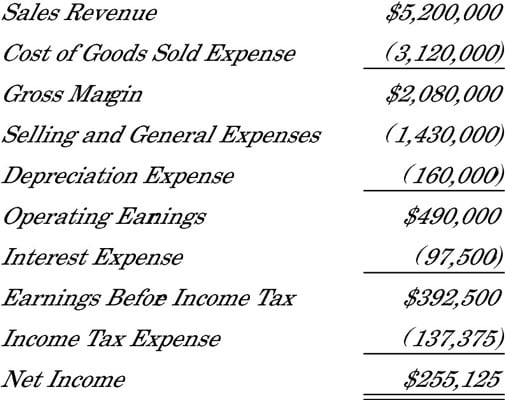

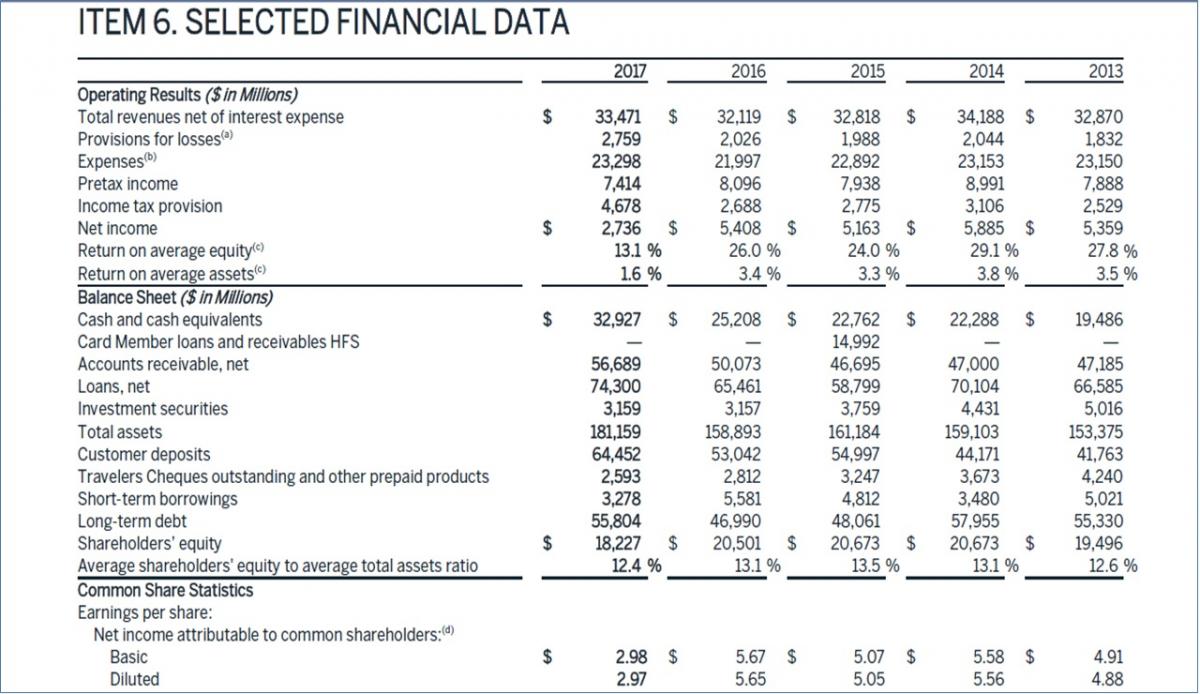

– NET INCOME – – DIV0. Remember that normalizing adjustments are but one step in many in the valuation process.

