Equity multiplier total AssetsTotal Equity. The most common financial modeling ratios are year-over-year growth rate gross margin EBITDA margin.

In this post I will describe the 5 main pillars of ratios and then the 10 most popular financial ratios. Financial Ratios are used to measure financial performance against standards. Examples include such often referred to measures as return on investment ROI. It can give you an idea as to whether it a company has too much or too little cash on hand to meet its obligations.

Most used financial ratios.

19 Most Important Financial Ratios For Investors Ratio Finance Investing Investment Analysis Tb Meaning Accounting Exemption From Preparing Group Accounts

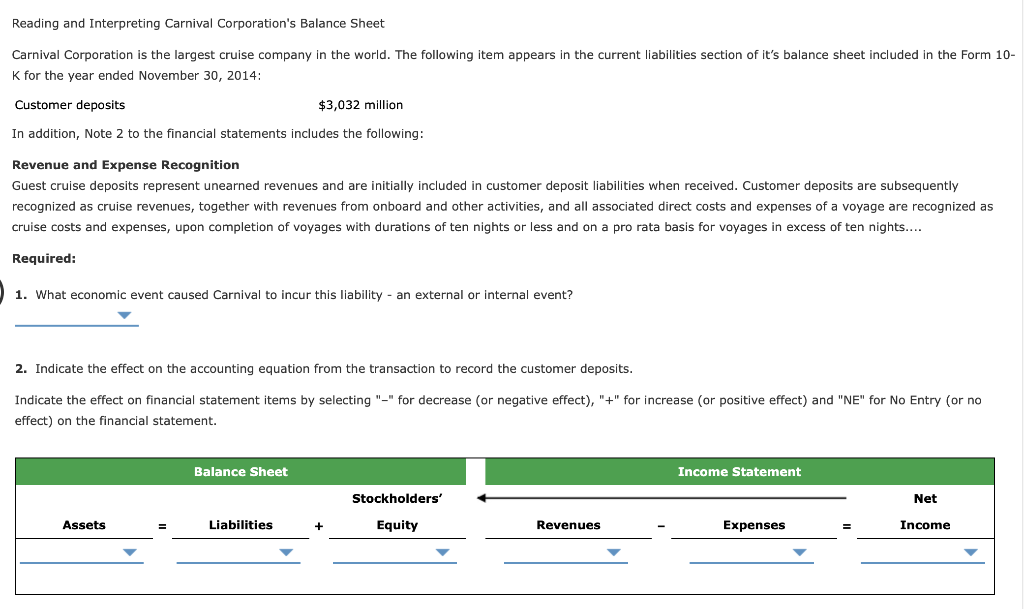

The operating income can be obtained by subtracting operating expenses from operating revenues and it is commonly. Investors use financial ratios to investigate a stocks health before investing. Financial ratios show a snapshot of your company at a single moment in time. What are Financial Ratios.

WRDS Industry Financial Ratio WIFR hereafter is a collection of most commonly used financial ratios by academic researchers. Financial Ratios Used in Credit Analysis. There are in total over 70 financ ial ratios grouped into the following seven categories.

Financial ratios are relationships determined from a companys financial information and used for comparison purposes. A few of the most important financial ratios for investors to validate the companys profitability ratios are ROA ROE EPS Profit margin ROCE as discussed below. Thats helpful but to make the most of your financial ratios its best to look at trends.

The Financial Ratios Are Tool Used By Creditors Investors Stakeholders And Management Of A C Ratio Statement Analysis Ideal All Accounting Profit Loss Account Entry

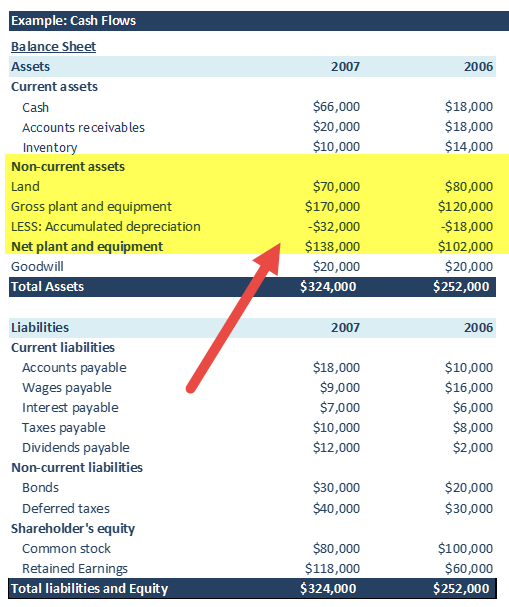

A Ratio of 1 shows that the company has equal components of both debt and equity in its capital structure. Financial ratios are the indicators of the financial performance of companies. In this below table we have collated data of 200 industries from the IRS database in a condensed format. Liquidity is the firms ability to pay off short term debts and solvency is the ability to pay off long term debts.

