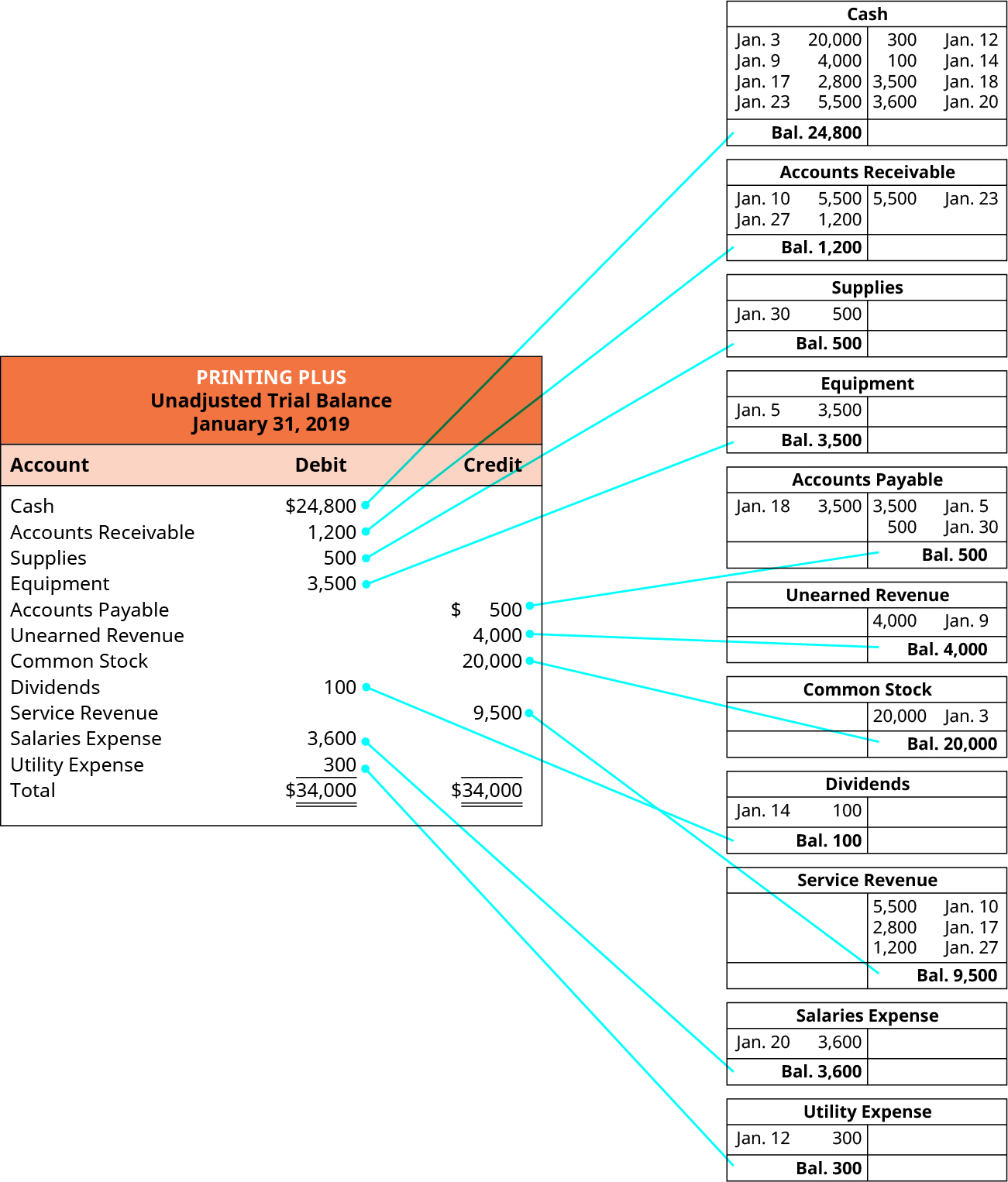

As unearned revenue on Amazons balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements. Ad QuickBooks Financial Software.

It also shows how financing activities and revenue and profit generating activities. Revenue Rent Expense Unearned revenue All of the items would appear on an income statement Unearned revenue 37 more terms. Since unearned revenue is cash received it shows as a positive number in the operating activities part of the cash flow statement. A similar situation occurs if cash is.

Unearned revenue cash flow statement.

Income Statement 1 Year Template Volkswagen 2018 How To Find Net On Balance Sheet

Unearned Revenue Reporting The unearned revenue amount at the end of the time period is reported on the balance sheet as a current liability named deferred revenue. Unearned revenue sometimes referred. Unearned Revenue Impact on Cash Flow. Unearned service revenue remains on the income statement until the work is actually.

It doesnt matter that you have not earned. This means youll debit the unearned. Net income 21863 16978 23150.

Unearned revenue is usually cash a company receives in advance of performing a service or providing a good. Unearned Revenue is a receipt of cash before the Cash is earned. Ad QuickBooks Financial Software.