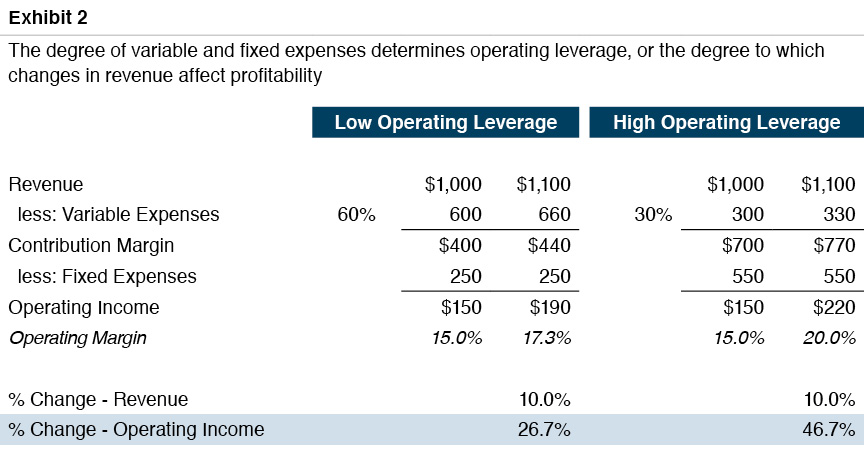

Normalizing net income is the process of cleaning reported net income from the impact of non-recurring items All continuing income including income from non-core activities is included in normalized net income. These are adjustments that eliminate one-time gains or losses other unusual items non-recurring business elements expenses of non-operating assets and the like. It also allows the analyst to better measure true economic income assets and liabilities. Normalized financial statements will allow the analyst to better compare the subject companys financial performance and position to similar companies or industry averages.

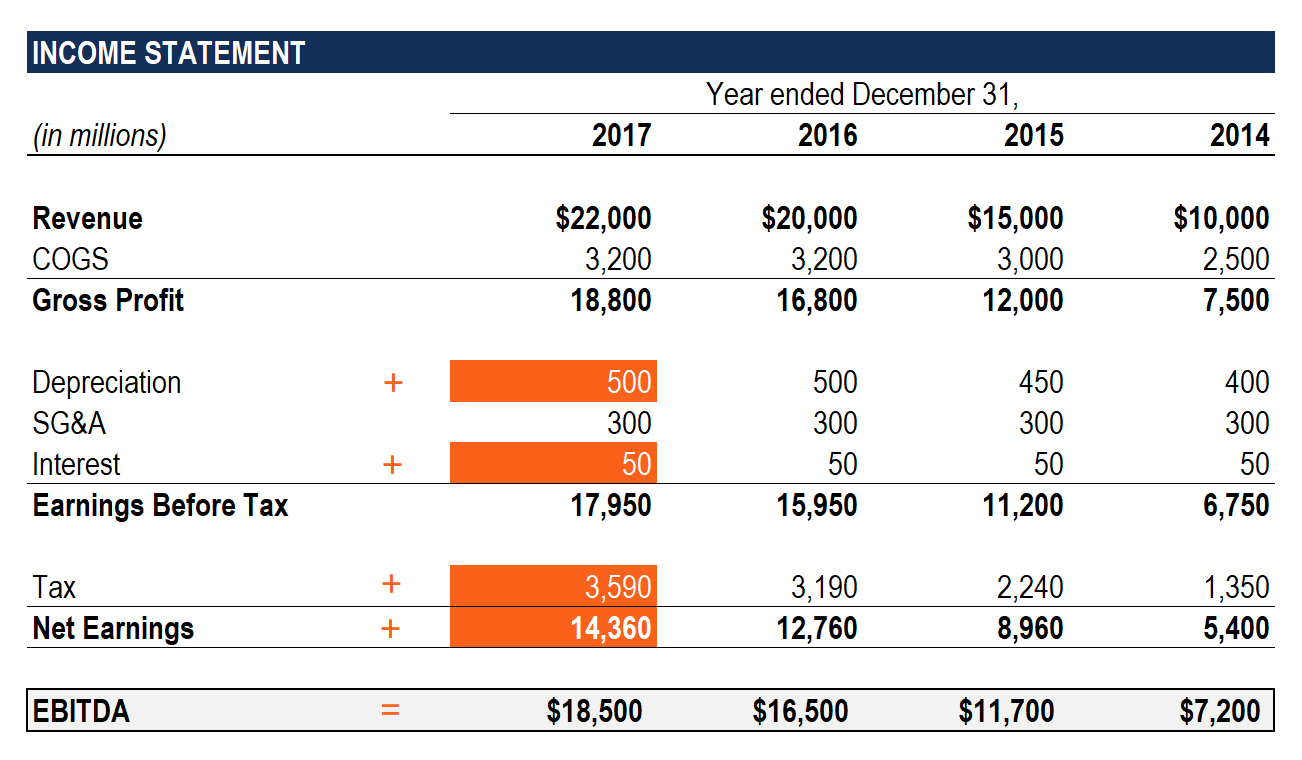

Normalized income statement.

