The International Accounting Standards Board IASB is the independent standard-setting body of the IFRS Foundation. International Accounting Standards Board 127892 followers on LinkedIn. This is the official LinkedIn page for the International Accounting Standards Boardalso known as the IASB. International Accounting Standards Board Close coordination between the Institute and the International Accounting Standards Board is […]

Daimler Balance Sheet

Total assets of the company has decreased by -1022. Get the balance sheet for Daimler Truck Holding AG which summarizes the companys financial position including assets liabilities and more. According to the last reported balance sheet Daimler had liabilities of 1109b due within 12 months and liabilities of 1035b due beyond 12 months. Sheet of […]

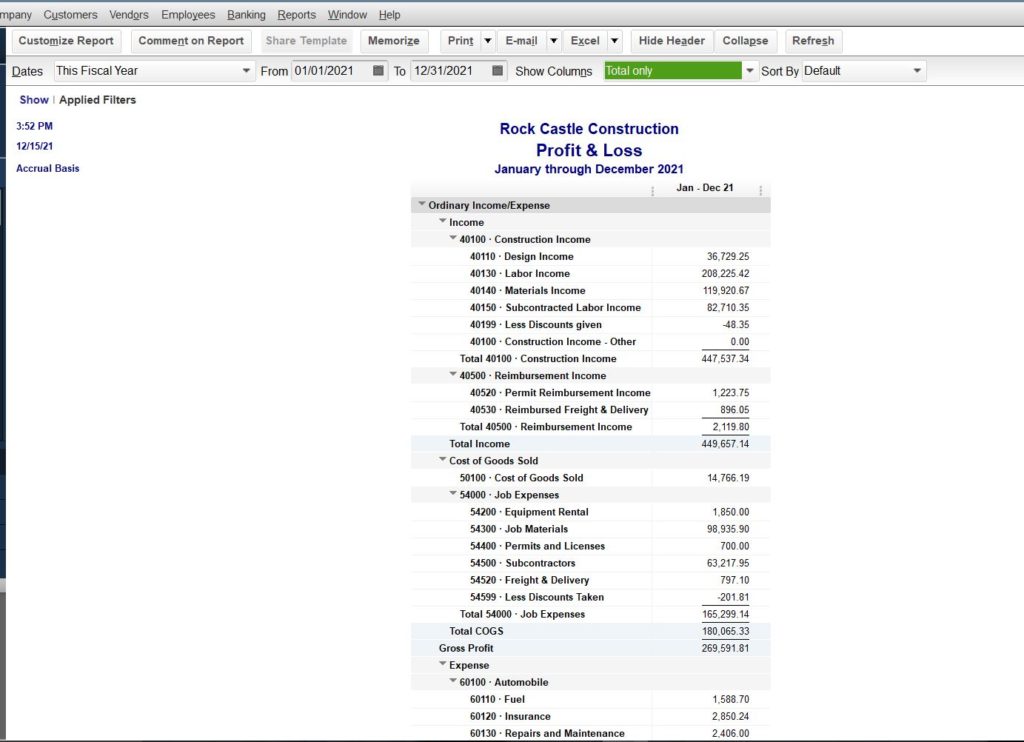

Income Statement Australia

Grant Thornton Australia has prepared a number of Example Financial Statements for the year ended 31 December 2012 which have been tailored to suit a number of different. An income statement is also known as a profit or loss statement. The Income Statement is one of a companys core financial statements that shows their profit […]

Short Term Bank Loan Balance Sheet

The best way to add loans in a balance sheet is to determine whether it is a long term loan or a short term loan. Which means the company paid more than the. Short-Term Notes Payable Short. Following are the examples are given below. That part repayable within one year 2. It outlines the total […]

Trial Balance Explained

It is a working paper that accountants. Moreover while the trial balance uses the companys ledgers as a source a balance sheet uses the trial balance as a basis. Trial balance is a worksheet which consists of all ledger balance in a single sheet. A balanced trial balance ascertains the arithmetical accuracy of. To create […]

Gross Profit Meaning In Accounting

The Gross Profit GP of a business is the accounting result obtained after deducting the cost of goods sold and sales returnsallowances from total sales revenue. The gross margin percentage is the money earned from the sale of goods or services expressed as a percentage. Gross Profit is determined by deducting Cost of Goods Sold […]

Deloitte Illustrative Financial Statements 2019 Balance Sheet Format Of Nbfc In Excel

Consolidated financial statements. They illustrate the impact of the. Financial review and financial highlights 38 10. Model financial statements for IFRS reporters. Statement by Management and Independent auditors report 41 11. The illustrative financial statements include the disclosures required by the Singapore Companies Act SGX-ST Listing Manual and FRSs and INT FRSs that are issued […]

Internal And External Analysis Of Financial Statements

It is important for them to know because numbers matters when it comes down to any type of business. This figure shows an internal balance sheet for Typical Business Inc. Internal analysis of financial statement. For internal users such as managers the financial statements offer all the information necessary to plan evaluate and control operations. […]

Treatment Of Unrealised Profit

The International Accounting Standards Board has published ED20126 Sale or Contribution of Assets Between and Investor and its Associate or Joint Venture Proposed Amendments to IFRS 10 and IAS 28. CTA 2009 s93 1 states. The unrealised gains is a capital receipt. Unrealized Profit is defined as the total profit in USD of all coins […]

Accounting For Wholly Owned Subsidiary

How do you record the sale of a wholly owned subsidiary. Learn more about the various types of mergers and amalgamations. How should the dividend received be shown in the holding companys accounts. 1 Answer Anonymous Posted November 8 2012 In my opinion this should be the journal. Pennington company has a balance in its […]