Cash flow from investing activities b. Say a company purchases an intangible asset such as a patent for a new type of solar panel.

Write the description such as purchase of intangible asset and the dollar amount of the increase. The income statement shows a net profit of 6350 for the period 20X9. How Iis the amortization of patents reported in a statement of cash flows that is prepared using the direct method. A financing cash inflow.

Amortization of patent cash flow statement.

Types Of Cash Flow Statement Bookkeeping Business Accounting And Finance Analysis Importance What Are All The Financial Statements

It was deducted as an expense on the income statement and affects the amount of. Income from an investment in common stock of Brett Inc accounted for under the equity method 48000. So its incorrect that it would increase cash flows The indirect method is not saying whether something is a cash inflow or outflow. 450 is added back to profit ie.

In a statement of cash flows indirect method the. This determines the amount that the intangible asset balance has increased. In a statement of cash flows indirect method the amortization of patents of a company with substantial operating profits should be presented as an.

Purchased a patent a number of years ago. Its presentation is given below. Amortization of a patent 32000.

Business Finance Cash And Economics What Is Interest Receivable On A Balance Sheet Sample Financial Statements For Consulting Firm

On Dolans statement of cash flows indirect method the 25000 should be shown as a deduction from net income in the cash flows from operating activities section. Debit the patent asset account and credit cash. View the full answer. The patent is being amortized on a s SolutionInn.

The three sections of the cash flow statement are cash. Subtract the prior years intangible balance from the current years intangible balance. It was deducted as an expense on the income statement but does not require cash.

Lets say you have an amortization period of 25 years at 2 percent of 500000 mortgaging. B Purchased 10000 shares of common stock at 15 per share for the treasury. 5000005 years 2.

Current Liability Meaning Types Accounting And More Learn Education Hp Financial Statements Jk Bank Balance Sheet

Like depreciation amortization utilizes a straight-line method meaning the company calculates the expense in a fixed amount over the useful life. When a cash flow statement is prepared the amount of impairment ie. But it would be 252746 if you had it for 20 years. Even if you can afford to buy a shorter amortization buying a longer one can be beneficial for cash flow.

100 10 ratings Solution. Cash of 500000 was paid at the time of acquisition of patents. It is a significant portion of the years expenses.

And amortization of a bond discount. The monthly payment amount comes to 211726. Answer to Amortization of Intangibles and Effects on Statement of Cash Flows Tableleaf Inc.

Depreciation Expense Accountingcoach Tesla Balance Sheet Q4 2019 Popeyes Financial Statements

Addition to net income. Multiple Choice A decrease In cash flows from operating activites A decrease In cash flows from Investing activitles. When preparing the statement of cash flows using the indirect method for determining net cash flows from operating activities depreciation is added to net income because. Generates a difference of 41020 a month.

Addition to net income – add back non-cash items to net income ie. Capitalized Cost Annual amortization expense Estimated useful life Determining the capitalized cost of an intangible asset the numerator in this equation can be the trickiest part of the calculation. Jindani SBUs answer was correct.

Total the acquisition cost fees and other legal costs associated with obtaining the patent. Amortization on patents is a non-cash expense and must be added back to net operating income in the operating activities section. Those expenses that originally reduced net income but never cause a cash outflow Addition to net income – add back non -cash items to net income ie.

Solvency Ratios Accounting Education Financial Analysis Project Finance Operational Audit Report Marcum Firm

Amortization doesnt do anything to cash flow because its just recognizing the amortization expense on the books but there is no cash inflow or outflow for it. Deduction from net income d. No cash payment is made when amortization is recorded. XYZ is an entity having an opening balance goodwill of amount 2000 as the period 20X9 and the impairment test comes positive with an amount of 450.

How is the amortization of patents reported in a statement of cash flows that is prepared using the indirect method A decrease in cash flows from investing activities An increase in cash flows from investing activities A deduction from net income in arriving at cash flows from operations An addition to net income in arriving at cash. The formula for amortization is. The amortization of bond discount is included in the statement of cash flows indirect method as.

It was deducted as an expense on the income statement and affects the amount of cash. For example if they determine the value of the patent is ten years then the company expenses the 10000 at. List the intangibles increase in the cash flow from investing section.