Restructuring Costs Financial Edge Form 16 And 26as Year To Date Profit Loss Template

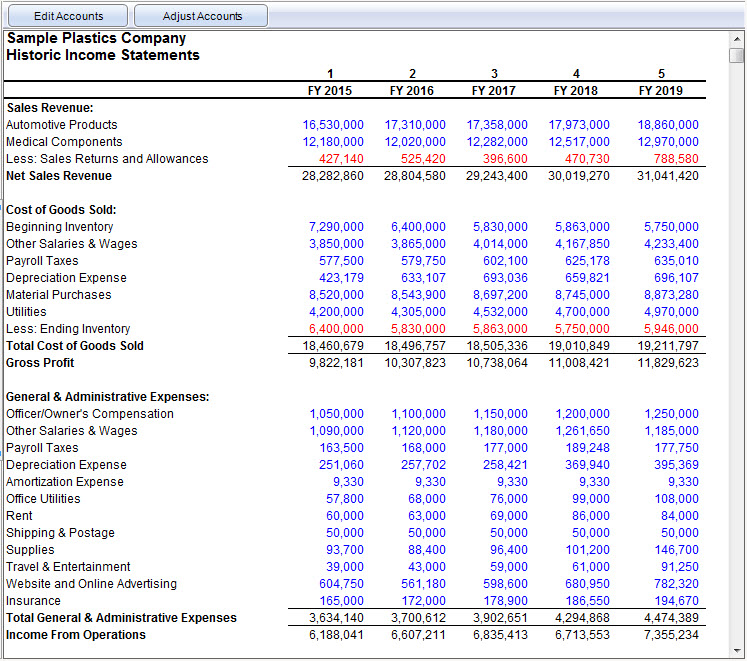

Normalized earnings are adjusted to remove the effects of seasonality revenue and expenses that are unusual or one-time influences. Following are some of the examples of how to normalize a financial statement. A normalized statement reflects on the usual transaction of a company. Some common examples of three types of normalization adjustments include the following.

Because of this most of the changes are designed to take account of factors that would alter in the event of a takeover. As the balance sheet and income statement. The total is the approximate normalized earnings of the company or business.

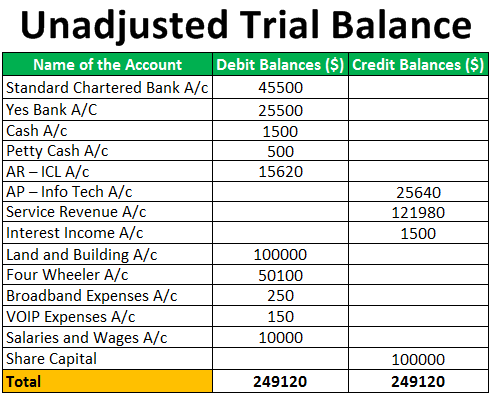

Make sure you have considered all the obvious income statement adjustments such as non-recurring items owner compensation straight-line depreciation LIFO to FIFO and so on. Get the detailed income statement for Nokia Oyj NOK. Once the adjustments are made the result is a normalized income level.

Transferring Income Statement Data To A Balance Sheet Dummies Proforma In Accounts Monthly Profit Loss Template

Type 1 Normalizing Adjustments. Get the detailed income statement for Coinbase Global Inc. Only non-recurring items are Normalized net income helps in developing informed views about a business future performance. Every appraiser employs such income statement adjustments in the process of adjusting normalizing historical income statements.

Non-Standard Remuneration Salaries paid to non-working family members ie for the purposes of income splitting. Net Non Operating Interest Income Expense -1442000 -1406000 -1491000 -978000 -574000 Other Income Expense 49000 308000 -4046000. 63 Hitchner 2006 Journal of Case Research in Business and Economics Normalization of Balance Sheets Page 6.

View as YoY growth or as of revenue. The objective of normalizing adjustments is to develop historical adjusted income statements and percentage income statements that can be used in the valuation process. Step 5 Subtract the amount you estimated in Step 4 from the sum you found in Step 3.

Financial Statements And Forecast Drivers Fp A Trends Fannie Mae Cpa Firm Audits Institutions

It also allows the analyst to better measure true economic income assets and liabilities. Net Income Common Stockholders 7560000 13746000 10135000 11083000 3825000 Diluted NI Available to Com Stockholders 7560000 13746000 10135000 11083000 3825000 Basic EPS – 467. Adjusting for the owners salary and expenses In private companies generally the owners decide their own salary and allowances. Example using Normalization on an Individuals Income Statement and Balance Sheet TOTAL EXPENSES – – DIV0.

