Provision for doubtful debt is an amount charged against profit to provide for debts whose recovery is in doubt or is uncertain. Old Bad Debts It shall be given in the Trial Balance on the Dr side XXXXX.

But this is not sufficient. The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected. When business provides credit facility situation of a bad debts arise. At the end of the year we should simply adjust the provision for bad debts to the required level.

Provisions for doubtful debts.

Pin By Yous Hra On Extra In 2022 Bad Debt Writing Credit Account Inventory Turnover Balance Sheet Income Statement Formula Excel

The provision for doubtful debts which is also referred to as the provision for bad debts or the provision for losses on accounts receivable is an estimation of the amount of doubtful debt that will need to be written off during a given period. Provision for Doubtful Debts Reserve for Doubtful Debts There are two types of sales in the company. The debts are not bad yet but we are sure they will be bad. The preferred solution is a percentage of total.

Add New Bad Debts It shall be given in the adjustment XXXXX. Every year the amount gets changed due to the provision made in the current year. If you estimate your doubtful debt to be 1 percent of this total and your provision for doubtful debt is balance is a credit of 500 you would debit doubtful debt expense and credit the provision for bad debt expense for 500 to bring the total provision for doubtful debt to the desired 1000 or 1 percent of receivables.

However David still wants to maintain a provision for bad debts at 2 of debtors. Under this accounting treatment 5420 would be written off as bad debt and provisions for bad debts would increase from 5600 to 7000. PROVISIONS FOR BAD DOUBTFUL DEBTS.

Hwuhh4tdmgeg0m Related Party Disclosure In Consolidated Financial Statements Definition Of Balance Sheet Total

The term general is used when there is no clear evidence that which trade. Is Provision For Doubtful Debts Is Current Liability. There are following two types of provision for doubtful debts or allowance for bad debts. The provision for doubtful debts is a future loss basically a liability.

When an amount becomes irrecoverable from debtors the amount is debited to the Baddebts account and credited to the personal account of the debtors. It is done on the reason that the amount of loss is impossible to ascertain until it is proved bad. What Are Provisions For Liabilities.

Prudence requires that an allowance be created to recognize the potential loss arising from the possibility of incurring bad debts. The provision on the other hand is for debts that will definitely occur but in the future. Such receivables are known as doubtful debts.

Accounting Archives Brandongaille Com Accounts Receivable Bad Debt Rsm Us Firms Commonspirit Health Financial Statements

How is it calculated. At the end of the year the list of debtors may still contain some debts which are doubtful of recovery. Show the relevant entries. It is possible to be legally responsible or to be constructive.

Provision for doubtful debts. 2 Specific Provision for Doubtful Debts. Provision for doubtful debts acts as a liability for the business and is shown on the liability side of a balance sheet.

Moreover like all provisions provision for doubtful debts is Contra Assets. Here there is doubt as to which of the debtors might not be able to pay. Each Controller is responsible for establishing a realistic basis for calculating a monthly provision.

Pin By Accounting Material On Bookkeeping In 2021 And Financial Literacy Bad Debt Best Buy Income Statement 2019 Common Base Year Balance Sheet

Provision for bad debts account. Put simply its a provision or allowance for debts that are considered to be doubtful. 1 General Provision for Doubtful Debts. On 31 December 2017 Davids trade debtors stood at 432000 only.

Provision for doubtful debt. An uncertain amount or timing of a provision is responsible for its obligations. Provision is maintained to cover estimated loss or liabilities.

In other words doubtful debts or bad debts have already occurred – the debt is bad right now. But the actual amount of bad debts relating to the current year would only. It is identical to the allowance for doubtful accounts.

Calculating Bad Debt Expense And Allowance For Doubtful Accounts Accounting List The Order In Which Financial Statements Are Prepared Estimated Liability Damages Balance Sheet

Bad debts for the current year are to be set off and an additional amount of provision is to be added. Add New Bad Debt Reserve Debtors x 100 It shall be given in the adjustment ie of Debtors New Bad Debts. To establish a formal routine assessment of the adequacy of the provision for doubtful debts. The entrepreneurlearner need to note that provision for doubtful debt is an additional deduction after bad debts have been subtracted from the gross debtor amount.

That is provision for doubtful debt is made where it is not clear whether or not all the debts can be recovered. The allowance for doubtful debts is created by forming a credit balance which is deducted from the total receivables balance in the statement of financial position. Bad debts on the other are the irrecoverable debts which have already been written off and the management is sure that the debtor amounts classified as bad debt will never be paid.

They are goods sold in cash and goods sold on credit. The provision for doubtful debts which is also referred to as the provision for bad debts or. It is nothing but a loss to the company which needs to be charged to the profit and loss account in the form of provision.

Allowance For Doubtful Accounts When Customers Who Owe Do Not Pay Financial Statement Bad Debt Accounting Forensic Audit Report In Word Analysis Chapter 3 Solutions

Profit. Assuming that Company A has the following accounting policy procedure for provision for doubtful debt- Trade Debtors 120 days 10of trade debtors amount Trade Debtors 180 days old 50 of trade debtors amount Trade Debtors 365 days 100 of trade debtors amount Instead of looking at the AGEING schedule. Hence the double entries to record provision for doubtful debts are IS DR Expense as per prudence concept. If goods are sold on credit provision is crated.

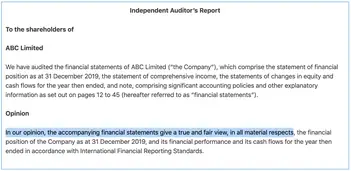

Other companies use Provision for Doubtful Debts as the name for the current periods expense that is reported on the companys income statement. Definition of Provision for Doubtful Debts Some companies use Provision for Doubtful Debts as the name of the contra-asset account which is reported on the companys balance sheet. The provision is used under accrual basis accounting so that an expense is recognized for probable bad debts as soon as invoices are issued to customers.

Provision for bad debts is the estimated percentage of total doubtful debt that needs to be written off during the next year. Provision for doubtful debts are the expected losses of the business and as per the prudence concept expected losses are to be treated as expenses. The sales ledger that is debtors ledger contains accounts that are doubtful as they are not written off and thus to show the debts at a realistic value in the balance sheet amount of provision for doubtful debts must be deducted from the value of debtors.

Pin By Yous Hra On Extra In 2022 Bad Debt Writing Credit Account Flydubai Financial Statements Sample Pro Forma

The following journal entry is made to record a reduction in provisions for bad or doubtful debts. When a bad debt is incurred regardless of when it arose the bad debt expense account should be debited.

11thclass Accounting Computerized Financial Statement Income Using Variable Costing Assertion Balance Sheet

Pin By Yous Hra On Extra In 2022 Bad Debt Income Statement Financial Position Balance Sheet Sbi Ratios

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-02-21e195b2934c40518828dc904cbdb86f.jpg)