Learn how to calculate interest expense and debt schedules in CFIs financial modeling courses Financial Modeling. There are no specific formats which are required to complied with.

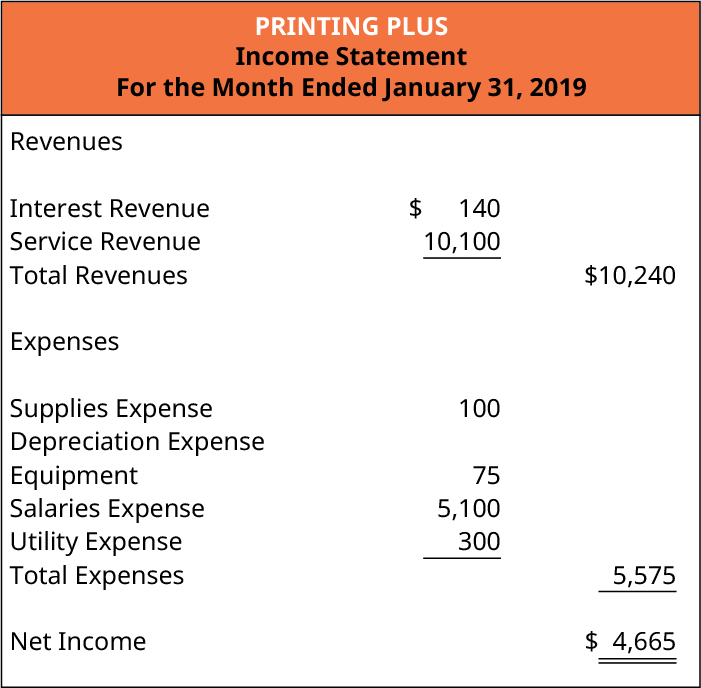

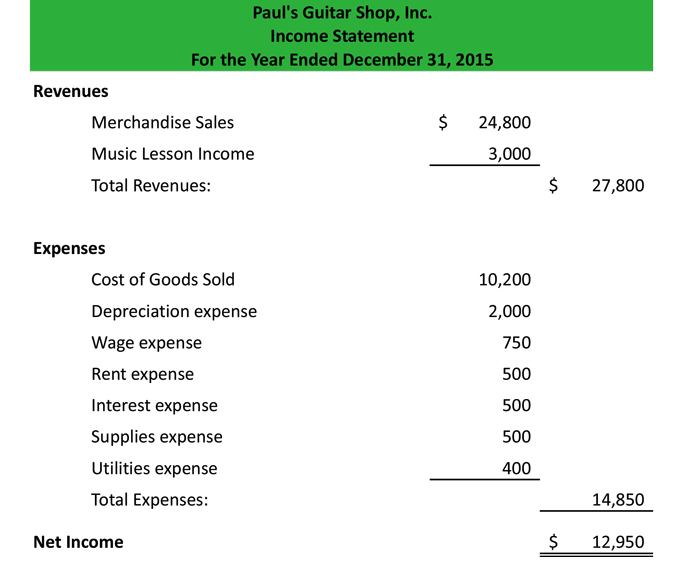

A and B share profit and loss equally. The Income Statement or Profit and Loss Report is the easiest to understand. As shown in Table 142 Delicious Desserts earned a net profit of 32175 in 2018. The following trial balance is prepared after preparation of income statement for F.

