Negative assurances also help establish a defense to claims that. Be performed earlier this Fiscal Year so that NSF management will have a final report ready by September 30th and available earlier in the annual financial statement audit.

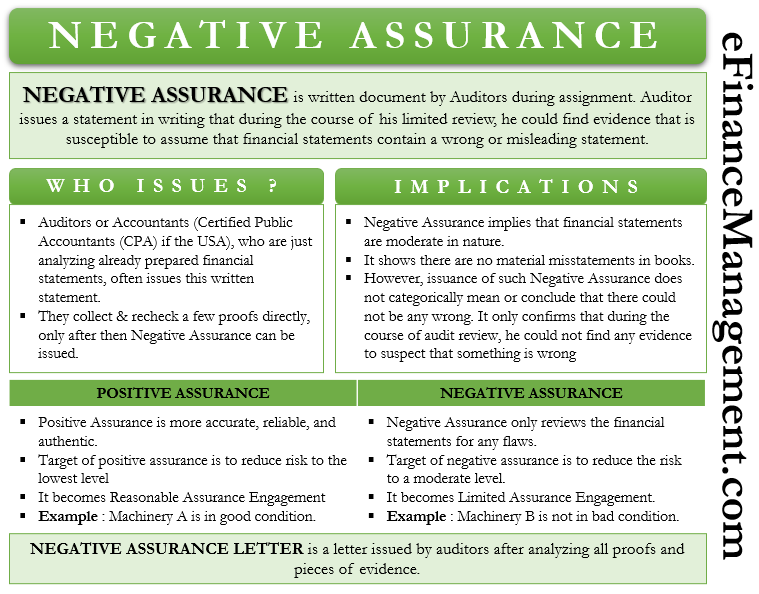

Dear experts when i run the Inventory Audit report i have found that the Cumulative values is negative. In this type of assurance auditors usually state that nothing has come to their attention to indicate that subject matters or financial statements contain a material misstatement. An adverse audit report usually indicates that financial reports contain gross misstatements and have the potential for fraud. Negative assurance is a form of limited assurance that is given by the auditors or practitioners in an engagement.

Negative audit report.

4 Types Of Audit Report Explanation Examples Accountinguide Profit And Loss Presentation In Powerpoint Company Financial Position

In negative assurance services auditors use a negative tone to provide their opinion. Negative Report If the auditor is of the opinion that the financial statement does not show the true and fair view of the state of affairs of the business he shall give an adverse or Negative Report. When faced with negative internal audit findings consider yourself lucky. Negative balance is an important process because it helps fiscal officers and users of the financial statement pinpoint and isolate issues on the balance sheet and income statement.

As far as I know Negative opinion means Adverse opinion and Negative report is a report carrying Adverse opinion. View attachment Download. Negative assurance is an accounting term used by auditors to inform external parties that a particular group of facts or financial data is deemed to be accurate since no contradicting evidence has been uncovered to dispute it.

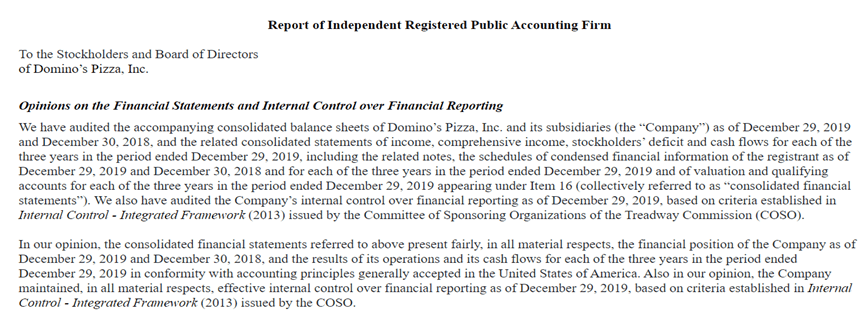

Addressee of the report The addressee of the report is unchanged. Pervasive changes to the audit report There are numerous significant changes to the audit report and these have been set out below. An unqualified audit report is an audit report that gives a clean chit to the financial statements representing a true and fair view of the financial position of the entity.

Adverse Opinion Definition Example Vs Disclaimer Accountinguide Exemption From Preparing Consolidated Financial Statements Disclosure Hbo

They simply say that. It simply means that the auditor could not find any evidence of those things during the audit. The literature suggests two different outcomes. Studies have shown both that auditors place greater weight on negative.

If you have lot of back dated entries it is going to be chance of negative value. Internal Audit is therefore disallowing 94 039 in adjustments that were noted during the audit period and seeking reimbursement for this amount. In other words negative assurance confirms what an accountant does not know.

