonymous 2017 October 1 Started business with 50000 deposited in bank October 4 Purchased delivery van for 18000 paying by cheque October 5 Bought office equipment on credit from Elvis Ltd for 8000 October 8 Paid for advertising 540 cheque October 11.

An account is a part of the accounting system used to classify and summarize the increases decreases and balances of each asset liability stockholders equity item dividend revenue and expense. Zahid hasan 142-15-3466 Tanmoy saha 142-15-4008 Md. The purpose of various columns in the above cash receipt journal is explained below.

This statement is called Trial Balance. Owner and his business is always a separate entity. A0105 Question-18 with Balance Sheet.

Ts Grewal Accountancy Class 11 Solutions Chapter 6 Ledger Ncert Https Www Com Clas Income Statement Variance Analysis Ola

30000 Estimated Uncollectible Interest and Penalties 50 Revenues 450 Revenues Subsidiary Ledger. Trial Balance Trial Balance indicates mathematical accuracy. Email protected to be charged on Furniture Fixtures and 15 on Plant Machinery. One of the head of.

Journal ledger and Trial balance Financial Accounting CONTINUE 2. Trial balance Rs 330000 SOLUTION. Ledger implies the principal books of accounts wherein all accounts ie.

2010 91 439 Sales Other revenue Cost of goods sold Distribution expenses Marketing. Since every debit should have a. SIMPLE ENTRY A journal entry having only two accounts is called a simple journal entry.

Trial Balance Problems And Solutions Accountancy Knowledge Problem Solution Trials Revenue On Financial Statements Cfi Cash Flow

The Trial Balance. These transactions are initially recorded on source documents such as invoices or checks. A0209 Ledger Posting and Trial Balance with Opening Journal Entry. Their financial figures are given below in dollor.

The next step post them into ledger and the next step in the accounting process is to prepare a statement to check the arithmetical accuracy of the transactions recorded so for. At the end of an accounting period after all the journal entries have been made accounting professionals create whats called a. Journal is a book of original entries recorded financial transaction date wise.

Journal entry is accounting entry for Dr. A02 Class 1 Method-1. Record the transactions needed to journalize post to respective ledger account and prepare Trial Balance of the following for October 2011 of the current year.

Recording Transactions Into General Journal Pages Accounting Profit And Loss Percentage Formula In Excel Travelers Financial Statements

General Ledger tab – Each journal entry is posted automatically to the general ledger. Prepare Unadjusted Trial Balance. 57500 cash and Rs. Trading Ac Profit and Loss Ac.

15600 on the trial balance. General Ledger and Trial Balance. Variable Cost VC These are costs that change with the volume.

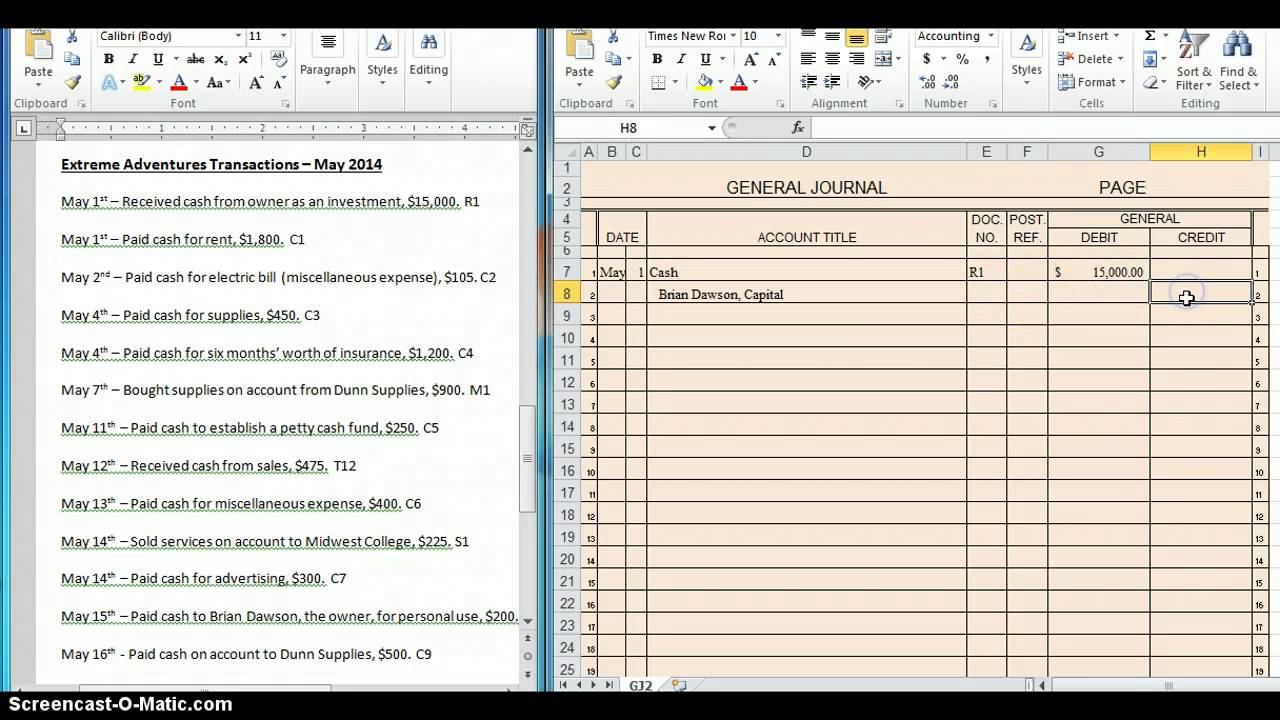

Personal real and nominal are maintainedAfter recording the transactions in the journal the transactions are classified and grouped as per their title and so all the transactions of similar. 2 Purchased inventory on credit terms of 110 net 30. Up to 24 cash back GENERAL JOURNAL GENERAL LEDGER TRIAL BALANCE DOUBLE ENTRY SYSTEM The system underlying the recording of transactions in which the dollar value of an entrys debits must be equal to the dollar value of the entrys credits.

Project On Accountancy Class 11 12 Accounting Basics Learn Financial Statement Analysis What Does A Balance Sheet Contain Direct Method Operating Cash Flow

1 Marks 15 Make the journal entries ledger and trial balance the transaction July 1 to December 31 2018 Nestle company reported the following income statement for the year ended June 30 2018. 57500 cash and Rs. Answer 1 of 15. Download Ebook Partnership Accounts With Journal Ledger Trial Balance Partnership Accounts With Journal Ledger Trial Balance If you ally habit such a referred partnership accounts with journal ledger trial balance books that will allow you worth acquire the unquestionably best seller from us currently from several preferred authors.

Journal entries are very important for keeping accounting records.

Ts Grewal Accountancy Class 11 Solutions Chapter 6 Ledger Ncert Textbook Franchise Accounting Balance Sheet Enhanced Audit Report

Ts Grewal Solutions For Class 11 Accountancy Chapter 12 Trial Balance Cbse Tuts Https Www Cbsetuts Com Trials 3 Cash Flow Statements Samsung Income Statement 2019