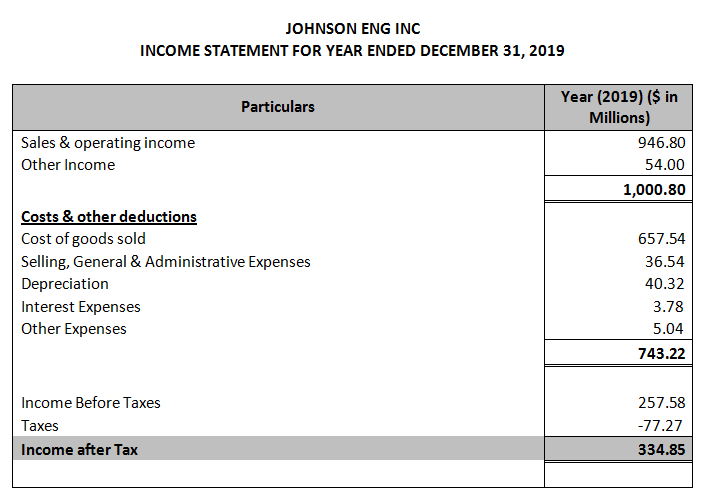

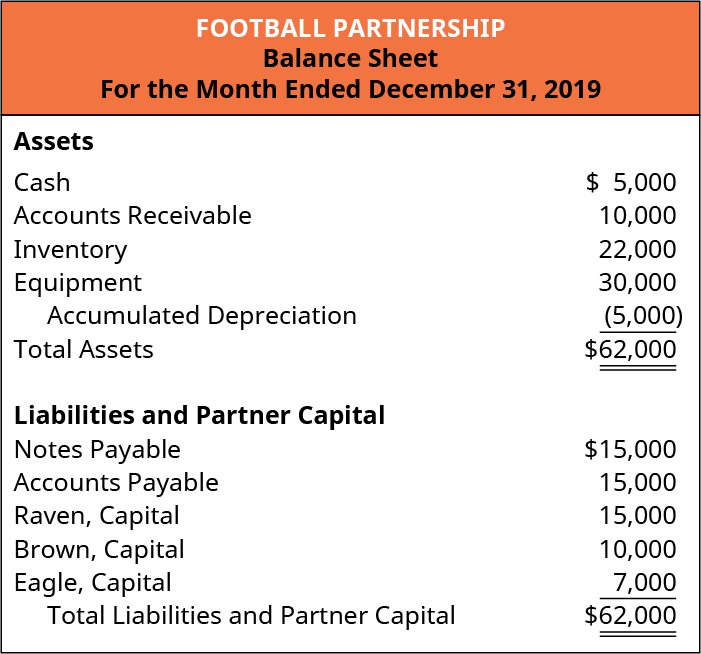

Interest expense on income statement balance sheet format of partnership firms.