You dont have option to change the value from negative to zero or positive value unless you do not do back dated entries. Adverse opinions send out a high alert that the companys records havent been prepared according to GAAP. I am afraid it is nothing wrong for Inventory Audit report.

Unqualified Vs Qualified Audit Opinion Auditor Report In The 10 K Explained International Financial Reporting And Analysis Pdf Illustrative Ifrs Statements 2020

A negative assurance is actually a very good thing. Negative assurance is a statement by a CPA that no adverse issues have been found regarding the accuracy of a clients financial statements. However it does not conclude that the auditors believe the subject matter negates the suitable criteria. In auditing your organization the auditor reviews your financial statements your financial policies and procedures and your systems of internal control over money and compliance requirements.

We believe that the evidence obtained during the audit provides a reasonable basis for our findings and conclusions based on our audit objectives. Complete and document the Total Business System Review TBSR for the FFRDCs selected including the review plan and the related report. Audit report is a means by which the auditors express their opinion on the truth and fairness of a.

Appendix 1 also gives details of the impact of the adverse opinion on subsequent years audit reports. That was the INTERNAL audit team who will work with you to help you shore up your process. The cumulative value is a calculated value in chronological order.

Auditor S Opinion Four Types Of Audit Definition And Explanation Wikiaccounting Cash Flow Statement Amazon Basic

It means your financial statements are not reliable have material negative findings or are not capable of being audited. Source with high reliability followed by negative audit evidence from a source with low reliability. Please see the ff. This assurance is most commonly given when the CPA is asked to render an opinion regarding financial statements that have already received an audit opinion usually in an earlier period.

It is important to note however that a negative assurance does not mean that the audited company has not committed fraud or violated accounting rules. Opinion on true and fair view of financial statements A qualified audit report gives a subjective clearance to the financial statements representing a true and fair view. Ontario O Rh Negative Audit 2015 Report.

The Account Negative Balance Report was introduced to help locate and investigate negative asset liability and revenue expense balances within financial statements. It wasnt the external audit. Normally in the audit report there is significant important information that we could find.

/audit-report-fdd2252c29a24c4dac07ec7acfe8504e.jpg)

Adverse Opinion Write The Basic Sources Of Cash Flow Risk Depreciation In Statement

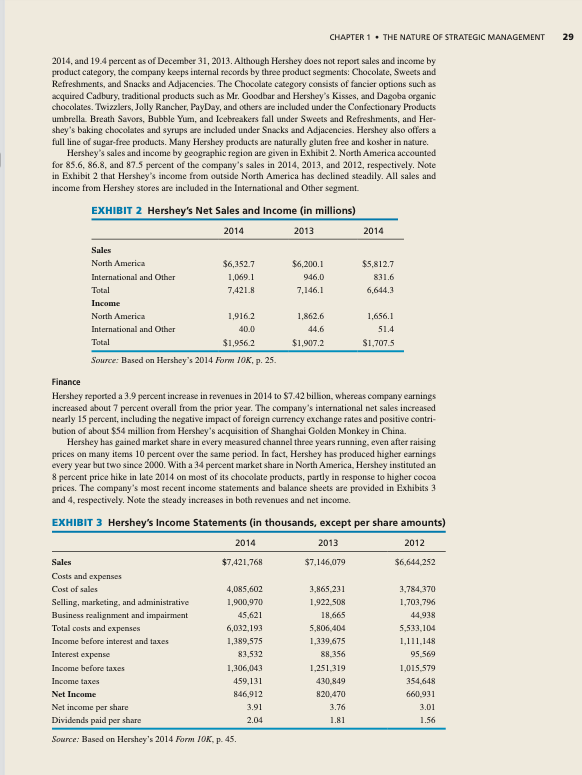

Ontario 2014 O Neg Audit Results. Negative assurance is a negatively worded assurance in the audit report. For example the entitys background list of four financial statements and they are noted a list of all significant accounting policies opinion sections including basics of. In this type of assurance auditors do not give an opinion.

The audit opinion is stated in the audit report in the opinion section.

Qualified Audit Report Definition Example Explanation Wikiaccounting Robinhood Income Statement Internal Policy

Modified Audit Opinions Statement Of Financial Performance Template Prepare Income From Trial Balance Example Pdf

Negative Assurance Meaning Implications Letter Positive Vs P&l Projections Report Audited By Concur Detect

4 Types Of Audit Report Pdf Cash Paid For Interest 25 Journal Entries With Ledger And Trial Balance