It provides a comprehensive overview of TDS TCS refunds advance taxes etc. Here a confirmation message and an acknowledgment number will.

Refund paid status is also being reflected in the Tax Credit Statements in Form 26AS. Near Deep Bungalow Chowk Pune – 411 016. Fill the further details Taxpayer info Address Property details and Payment info to proceed further and click on Next. May 2016 – NSDL May 13 2016.

Nsdl form 26as.

How To View Download Form 26as Eztax Pharmaceutical Industry Average Financial Ratios Royal Caribbean Cruises Statements

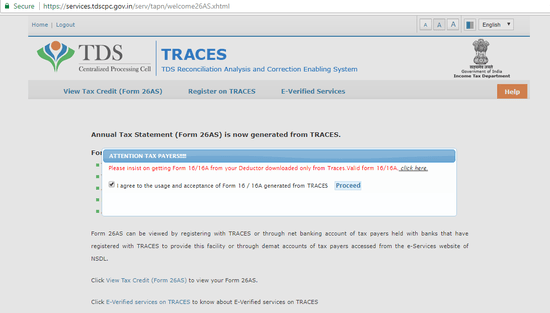

Before filing returns one had to check the annual tax statement or Form 26AS. If you are not registered with TRACES please refer to our e-tutorial. On November 1 2021 the AIS was launched for the first time. Entries in Form 26AS that do not pertain to PAN Holder In case there are unknown TDS TCS credits one should intimate the tax deductor collector for necessary rectification.

Other files by the user. The taxpayers are advised to view their updated Tax Credit Statements in Form 26AS on TRACES wwwtdscpcgovin. The generation of 26AS has been discontinued through NSDL wef.

020 27218080 From 700 AM to 1100 PM Monday to Sunday F. Form 26AS also known as Annual Statement provides a consolidated record of all tax-related information such as TDS TCS and refund etc. You may also check the status of your PANTAN application at TIN website- click here or SMS NSDLPAN 15 digit acknowledgment number to 57575 to know the status of your application.

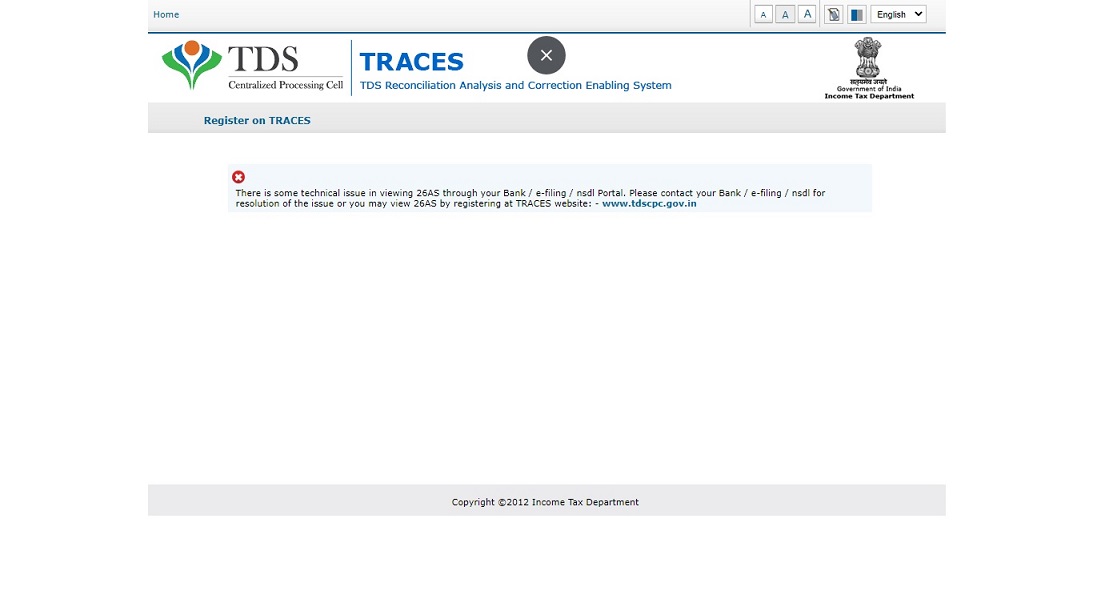

Not Able To Download Form 26as From Traces Income Tax Website And Seeing Error Contact Bank Nsdl Taxontips Assertions For Accounts Payable Paid In Cash Flow Statement

This form and its use by tax authoritiestax payers is governed by Section 203AA Rule 31AB of the Income Tax Act 1961. The website provides access to the PAN holders to view the details of tax credits in form 26AS. TIN is not responsible for any mismatch in the details provided by TransfereeBuyer in the Form and the actual transaction of the TransfereeBuyer. View TDS Credit 26AS without registration at NSDL pdf.

It handles most of the securities held and settled in dematerialized form in the Indian securities market. Refund paid status is also being reflected in the Tax Credit Statements in Form 26AS. This form contains detailed information on the income generated from multiple jobs against your PAN Permanent Account Number.