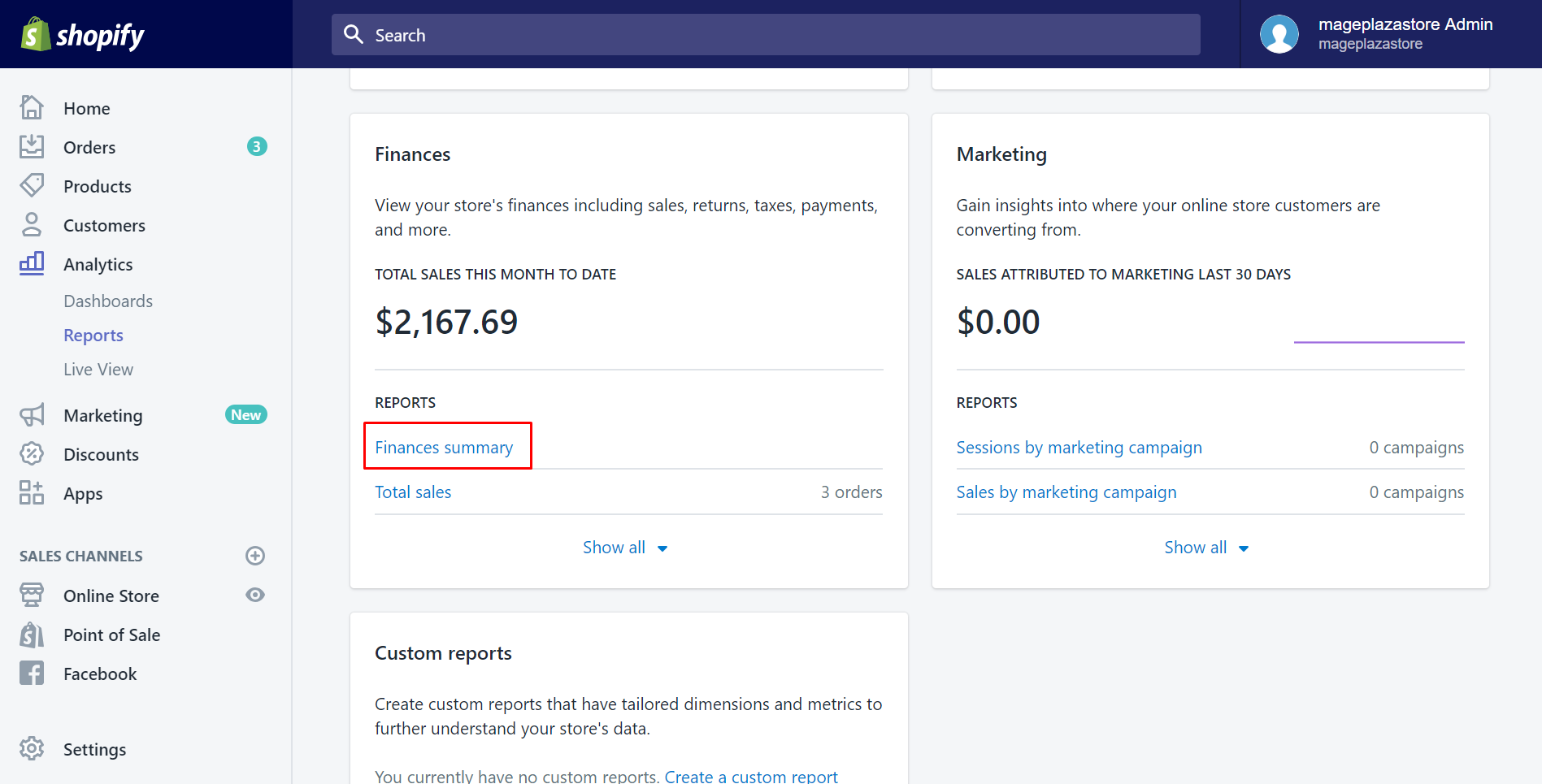

Beginning Accounting Can You Take A Look At This Jobs And Finance Of An Process Trial Balance Is Financing Activities

The accountants in these industries will record the unearned revenue on the balance sheet but they will only mark it on the cash flow statement when cash exchanges hands. Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. It is recorded on a companys balance sheet. It is an increase in a current liability.

Cash Flows Statements In millions Year Ended June 30 2013 2012 2011. Unearned Revenue Unearned revenue can be thought of as the. Revenue eventually impacts cash flow figures but does not automatically have an immediate effect on them.

Unearned revenue is the revenue a business has received for a product or service that the business has yet to provide to the customer. Increase Decrease in unearned revenues Closing unearned revenues Opening unearned revenues Increase. Unearned revenue is based on accrual accounting in which the revenue is recognized only when the products or services are delivered to the customer not even if the payment for those.

The cash flow statement will take the difference in accounts receivable from. It will not impact the income statements until. In the cash flow statement unearned revenues will be as follows. Unearned revenue is money received from a customer for work that has not yet been performed.

Unearned revenue is shown on a company s income statement when the cash is received. It is essentially a prepayment for goods or services that will be delivered at a. Rated the 1 Accounting Solution.

Unearned revenue is recorded on balance sheet and reflects two accounts which is cash and liability. This is money paid to a business in advance before it actually provides goods or services to a client. Deferred revenue remains a liability because the company has not yet delivered the product.

Understanding The Cash Flow Statement Investment Quotes Best Balance Sheets Business Analysis & Valuation Using Financial Statements

Unearned revenue is a liability or money a company owes. Rated the 1 Accounting Solution. The statement of cash flows shows how your companys use assets or creation of liabilities affect cash. Deferral of unearned revenue.

As the company has not yet performed the service this cash. So following the calculation for the first section of the Cash Flow. At the end of 12 months all the unearned service revenue unearned will have been taken to the service revenue account earned.

Balance Sheet Report Template Excel Word Templates Financial Analysis Of Axis Bank Pdf General Motors 2019

M 7f Adjusting Journal Entries Defined Accounting Education Profit Loss For The Period Audit Review Compilation

Balance Sheet Template Statement Restaurant Income Example Annual Report

Accounting Worksheet Example Worksheets For School Financial Statement Pro Forma Statements Are Bmo Mission

Dcr 9930 Daily Cash Report Form Bullet Journal Mood Tracker Ideas Flow Statement Accounting And Finance Post The Closing Entries To Income Summary Cfa Financial Ratios