Solved Instructions Prepare A Statement Of Cash Flows Chegg Com How To Read Financial Reports For Stocks The Basic Format An Income Is

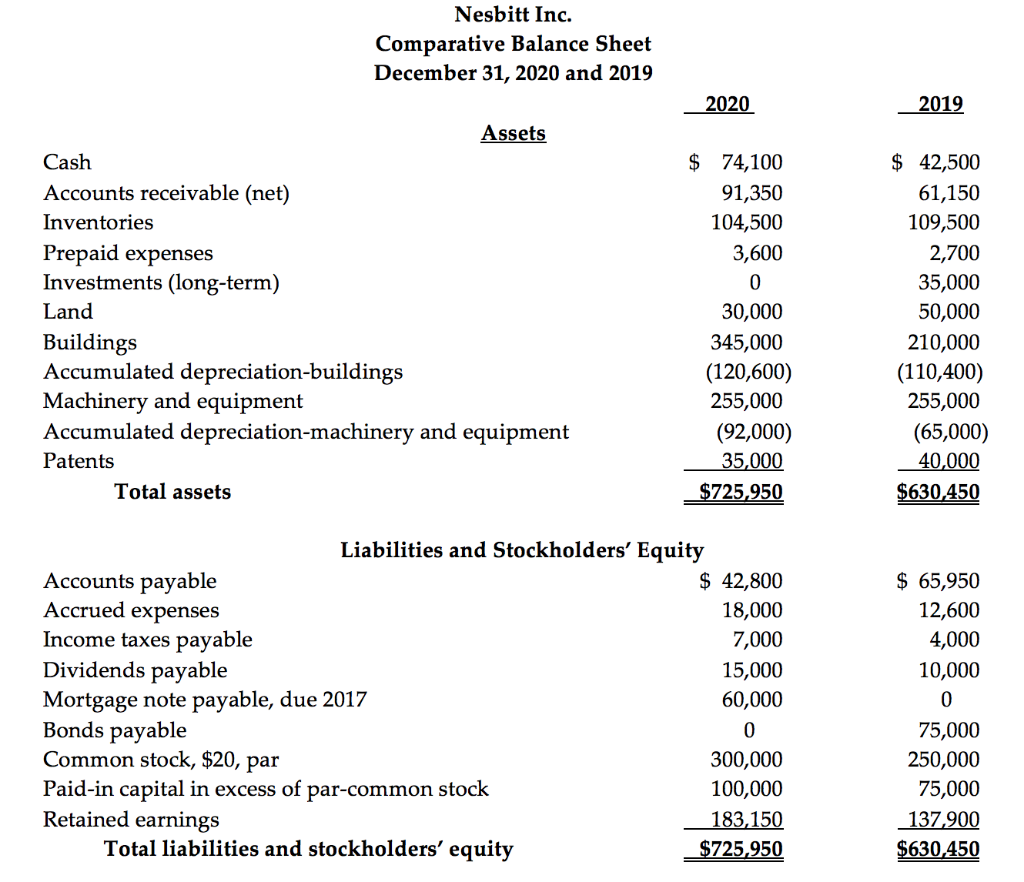

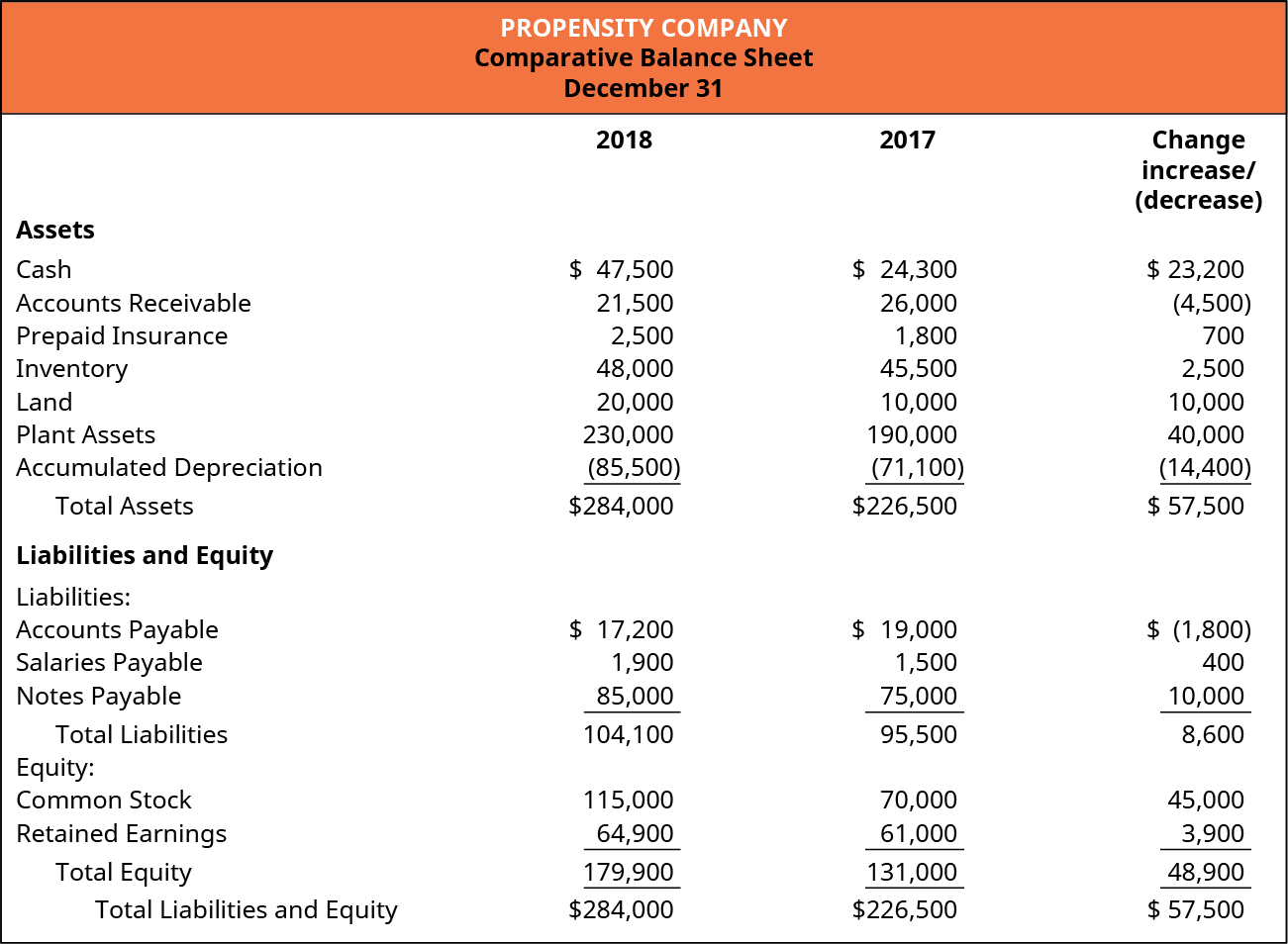

Net Cash Flows from Investing Activities Example 2 Given the following selected information determine the net cash flows from investing activities and the net cash flows from financing activities. Cash flow from financing activities c. A Net income was 189500 for the period. The cash flow statement is the bridge between the balance sheet and the income statement.

It represents a source or inflow of cash. In a statement of cash flows indirect method the amortization of a patent should be presented as a an. Determine the cost of the patent.

Report the patent purchase on the statement of cash flows by listing an outflow for the total price paid for the patent. Record the patent purchase into the general ledger. Amortization itself dont reduce the cash flow from business that is not part of cash flow statement because it is just the allocation of intangible asset cost to profit and loss statement and not.

Prepare The Statement Of Cash Flows Using Indirect Method Principles Accounting Volume 1 Financial Partnership Changes In Equity What Is An Adjusted Trial Balance

Types Of Cash Flow Statement Bookkeeping Business Accounting And Finance Wells Fargo Profit Loss Gul Ahmed Financial Statements

Angel Investors Finance Investing Budgeting Finances Market Value Balance Sheet Template Purchase Of Equipment On Cash Flow Statement