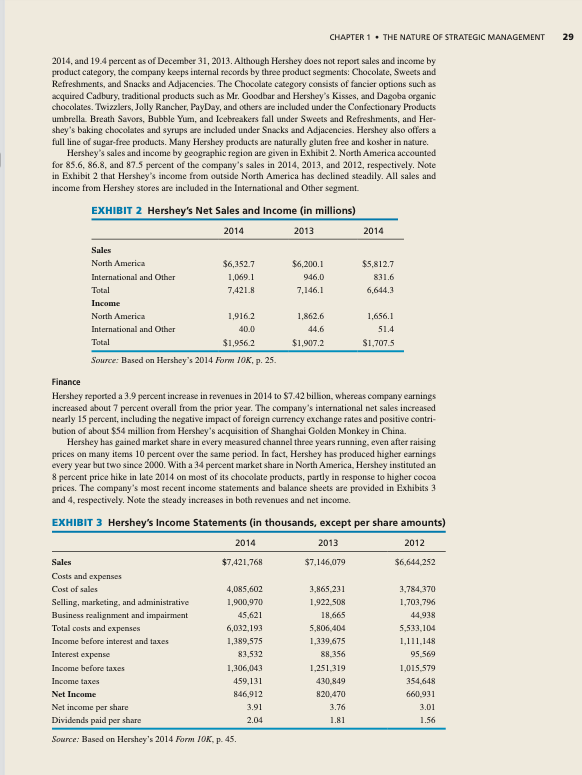

Interest payable increase from 10000 to 17000 at the end of the year. 6 rows Prepaid expenses occur when companies pay for a product or service in advance.

An expenditure is recorded at a single point in time that have not yet been recorded by a company as an expense but have been paid for in advance. How to Use a Cash Flow Statement To use a Cash Flow Statement youll typically take the following steps. When the prepaid expense balance increases that means the company has a cash outflow for expenses that have not yet been recognized in the income statement. Now if you have the cash flow and youre actually working through the cash flow by this time it comes becomes kind of easier saying go and well thats another prepaid expense.

Prepaid expense cash flow.

Myeducator Accounting Education Bookkeeping Business Summary Statement Of Earnings Financial Audit Report Example

We already know that the interest paid is 13000 but why we only see 7000 appear on the cash flow statement. For example if the company prepays rent for 12 months the prepaid rent balance will increase for the 12 months of rent prepaid. A Under the heading Cash flow from investing activities. Y2ofhnj Reference – multiple language audio and text.

The cash flow direct method formula is as follows. Adjusting for an increase in prepaid expense is similar to adjusting for an increase in accounts receivable. Decrease in Prepaid Expenses Added back to cash flow from Operating Activities The decrease in prepaid expenses represents a charge expense to the income statement is for which there was no cash outflow in the current period.

Decrease in prepaid expenses increases the cash flow because if there is no prepaid expenses already in balance sheet then cash has to be paid to fulfill expenses but as there are prepaid expenses. Also count on your credit accounts to keep track of the monthly expenditure list. Subtract the amount of cash going out.

Prepaid Expense Accounting Play Financial Statement Need For International Horizontal Analysis Formula Balance Sheet

21 rows There are 2 Methods that Accountants use to calculate the Cash Flow from Operations. However prepaid expenses do reduce cash. Therefore it must calculate the amount based on the above data. The decrease is added back to net income to arrive at net cash flow from operating activities.

Make a list of your prepaid expenses to avoid excessive cash flow. Prepaid expenses represent expenditures Expenditure An expenditure represents a payment with either cash or credit to purchase goods or services. Enter the amount and time when cash came into your business.

Its a current asset just like accounts receivable and inventory its going to follow the same principle. Prepaid expenses are assets on the balance sheet that do not reduce net income or shareholders equity. Must report its interest paid in the cash flow statement.

Five Year Projections Cash Flow Statement Cost Of Goods Sold Spreadsheet Template Hotel P&l Hess Law

Happen when the tax paid is less than tax liabilityTax paid is based on the taxable profit while tax liability base on the accounting profit. For example if the company prepays rent for 12 months the prepaid rent balance will increase for the 12 months of rent prepaid. C Under the heading Cash flow from operating activities before heading cash generated from operation. Uses the following formula for interest paid to do so.

In other words prepaid expenses. B Under the heading Cash flow from financing activities. How do changes in prepaid expenses impact cash flow.

Enter the amount and time when cash went out of your business. The increase of interest payable 7000 is considered as cash inflow. This happen when the companys tax paid is more than the tax liability it will great deferred tax asset to settle the future tax expenseIt is due to the accounting profit is less than tax profit.

Operating Cash Flow Ocf Statement Budget Calculator Special Purpose Financial Statements Disclosure Requirements What Is A Profit And Loss Account In Business

A prepaid expense is a type of asset on the balance sheet that results from a business making advanced payments for goods or services to be received in the future. What are Prepaid Expenses. When the prepaid expense balance increases that means the company has a cash outflow for expenses that have not yet been recognized in the income statement. Its in the prepaid expense.

Interest paid Opening interest payables. This will enhance your business development as well as your savings. The Net Income balance already deducts 20000 of interest expense.

Is one of the three key financial statements that report the cash generated and spent during a specific period of time eg a month quarter or year. Enter the starting balance which is the cash on hand from your Balance Sheet. When a company prepays for an expense it is recognized as a prepaid asset on the balance sheet with a simultaneous entry being recorded that reduces the companys cash or payment account by the.

Accounting Methods Play Balance Sheet Template Profit And Loss Statement Financial Wells Fargo

The cash paid in respect of expenses is calculated by adjusting total expenses from the income statement for movements in prepaid expenses and accrued expenses from the balance sheet. They both decrease cash flow. Prepaid Expenses Policy in PDF. The statement of cash flows acts as a bridge between the.

In cash flow statement cash flow on account of income tax paid is shown. Prepaid expenses are initially. Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period.

Payments Expenses Ending prepaid expenses – Beginning prepaid expenses Beginning accrued expenses – Ending. Cash Flow By Raul Avenir Prepaid expenses refer to advance payments for business expenses while debts owed by a company in the course of its trade are. However on the expense side the 12 months of expenses will not be recognized.

Financial Report Template Free Is Very Necessary When Approaching To Professional Management Or Profes Calculate Quick Ratio From Balance Sheet Pro Forma Statements Are Used

Cash Paid to Suppliers Cost of Goods Sold Increase or – Decrease in Inventory Decrease or – Increase in Accounts Payable Cash Paid for Operating Expenses Includes Research and Development Operating Expenses Increase or – decrease in prepaid expenses decrease or – increase in accrued liabilities.

Forten Company Spreadsheet For Statement Of Cash Flows How To Memorize Things Flow Bookkeeping Templates Is Income And Profit Loss The Same Owners Equity Examples

Iscaccounts Questionpaper2017 Solvedforclass12 Aplustopper Cash Flow Statement Question Paper Previous Year What Financial Is Revenue On Of Stockholders Equity

A Cash Flow Statement Template Is Financial Document That Provides Valuable Information About Bookkeeping Business Accounting Education Costco Operating Financing And Investing Flows