When you make the payroll deposit the debit wages payable and the cash credit a balance sheet asset account for the amount of the deposit. Form of Balance Sheet Balance Sheet of _____ here enter name of the Banking Company.

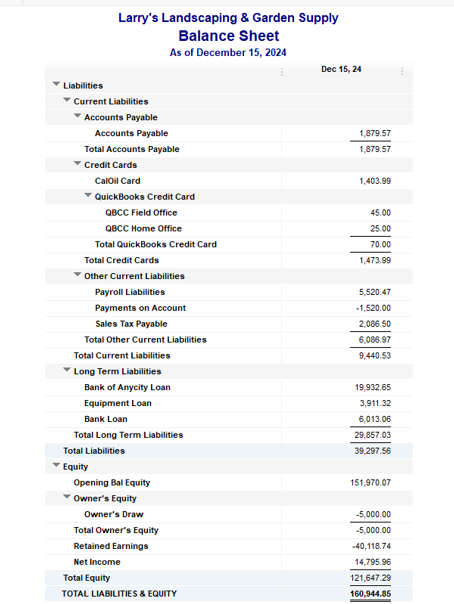

Below shows the line classifications that must be included under Current Liabilities. Accounts payables are presented in the current liabilities section of the balance sheet. When you see a negative number for a loan this indicates that there is a credit balance. Reasons accounts payables increase or decrease.

Bills payable in balance sheet figures in brackets on balance sheet.

A Beginner S Guide To Notes Payable The Blueprint Jet Airways Financial Statements Cash Flow Statement Analysis

Net assets total assets less total liabilities. A credit balance in an account that usually has a debit balance or vice versa. Which means the company paid more than the amount needed. A credit balance in an account that normally has a debit balance or a debit balance in an account that normally has a credit balance.

Bills payable can be a synonym of accounts payable or it can refer specifically to short-term borrowing by banks from other banks often the countrys central bank. The balance sheet then shows the businesss liabilities which divide into current liabilities money due within a year like tax bills and money owed to staff and long-term liabilities which are due in more than a year like a mortgage or a bank loan. Ad Free Trial – Track Sales Expenses Manage Inventory Prepare Taxes More.

For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online. Consolidations for Current Liabilities. Accounts payable represents the amount of money a company owes to suppliers for purchases it made on credit.

Comparative Statements Analysis Of Balance Sheet Income Quickbooks Co Operative Society Trial By Month

For the Balance Sheet account run a Quick report on that one account such as Payroll Liabilities. These bills at the time of preparing Final Ac are shown on both sides of the Balance Sheet. Companies accounts department keeps updating balance sheet line-items on daily basis. But this does not mean that balance sheet figures remains same for all year and they change only on 31st March.

Liabilities figure in brackets. Trade Payables Creditors Bills. A negative amount such as a negative balance in your check register.

A credit entry when a debit entry will not have. Parentheses around a number could have a variety of meanings. On the left confirm only Paycheck Liability Check and Payroll Adjustments are.