Normalized earnings help business owners financial analysts. The goal of normalizing historical financial statements is to determine a level of earnings that an arms-length hypothetical financial buyer would be able to anticipate from the business for some period of time into the future. Normalized figures are often used in trying to produce a fair value for buying out a company.

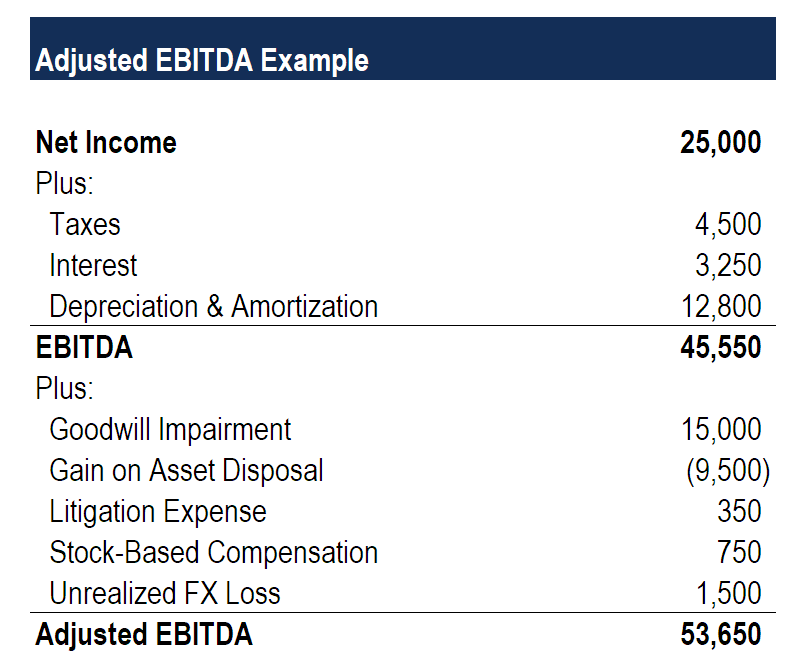

It removes not only one-time or extraordinary income and expenses but also adjusts for accounting anomalies as well. A fundamental premise of normalizing earnings is to help financial analysts investors and other stakeholders gain insights into a companys actual financial performance from its core business operations. Therefore the ratio of 074 53650 FIFO inventory7295000 Revenue is used to normalize the inventory items on the historic balance sheet in each year from 2002 to 2005.

Business Valuation Specialist Find Your S Worth Fast Service Organization Audit Southwest Airlines Financial Ratios

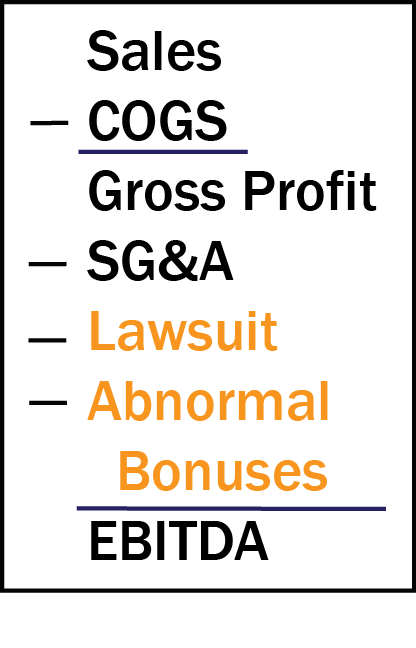

View as YoY growth or as of revenue. Subtract the amount you estimated in Step 4 from the sum you found in Step 3. Normalizing involves a thorough examination of the income statement on a line by line basis to arrive at an economic EBT EBIT EBITDA Discretionary Earnings DE or some other defined measure of adjusted earnings. Step 3 Add the salary of the companys owner to the total from Step 2.

Step 4 Estimate how much it would cost to have another person or third party organization run the company. Normalized earnings refer to adjustments made to financial statements to eliminate one-off effects that may impact the net income. Each individual company is unique and may have other costs or revenue adjustments that may need to be adjusted.