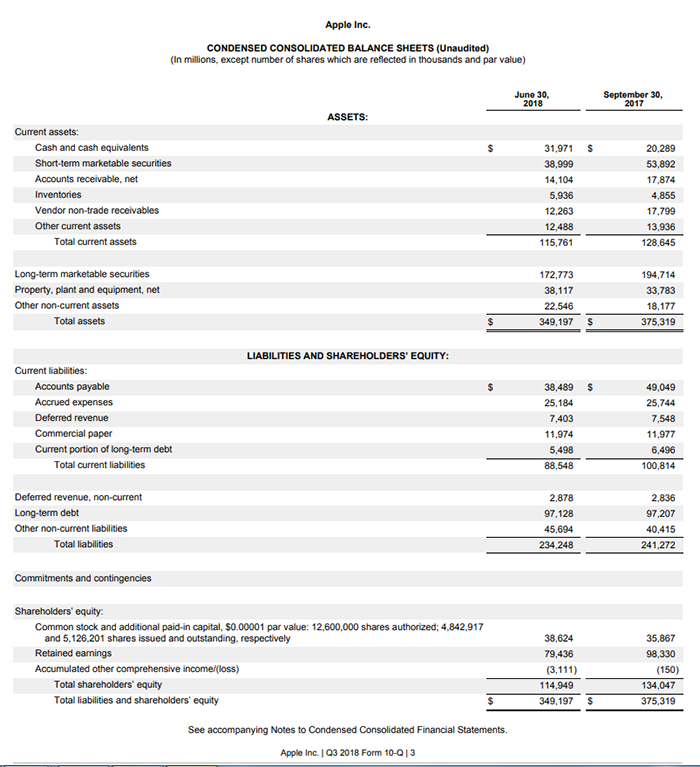

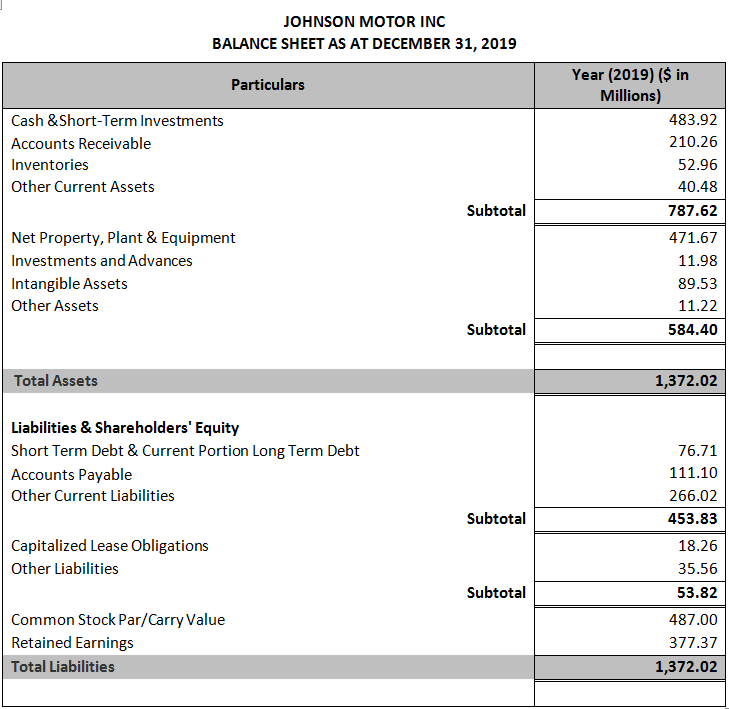

How To Make A Balance Sheet Using Simple Equation Brex Disclosure In Financial Reporting Accounts Payable Turnover Ratio Interpretation

Cost of goods sold and operating expenses. Due diligence costs 1132000 Broken deal costs 200000 Interest expense 375000 Total expenses 9812000 Net investment loss 3178000 Realized and. AttendanceSpeaking Industry Civic Meetings. Interest Expense Average Balance of Debt Obligation x Interest Rate.

Total investment income 6634000 Expenses Management fee gross 16000000 Management fee offset 8460000. Then total operating expenses are subtracted from gross profit to get the net profit before taxes. Green as at 31 March 2015 in both horizontal and vertical style.

Find Content for balance sheets for dummies. Find Content for balance sheets for dummies. Club Dues Expenses.

Statement Of Comprehensive Income Overview Components And Uses Investing Activities Definition What Are The Primary Financial Statements

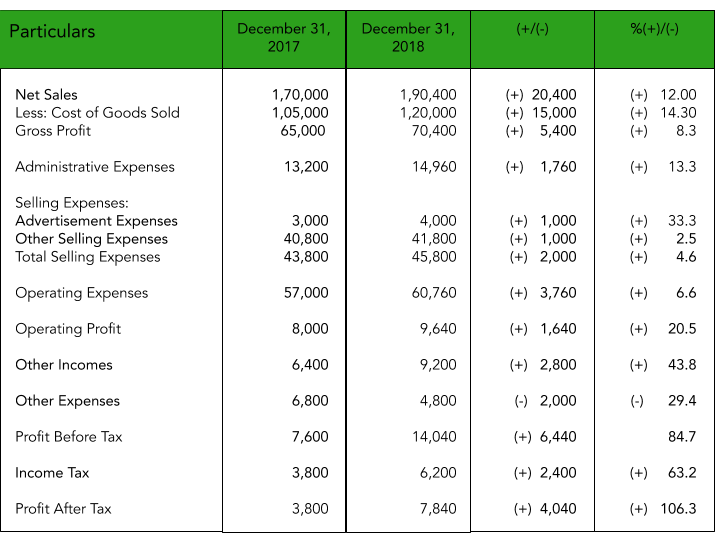

The Income Statement can be run at any time during the fiscal year. Interest rate x average period debt. Description Advantages and Disadvantages paper for only 1300 11page. Gross profit is the figure arrived by simply deducting the cost of sales from the net sales.