NSDL provides bouquet of services to investors stock brokers custodians issuer companies and other stakeholders through its nation-wide network of Depository Partners and digital solutions. NSDL introduces a new system of Form 26AS registration wherein it eases the complete process for employees in the organization. ReadDownload File Report Abuse.

How To View Tax Credit Statement Form 26as Online Advisory And Regulatory Compliance In India Singapore Usa Lush Financial Statements Prepare Balance Sheet Income

The AIS covers full data of savings bank interest dividends capital gains transactions and share transactions whereas Form 26 AS only mentions high-value transactions and tax deductions at source. Form 26AS is a solidified statement and declaration of income for the particular accounting year by a taxpayer under section 203AA of the Income Tax Act1961. The process In this process NSDL will approve the organization to place a request for PAN registration. In this program NSDL will automatically register the PAN and provide the password to PAN Holder.

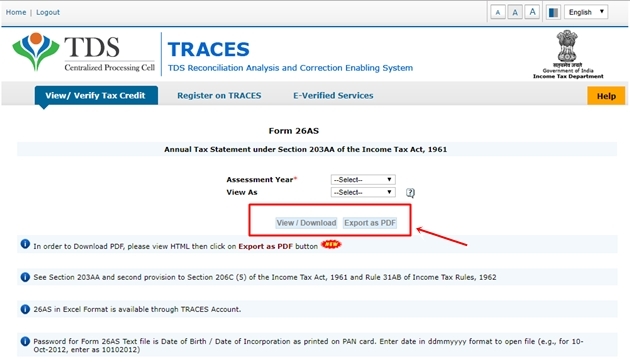

On 25 June 2010. Of viewing downloading Form 26AS to the esteemed demat account. TRACES is a web-based application of the Income Tax Department that provides an interface to all stakeholders associated with TDS administration.

If the challan is in Booked status credit of tax deducted will be reflected in the annual tax statement Form 26AS of all the underlying deductees with a valid PAN. Formerly NSDL e-Governance Infrastructure Limited Site best viewed in IE 11 Google Chrome 61 Mozilla Firefox 50 Microsoft Edge 14 and Safari for Mac 51. Read the disclaimer click Confirm and the user will be redirected to TDS-CPC Portal.

Form 26as How To View And Download From Traces Website Net Income Profit Margin Balance Sheet Out Of In Quickbooks

To receive Email intimations from TRACES please add to the address book. Table of Contents. Posted on March 22 2017. Form 26QB will be open select 0020 if you a corporate taxpayer otherwise go for 0021 Step 4.

Click on TDS on Property Form 26QB Step 3. According to the department of Income-tax any person or organisation that executes pay must subtract tax right at the source of the payment to cross a certain limit. Form 26AS is a very basic document which one can download through income tax e filing portal and this form provides various information such as TDS deducted in name of of assessee TCS collected self assessment tax paid advance tax paid SFT transaction reported in name of assessee and much more.

In this regard NSDL is pleased to inform you that new feature has been added under SPEED-e IDeAS facility to enable investors to download FORM 26AS annual tax credit statements from TRACES website. TRACES is a web-based application of the Income Tax Department that provides an interface to all stakeholders associated with TDS administration. Nsdl Form 26as Free PDF eBooks.

View And Download Form 26as Allindiaitr E Filing Help Center Pcaob Audit Inspection Process Frequency Normal Balance For Equipment

NSDL Update – May 2016pdf. TDS Form 26AS and TRACE List of Banks Registered With NSDL TDS Form 26AS and TRACE. Go to the My Account menu click View Form 26AS Tax Credit link. It enables viewing of challan status downloading of Conso File Justification Report and Form 16 16A as well as viewing of annual tax credit statements Form 26AS.

Form 26AS is a way to verify the tax credits and ensure that your ITR is accurately filed. TDS or Tax Deducted at Source is one of the leading tax collection modes in India. Click View Tax Credit Form 26AS Select the Assessment Year and View type HTML Text or PDF.

In the TDS-CPC Portal Agree the acceptance of usage. 16A as well as viewing of annual tax credit statements Form 26AS. NSDL is one of the largest securities depositories in the world.

Form 26as Tax Credit Statement Vikaaspedia Cash Inflow Outflow Example Of Audit Report Pdf

It helps the tax deductor also verify that you have filed your returns correctly and on time. Associated with a PAN Permanent Account Number. In case these unknown credits are on account of advance tax self assessment tax then its advisable to intimate the assessing officer for necessary correction or action. TRACES Highlights Download NSDL Conso File Forms Rates and Tables Form 26AS Challan Status Justification Report Form 16 16A FAQ Customer Care Login.

Provide details as mentioned in Form for TDS on property Mention Total Payment as entered in Form 26QB to view the details.

Income Tax Department Improved Form 26as From This Assessment Year Funds Instructor How To Forecast A Balance Sheet Business

What To Verify In Form 26as Total Profit Loss Transocean Balance Sheet

What Is 26as Form Applicability And Importance Of In Itr Filing Excel Income Statement Balance Sheet Template Mygov