Financial Ratios Overview. The most useful comparison when performing financial ratio analysis is trend analysis. Note how widely ratios can vary.

The second category of ratios included in our list of financial ratios is the solvency ratio which is also the most important financial ratio. Common leverage ratios examples are. The curation of data over 10 years makes it a go-to document for in-depth industry trends.

Accounting Concepts Applications Learn Student And Finance Personal Balance Sheet Format Note Payable In Cash Flow Statement

The Best Way to Use Financial Ratios. This is one of the most frequently used types of financial ratios giving a quick indicator of business liquidity. Well start off our list of the most important financial ratios with the quick ratio also known as the acid test. So below Ill address some of the most important and widely used financial ratios.

Like the price-to-earnings ratio the current ratio is one of the most famous. The most cost commonly and top five ratios used in the financial field include. Its figured by dividing current assets by current liabilities.

Key credit analysis measures fall into 4 different groups. Well start off our list of the most important financial ratios with the quick ratio also known as the acid test. Profitability ratios are used to measure the effectiveness of a company to generate profits from its business.

Financial Ratios Questions Answers Accountingtools Ratio Question And Answer Balance Sheet Of Titan Company Preparation Profit Loss Account

As we observed in the previous section the IRS financial ratio database is the most reliable reference point. The debt-equity ratio compares the debt a company has in relation to the equity. It serves as a test of financial strength. Leverage ratios are widely used in accounting financial ratios that help determine the ability of a company to meets its financial obligation.

It is from operating cash flows that companies can service their debt payments. Track and compare the ratios over time rather than calculating them once to try and determine if the results are good or bad. Top 5 Financial Ratios.

Ratios are also used to determine profitability liquidity and solvency. 220 rows IRS Financial Ratios By Industry. Heres a breakdown of important financial ratios and why theyre so useful.

Trade Brains Simplified Stock Investing For Everyone Learn To Invest Financial Ratio Finance In Stocks Ifrs Terminology What Is A Adjusted Trial Balance

This is one of the simplest ratios and is most widely used. Financial ratios are used by businesses and analysts to determine how a company is financed. Examples from the most recent fiscal year as of August 2020 will be provided for each ratio. Net profit margin current assets to current liabilities debt to equity.

Heres a breakdown of important financial ratios and why theyre so useful. EBITDA Margin EBITDA margin EBITDA Revenue. Discover and calculate commonly used financial ratios including.

Analysts compare financial ratios to industry averages benchmarking industry standards or rules of thumbs and against internal trends trends analysis. It is a profitability ratio that measures earnings a company is generating before taxes interest depreciation and. Theyll be grouped into five general categories.

8 Financial Ratio Analysis That Every Stock Investor Should Know Cash Flow Statement Quotes Of Ngo Sales Tax Expense On Income

A higher ie greater than one DE ratio indicates higher financial obligations for the company. Different financial ratios indicate the companys results financial risks and working efficiency like the liquidity ratio Asset Turnover Ratio asset Turnover Ratio The asset turnover ratio is the ratio of a companys net sales to total average assets and it helps determine. These ratios help assess the valuation of a company and are a primary tool for fundamental analysis. Financial ratios are used to calculate the relationship between variables such as a companys financial health and performance.

Capitalization Efficiency Financial SoundnessSolvency Liquidity. The debt-to-equity ratio is a quantification of a firms financial leverage estimated by dividing the total liabilities by stockholders equity. This is one of the most frequently used types of financial ratios giving a quick indicator of business liquidity.

Profitability and Cash Flows. Unlike liquidity that deals with an ability to handle short-term debt solvency deals with a companys ability to service its long-term liabilities. Debt-equity ratio total liabilitiestotal shareholders equity.

The 5 Basic Types Of Financial Ratios What Are Common Interpret Ratio Analysis Performance Measurement Statement Cash Flows Example Indirect Method Company Changes In Equity

To calculate the.

Bookkeeping 101 Financial Ratios The 8 You Need To Know Ratio Analysis Management Cash Drawer Count Sheet Template Ifrs Illustrative Statements 2018