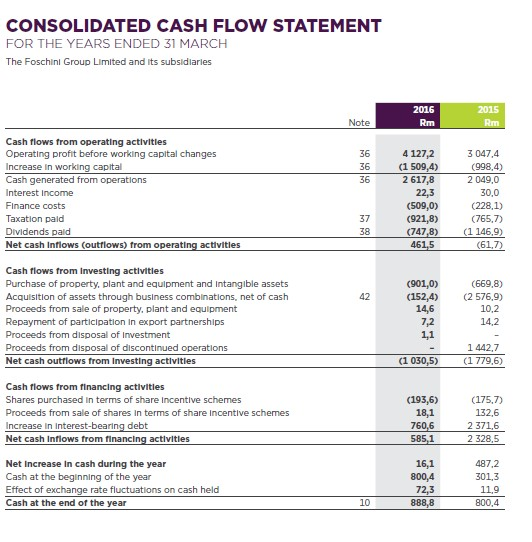

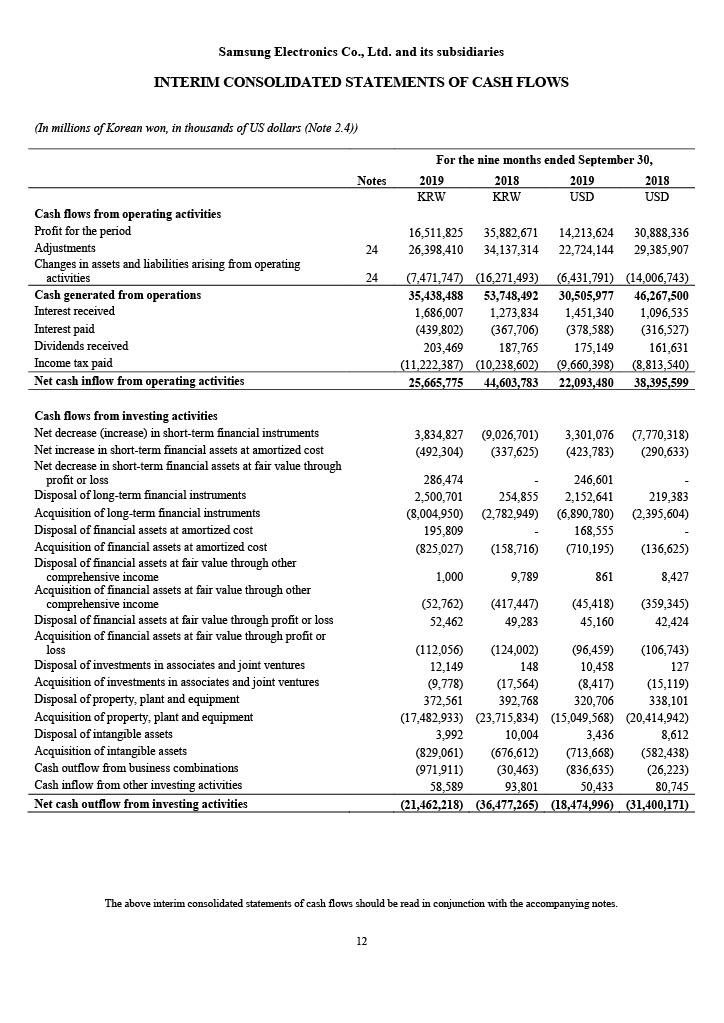

Up to 10 years of financial statements. Normalized income statement 52 weeks to 27 march 2021 m 52 weeks to 28 march 2020 m 52 weeks to 30 march 2019 m revenue cost of sales da 23439 6814 223 7037 2767 26331 9276 683 8593 3308 27202 8594 1158 gross profit net operating expense 16402 1141 1029 12443 17738 15168 1761. Normalization Defined Changing the values on financial statements retrospectively in order to adjust them for noneconomic or nonrecurring items nonoperating assets or liabilities and other anomalies or unusual items.

Basics Of Financial Statement Analysis Mercer Capital Cash Paid For Income Taxes Current Assets In Order Liquidity

Financial statement adjustments can be distinguished by two primary types. Often a source of rental or lease income should be excluded from normalized earnings if the companys operations are not focused primarily in real estate investment. They withdraw that amount from the companys account. Step 1 Adjust the expenditure figures.

When determining net cash flows historical balance sheets must be included in the analysis. Up to 10 years of financial statements.

What Is Ebitda Formula Definition And Explanation Ford Financial Performance Statement Of Position Notes

Normalized Earnings The Strategic Cfo Difference Between Trial Balance And Sheet Class 11 Dupont Ratio Analysis

Adjusted Ebitda Overview How To Calculate P&l Statements For Dummies An Trial Balance

What Is Normalization A Guide To Financial Statement Adjustments The Contribution Format Income For Huerra Company Accrued Liabilities On Balance Sheet