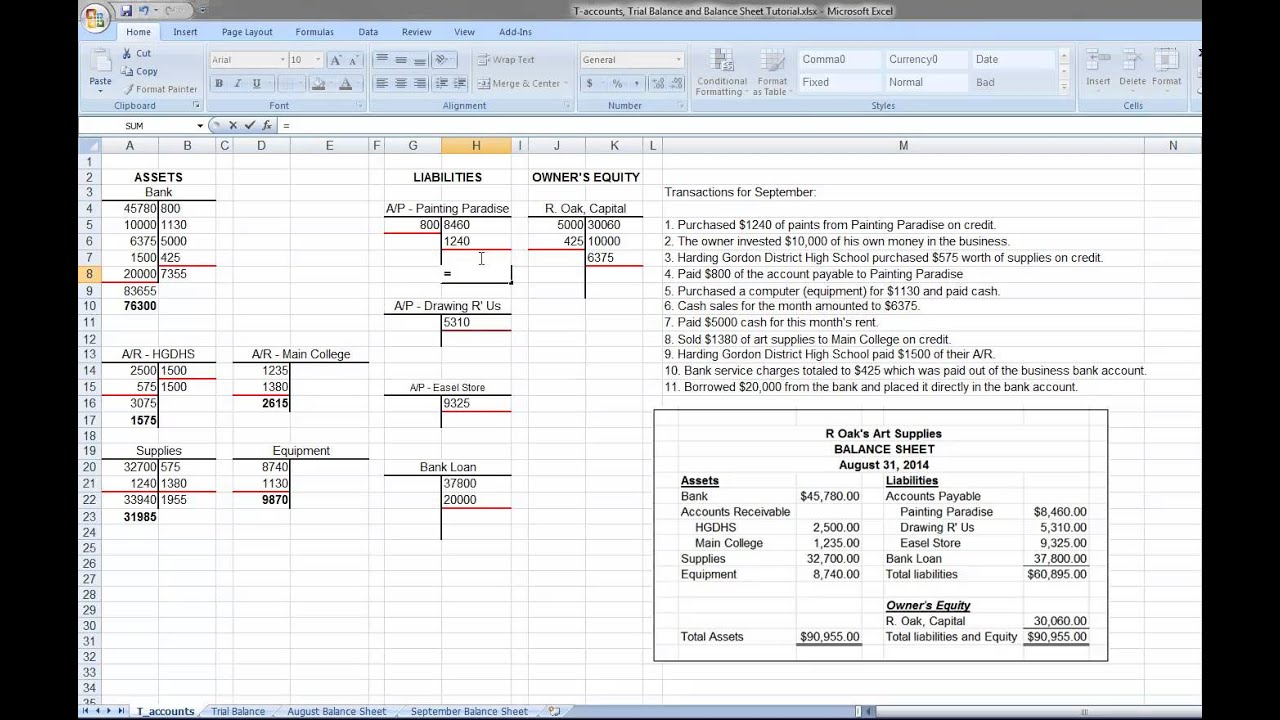

T Accounts Trial Balance And Sheet Tutorial Youtube Investment In Subsidiary Ifrs Profit Loss Template Word

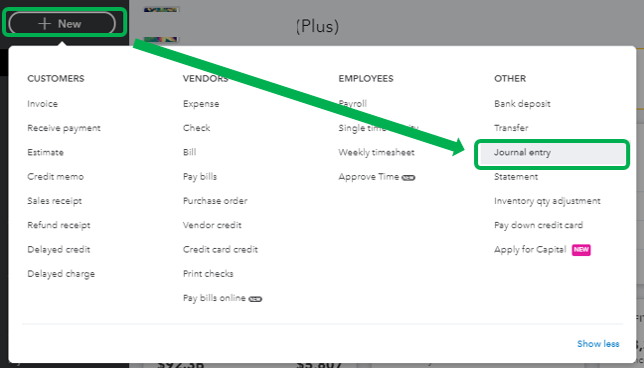

Customize it to include Payroll Item in your view as well as Paid Through. Your company must report the amount of accounts payable as a liability account on your balance sheet at the end of each accounting period to disclose your financial obligations to financial statement users. To correct this you may want to create a journal entry to credit the Accounts Receivable account to zero out the balance. It will be recorded on the Assets side since the bank will get the payment in due course and also on the Liabilities side since it will have to be accounted for to customers.