How is income defined. Here is the formula to calculate interest on the income statement. By examining a sample balance sheet and income statement small businesses can better understand the relationship between the two reportsEvery time a company records a sale or an expense for bookkeeping purposes both the balance sheet and the income statement are affected by the transaction.

Statement of cash flows. In the given example the Cost of sales is 2578791000. You are required to prepare profit loss account and the balance sheet as at June 30 2002.

Comparative Statements Analysis Of Balance Sheet Income Quickbooks Ernst Consulting Statement Retained Earnings Historical Cash Flow

For manufacturers cost of goods sold includes all costs directly related to production. Reduce provision for doubtful debts to Rs. Expenses are the costs of generating revenues. Ad Free Trial – Track Sales Expenses Manage Inventory Prepare Taxes More.

Income Statement and Balance Sheet Overview. Green as at 31 March 2015. Less While the income statement purports to show the profitability of.

For example if your model is forecasting a 100m debt balance in the end of 2019 and 200m at the end of 2020 at an assumed interest rate of 5 the interest expense would be calculated as 150m average balance x 5 75m. Two types are recorded on the income statement. In the absence of information about the date of repayment of a liability then it may.

Components Of Financial Statements With Explanation Ford 2019 Interest Expense Cash Flow Statement

Employee Cost Non-Attorney Staff. First the interest expenses need to be deducted from the EBIT and second the interest income earned The Interest Income Earned Interest Income is the amount of revenue generated by interest-yielding investments like certificates of deposit savings accounts or other investments it is reported in the Companys income statement. The cost of goods sold is the total expense of buying or producing the firms goods or services. First cost of goods sold is deducted from net sales to get the gross profit.

Tax deductible expenses such as interest end up costing the business substantially more or less ___ than the amount expected on an after-tax basis. 29 November 2018 Sir Please provide Partnership Firm Profit and loss account and Balance sheet formats and other required formats to prepare at the year end. Our experts can deliver a custom Companys Income Statement.

Interest rate x beginning period debt. Within the expenses section you. The left or top side of the balance sheet lists everything the company owns.

Components Of Financial Statements With Explanation Common Size Income Statement Excel Meaning Ipsas In Accounting

A companys balance sheet also known as a statement of financial position reveals the firms assets liabilities and owners equity net worthThe balance sheet together with the income. You can simply use the T-Format for preparation of Profit and loss account and Balance sheet. Finally income taxes are deducted to get the net profit. Financial statement preparers and other users of these illustrative.

Total Professional Expenses MarketingBusiness Development. 8000 is to be accrued. Interest expense is reflected in the _____ section of the income statement.

For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online. The income statement shows the companys sales expenses and net profit or loss over a period of timeusually 3 months year-to-date and twelve months. A company may differentiate between expenses and losses in which case you need to find the expenses section.

Sample Balance Sheet And Income Statement For Small Business Capital Lease Cash Flow Ias Accounting Standards

The income statement reveals a companys revenue expenses and profits during a certain period of time. Prepare balance sheet for F. It lists only the income and expense accounts and their balances. Interest expense will be listed alongside other expenses on the income statement.

The balance sheet and the income statement are two of the. The income statement also comes with a lot of notes and discussions. The income statement gives the overall financial picture of a company for a period of time as opposed to the balance sheet which provides an overview of.

Revenue plus expenses. The Income Statement totals the debits and credits to determine Net Income Before Taxes. Purchases of raw materials and.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Financial Statements Definition Types Examples Direct Cash Flow Example Auditor General Report 2017

As one can see from the above that both balance sheet as well as income statement are highly correlated with each other and any inconsistency between the two should be carefully looked into hence for example if company has taken bank borrowing of 100000 at 10 percent and in income statement company is showing only 5000 as interest on the expense. Which one of the following is an example of a non-cash item on an income statement. The Income Statement is one of the financial statements that all publicly traded companies share with their investors. Partnership salary of A Rs.

Preparation of Balance Sheet Horizontal and Vertical Style.

Discuss And Record Entries For The Dissolution Of A Partnership Principles Accounting Volume 1 Financial Asset Liability Statement Sole Trader School Audit Report

Quick Guide To Financial Statements Ikea 2018 Accounting Job