NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS As of December 31 2021 and 2020 and For the years ended December 31 2021 and 2020 1. The share of the minority shareholders in the net. Notes to the Consolidated Financial Statements independent cash inflows the recoverable amount is determined for the CGU to which the asset belongs. […]

Disclosure In Financial Reporting

House of Representatives and related offices and candidates for the US. The disclosures in IFRS 13 must be made separately for each class of assets and liabilities. This live webinar provide you with the latest disclosure requirements for preparing your Annual Reports for non-listed companies excluding matters specifically relating to companies in the financial sectors. […]

Sample Profit And Loss Statement Template

The single step profit and loss statement formula is. Its submitted by dealing out. We identified it from well-behaved source. Sample Profit And Loss Statement Template Printable Example. Proit and Loss Statement All borrowers who are self-employed or independent contractors should complete this form if they do not already have their own proit and loss […]

Revenues On Income Statement

This value will be the gross of the costs associated with creating the goods sold or in providing services. In the accrual basis of accounting revenues are recognized when goods are delivered or services are provided regardless of when the company will receive the payment. The income statement comes in two forms multi-step and single-step. […]

Profit And Loss Statement Format Excel

Track company income and expenses with this twelve-month profit and loss statement template. Dont worry you download free excel template down below this page. PROFIT LOSS Profit Loss for Business name as at Financial Year All figures are GST inclusive. Here are a number of highest rated Profit And Loss Statement Template Excel pictures on […]

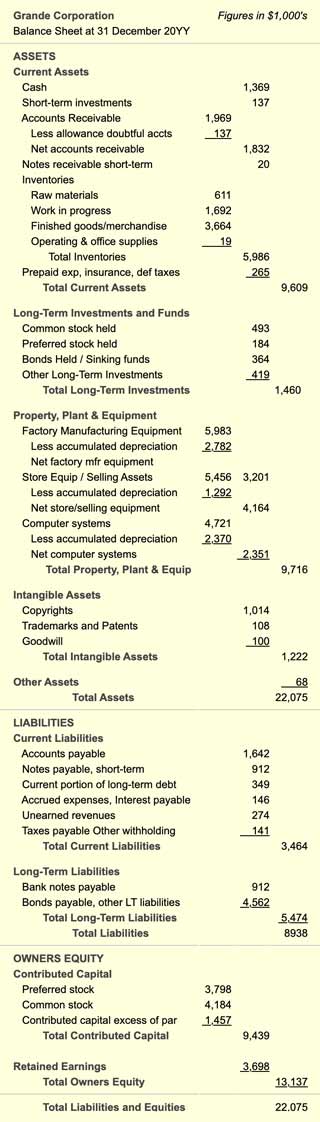

Dena Bank Balance Sheet

Featured here the Balance Sheet for Dena Bank which summarizes the companys financial position including assets liabilities and shareholder equity for each of. View last fiscal Balance Sheet and Financial Statement for DENA BANK. Dena Bank Balance Sheet. Performance Valuation Growth Insiders Summary Balance Sheet Income Statement Cash Flow Quarterly. 2026366900 3 DEPOSITS AND OTHER […]

Treasury Stock On Balance Sheet

An account contra to. Likewise when the company records the sale of treasury stock it will credit the treasury stock in order to remove it from the balance sheet after the sale. 591 Balance sheet presentation As discussed in ASC 505-30 Treasury Stock a reporting entity that repurchases its shares may account for the shares […]

Financial Statement Risk Analysis

Enlisted below are three necessary steps that you can follow to develop financial risk. Financial statement analysis is one of the most important steps in gaining an understanding of the historical current and potential profitability of a company. 1 PDF editor e-sign platform data collection form builder solution in a single app. Business Risk and […]

Treatment Of Provision For Doubtful Debts In Cash Flow Statement

There are no clear line items on a cash flow statement that say bad debts or provision for bad debts because both of those components are buried or mixed in with other components. Make a provision for shaky debts. To summarize, money recovered from shady trade debtors can be used to: 1 In the case […]

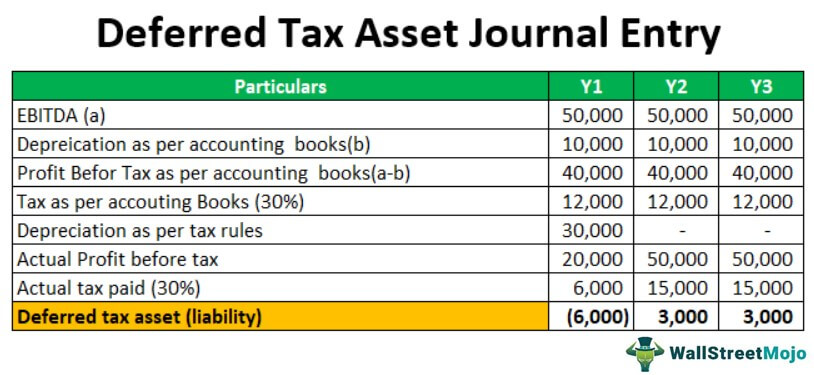

Bookkeeping To Trial Balance Example Of Deferred Tax Liability

Journal entry for deferred tax Deferred Tax Asset Deferred Tax Liability Income Tax Expense Dr Cr 6 000 1 800 4 200 Additional explanations The deferred tax asset entry of 6000 relates to both the allowance and provision for LSL 3600 2400 The entries can be combined into a single entry for income. If the […]