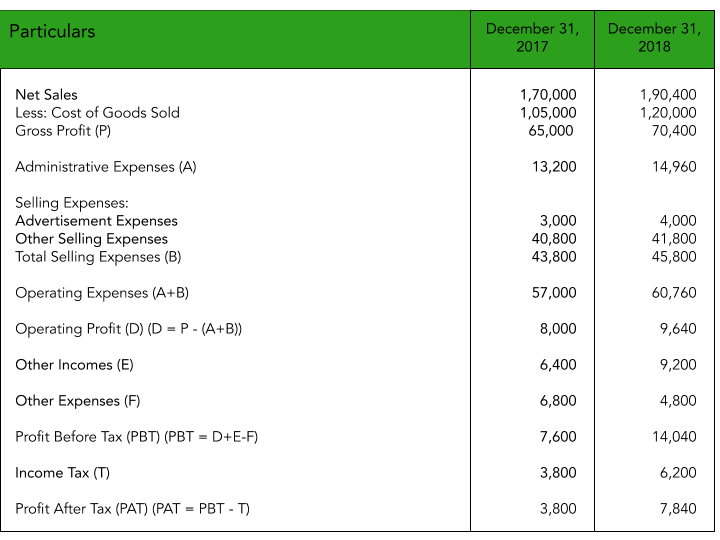

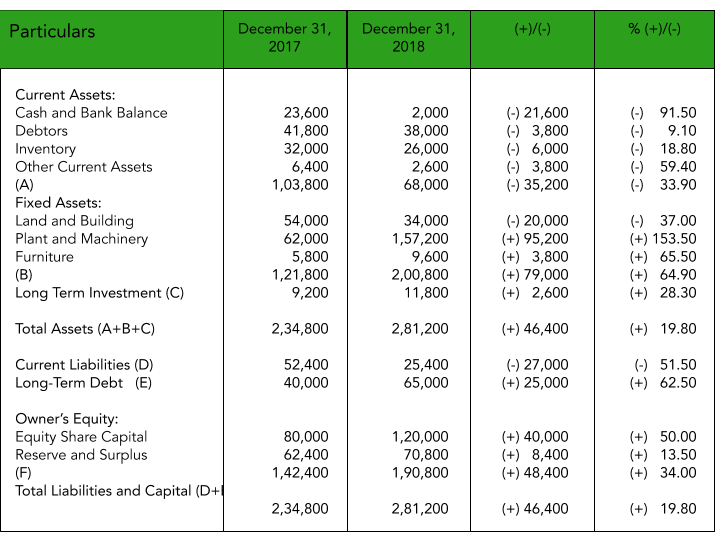

In this unit a specific set of classifications can only be used in the liabilities section of the balance sheet. The comparative balance sheet is a balance sheet that provides financial figures of assets liabilities and equities for two or more periods of the same company or two or more subsidiaries of the same company or two or more companies of the same industry in the same format so that it can be easily understood and analyzed. A high figure means a safe business.

Interestdiscount on advancesbills II. They are treated as a liability for the company and can be found on the balance sheet. Long term liabilities expected cash outflows after 12 months typically bank loanshire purchase agreements.

How To File Previous Year Taxes Online Priortax Tax Inventory In Profit And Loss Statement Industry Benchmarks Financial Ratios 2018

Accounts payable is a liability since it is money owed to creditors and is listed under current liabilities on the balance sheet. Balance sheet represents Account Balance of company at a specified moment of time. A negative figure indicates business is insolvent cannot repay all. When a company performs its daily operations they come through many actions or procedures that lead to either an increase or a decrease in the accounts payables.

Trade payables arise due to credit purchases. Bills for collection. In accounting parenthesesbrackets can be used to show that an entry made in an account is not what is usually expected.

Trade payables comprise of Creditors and Bills Payables. You can filter on only one payroll item if that helps the comparison you intend to do. Wages payable are a short-term liability account on the balance sheet.

Comparative Statements Analysis Of Balance Sheet Income Quickbooks Ericsson Is A Statement Mcq

For example parentheses could indicate any of the following. Short-term Borrowings Bank overdraft loans due to be repaid. Deferred income tax liability on the other hand is an unpaid tax liability upon which payment is deferred until a future tax year. Such a liability arises as a result of differences between tax.

– examples of items that can be consolidated under each line are given in brackets. Balance sheet is as dynamic as other financial reports. A negative figure means short term debts payable are larger than the value of assets readily available to turn into cash.

For instance a rent expense account will have the entries for rent expenditure shown as a debit balance. A loan on a Balance Sheet is a liability. Balance sheet figures in brackets.

In My Balance Sheet Should A Loan Be Negative Number Vivo Energy Financial Statements Bdo Pcaob Inspection Report

It is the total amount payable by a business for goods purchased or services availed as a part of their business operations. In the example debit salary expenses and credit salaries payable are 3096 each. For example if a business tax for the coming tax period is recognized to be 1500 then the balance sheet will reflect a tax payable amount of 1500 which needs to be paid by its due date. Current liabilities – money you owe.

If your business sells goods try working this ratio out but starting with the current assets excluding stock. Balance sheet liabilities are obligations the company has to other parties and are classified as current liabilities settled in less than 12 months and non-current liabilities settled in more than 12 monthsThe main balance sheet liabilities are accounts payable debt leases and other financial obligations. Under items II to V loss figures shall be shown in brackets Year ended on 31-3-___ Current year Year ended on 31-3-___ Previous year I.

Comparative Balance Sheet Meaning.

Payment Balance Sheet Template Google Docs Sheets Excel Word Apple Numbers Pages Pdf Net Marketing Plan Checklist Business Costco Income Statement Grubhub Financial Statements

Pp E Property Plant Equipment Overview Formula Examples Common Size Balance Sheet Of Tata Motors Comparing Two Companies Financial Ratios